You think it’s all about banks and interest rates, right? Think again. Peer-to-peer lending is the new kid on the block, and it’s shaking things up.

Imagine you’ve got some cash to spare, and your friend needs a loan. You lend them money, they pay you back with a bit of interest.

Sounds simple?

That’s essentially what peer-to-peer lending is. Only now, technology has jumped into the mix, bringing along apps like Lenme to make the process smoother and more efficient.

Now, instead of just you and your friend, imagine a platform where thousands of people lend and borrow. No banks, no lengthy paperwork. Just pure, human-to-human transactions.

Importance of Choosing the Right Lending App

So, why is choosing the right app a big deal? Simple. Your money’s on the line. And you want to make sure it’s in good hands.

With the digital boom, so many apps like Lenme have cropped up. Some are good, some…not so much.

Let’s get real here. You want an app that’s user-friendly, transparent, and doesn’t rip you off with crazy fees. And that’s why I’m here—to guide you through this maze of lending apps.

Apps Like Lenme

| App Name | Purpose | Interest/Fees | Loan Amounts | Repayment Terms |

|---|---|---|---|---|

| Solo Funds | Peer-to-peer lending platform focused on small-dollar loans. | Borrowers tip what they can afford. Lenders set terms. | Typically up to $1,000 | Short-term, usually up to 30 days |

| Zirtue | Relationship-based lending between friends and family with formalized loan agreements. | Flat borrowing fee; no interest for lenders. | Varies; based on agreements between users | Flexible; set by lender and borrower |

| Prosper | Peer-to-peer lending platform for personal loans. | APR varies based on creditworthiness. | $2,000 to $40,000 | Fixed terms of 3 or 5 years |

| Hundy | Peer-to-peer cash advance app for small cash infusions. | Platform fee plus optional tip. | Up to $250 | Typically by next paycheck or within 30 days |

| Kiva | Crowdfunding loans for entrepreneurs worldwide, focus on developing countries. | 0% interest, no fees for borrowers. | Up to $15,000 | Up to 36 months; grace periods available |

Buckle up, ’cause we’re diving deep into the world of apps like Lenme. Each has its flavor, ya know? So, let’s break it down and see which one vibes with you.

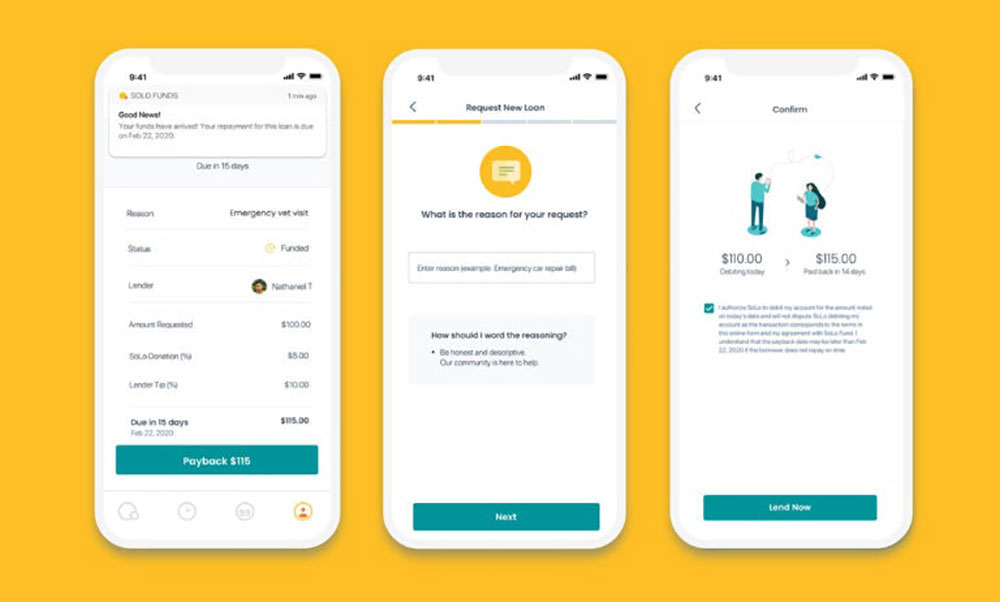

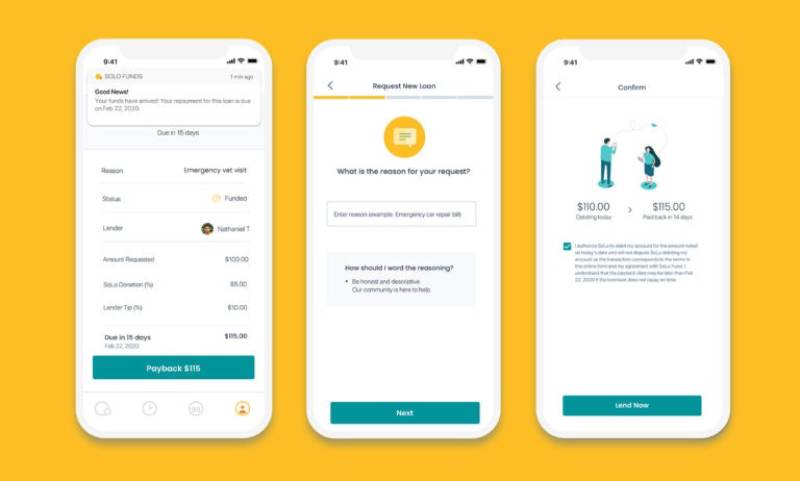

Solo Funds

Overview of Solo Funds

Ever heard of Solo Funds? It’s kinda like that friendly dude in your neighborhood. Laid-back, chill, but super reliable. Solo Funds is all about bringing people together—those who got a little extra moolah and those who need it.

How Does Solo Funds Work?

Simple.

- Create a profile.

- Decide if you’re lending or borrowing.

- Browse through offers or requests.

- Make a match.

- Send or receive cash.

It’s kinda like online dating, but for your wallet.

Pros and Cons of Solo Funds

Pros:

- Super easy-to-use.

- No hidden fees. What you see is what you get.

- Rapid transactions. No waiting around.

Cons:

- Might not have as many features as other platforms.

- Limited loan amounts for some.

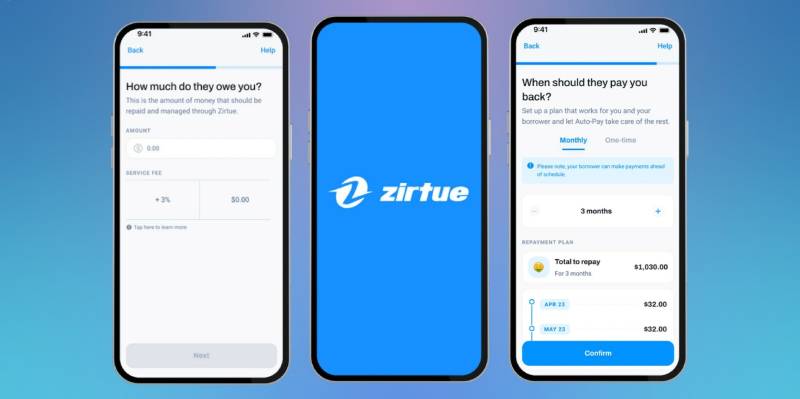

Zirtue

Overview of Zirtue

Enter Zirtue. No, it’s not a planet from a sci-fi movie. It’s another one of those apps like Lenme. It’s got this cool trust-based vibe going on. It’s all about lending to people you know.

How Does Zirtue Work?

Alright, here’s the drill:

- Connect with friends or family through the app.

- Request a loan.

- They review it, accept, and bam! Funds are on their way.

Think of it as borrowing from a buddy, just more official-like.

Pros and Cons of Zirtue

Pros:

- Trust-based system.

- Scheduled auto-payments. No forgetting due dates!

- Transparent fee structure.

Cons:

- Limited to people you know.

- Some might find it awkward to mix finances with relationships.

Prosper

Overview of Prosper

Prosper is like the wise old owl of apps like Lenme. Been around since 2005 and kinda pioneered this whole peer-to-peer lending scene.

How Does Prosper Work?

It’s a step-by-step process:

- List your loan request.

- Investors check it out.

- Once funded, you get the cash.

- You repay monthly.

Yep, investors. That’s what sets Prosper apart.

Pros and Cons of Prosper

Pros:

- Established and reputable.

- Customizable loans.

- Range of loan purposes.

Cons:

- Might require a better credit score.

- Interest rates can vary.

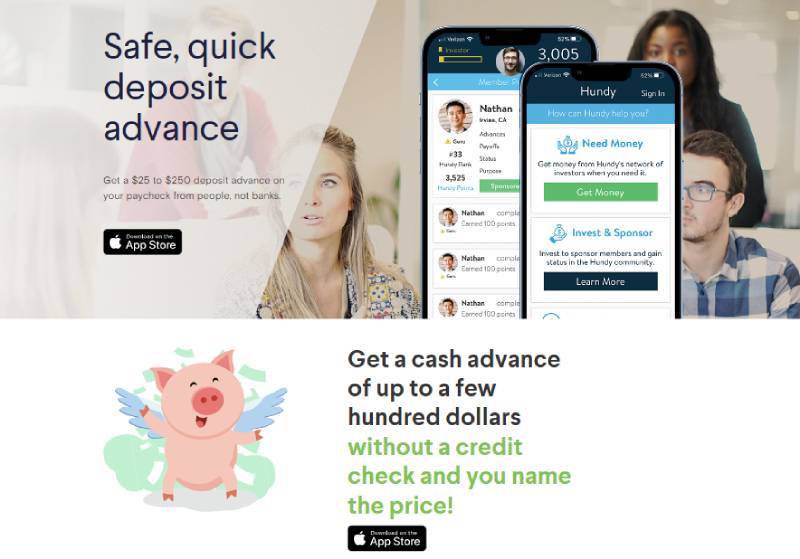

Hundy

Overview of Hundy

Hundy is like that super chill friend who’s always up for a coffee. It’s friendly, approachable, and all about community vibes.

How Does Hundy Work?

- Sign up, create a profile.

- Borrow or lend based on your comfort.

- Enjoy low fees and a super transparent system.

You earn points for being a good sport, which is kinda fun.

Pros and Cons of Hundy

Pros:

- Community-centric.

- Reward system for good behavior.

- Transparent fee structure.

Cons:

- Newer to the scene.

- Limited features.

Kiva

Overview of Kiva

Kiva’s the dreamer of the group. It’s not just about lending money; it’s about changing lives, especially for entrepreneurs in need.

How Does Kiva Work?

Magic. Just kidding.

- Browse stories of people needing funds.

- Lend as little as $25.

- Over time, they repay.

Your money goes on a journey, making dreams come true.

Pros and Cons of Kiva

Pros:

- Social impact focus.

- Connect with borrowers via their stories.

- No interest. Yep, you read that right.

Cons:

- Repayment isn’t always guaranteed.

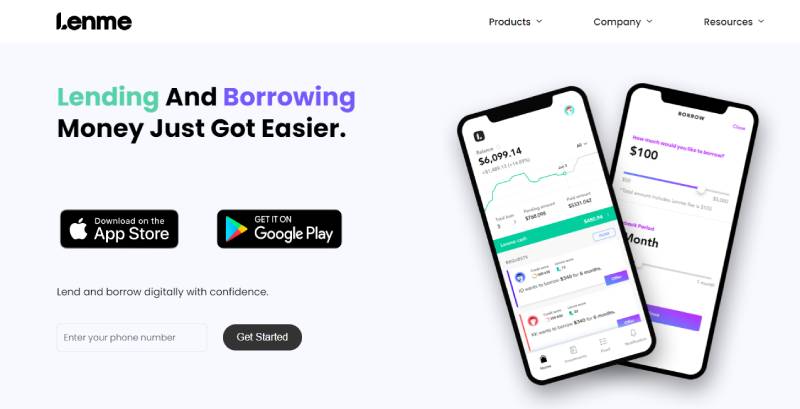

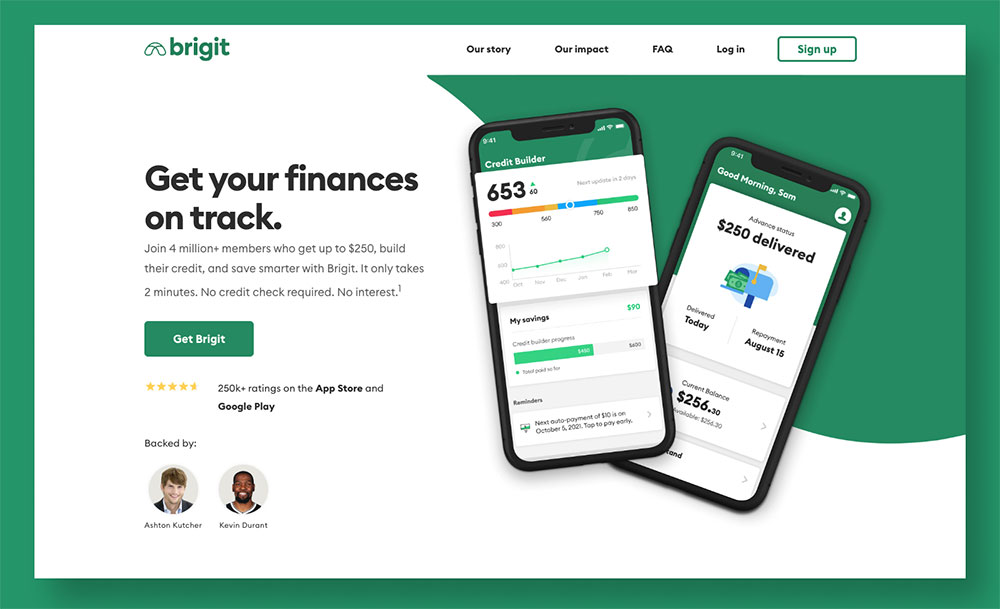

Understanding Lenme

Lenme has gained traction in recent times, but what’s the buzz about?

What is Lenme?

It’s a digital platform, a space where lenders and borrowers meet. Think of it as a modern marketplace, but instead of buying veggies or crafts, you’re dealing with money.

Lenme is one of those apps like Lenme that’s garnered attention, but is it worth the hype?

How Does Lenme Work?

It’s pretty straightforward. Say you want to lend some money. You hop onto Lenme, check out borrower profiles, see who you vibe with, and lend. Borrowers do the same. They check out lender offers, choose one, and voila! Money’s on its way.

Pros and Cons of Lenme

Now, no app’s perfect. Let’s spill the beans.

Pros:

- User-friendly interface.

- Quick transactions.

- A wide array of borrowers and lenders.

Cons:

- Fees might be a tad higher than some other platforms.

- Requires a bit of financial savviness.

It’s crucial to weigh these out when considering apps like Lenme.

Quick Comparison: Apps like Lenme

So, Lenme’s cool. But what about other apps like Lenme? How do they stack up?

Maximum Loan Amount

Different apps, different limits. While some might allow you to lend a massive sum, others might cap it. It’s all about finding the right fit for your pocket.

Interest Charged

Here’s the deal. Interest is how lenders make money. But rates can vary. Some apps might offer competitive rates, while others…not so much. Stay sharp.

Monthly Fee

Now, this is sneaky. Some platforms might charm you with low interest but hit you with a monthly fee. Keep those eyes peeled.

Credit Check

A biggie for borrowers. Some platforms do a deep dive into your credit history. Others, not so much. It all depends on what you’re comfortable with.

FAQ about apps like Lenme

How Does Lenme Work?

Oh, it’s really straightforward. Think of it as a marketplace. Lenme connects borrowers with lenders. So, if you need a loan, you create a profile, put in your request and the platform matches you with potential lenders.

If you’re a lender, you’ll get to see potential borrowers and their risk profiles, and then decide where to invest your money. The app handles the transaction and repayment. Nice, right?

What’s the Deal with Lenme’s Interest Rates?

Well, rates can vary a lot. It all depends on the risk profile of the borrower. If the lender sees a higher risk, they might ask for a higher interest rate to compensate.

But, on average, the rates tend to be higher than your traditional bank loan. This platform is definitely geared towards those who need money fast and might not have other options.

Is My Money Safe with Lenme?

Great question! You’re thinking like a pro here. The big thing to know is that Lenme itself doesn’t offer any insurance on your loans. If you’re a lender, you’re taking on the risk.

The platform tries to give you as much info as they can about each borrower, but the decision, and the risk, is ultimately yours.

What Are the Requirements to Use Lenme?

Ah, the fine print, right? Well, to use Lenme as a borrower, you need to be at least 18, have a bank account, and live in the U.S. There’s a credit score check too.

On the lender side, you’ve got to have some money you’re willing to lend. You’ll also need a bank account. Pretty straightforward, yeah?

How Quick is the Lending Process?

Speed is the name of the game here. Once your profile is up, and you’ve made a loan request, it can get approved in as little as 24 hours. Of course, it can also take a bit longer, depending on the lender. But, in general, it’s faster than your traditional bank loan.

Can I Trust Lenme?

Trust is a biggie, especially when it comes to your hard-earned cash. Lenme is a legitimate platform, but like anything in life, it’s not without risks.

As a lender, you’re taking a gamble on whether the borrower will pay you back. Lenme provides risk assessment tools, but the final call is yours.

How Does Lenme Make Money?

I get asked this one a lot. Lenme makes its money by charging subscription fees to the lenders, and a service fee to borrowers. The service fee varies depending on the loan amount. So, they’re sort of like the middleman, facilitating the loan process for a fee.

Are There Any Penalties for Late Payment?

Yes, indeed. Borrowers, listen up! If you don’t pay on time, you’ll be hit with a late fee. It’s also going to hurt your credit score, and could make it harder for you to borrow in the future. So, always, always make sure you’re able to repay on time.

Can I Cancel a Loan Once It’s Approved?

Well, that’s a bit tricky. Once the loan is approved and the funds have been sent, you can’t just cancel it. You’d need to repay it, along with any interest and fees that are due. Remember, once you commit, it’s a legal contract, folks.

Does Lenme Have a Customer Service?

Yep, they’ve got a customer service team, and you can reach out to them via the app or email. They’re there to help you out if you’ve got any problems or questions.

Keep in mind though, they’re not financial advisors. They can’t tell you whether to take out a loan or lend money. That’s all on you.

Conclusion

Choosing a lending app isn’t rocket science. But with so many apps like Lenme out there, it’s easy to get lost. Remember to keep your needs in focus, do your research, and trust your gut.

With all these options at your fingertips, it’s essential to stay informed. Dive deep, ask questions, and make sure you’re getting the best bang for your buck.

Every coin has two sides. Lending can be rewarding, but there’s always a risk. Make sure you’re prepared, come what may.

We’re just scratching the surface here. With technology evolving, the world of lending’s bound to transform. And who knows, maybe in a few years, we’ll be chatting about some other apps like Lenme that are changing the game. Until then, happy lending!

If you liked this article about apps like Lenme, you should check out this article about apps like Possible Finance.

There are also similar articles discussing apps like Klover, check cashing apps that don’t use Ingo, apps like Albert, and international money transfer apps.

And let’s not forget about articles on apps like FloatMe, apps like Tally, apps like Even, and apps like Kora.

- Professional Video: Cinematography Apps Like FiLMiC Pro - April 26, 2024

- Optimizing Your Shopify Store for Maximum Dropshipping Success - April 26, 2024

- Python Explained: What is Python Used For? - April 26, 2024