Imagine trying to squeeze every penny and dime into a jar, watching your hard-earned cash accumulate and plotting your next big financial move. That’s the thrill—and challenge—of managing money in today’s digital decade.

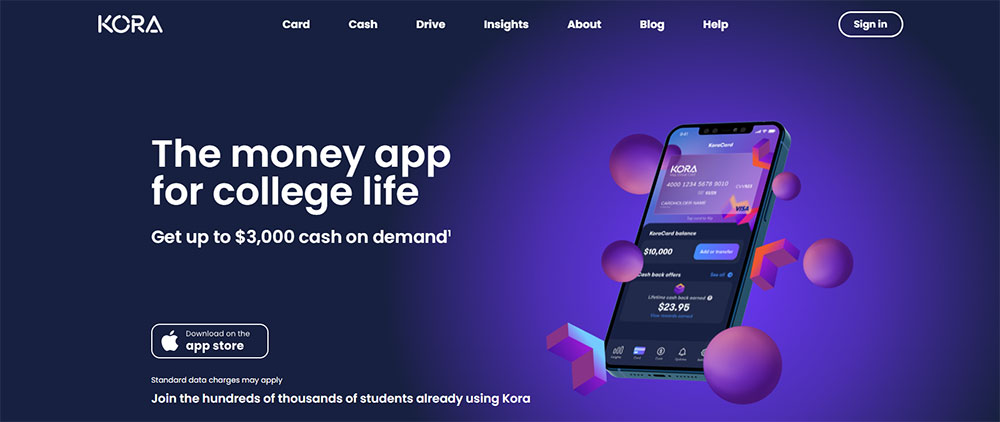

Now, toss in apps like Kora into that picture. Suddenly, you aren’t just stacking coins; you’re wielding a high-tech tool that tracks, teases apart, and turbocharges your financial fitness game.

We live in an age where a tap or a swipe on our phones can tidy up our finances, from squaring away debts to nudging us closer to our savings goal.

Join me as I unpack the world of money management software and finance trackers—a space where Fintech applications punch above their weight, giving you the power to micromanage your moolah even on the move.

I’ll guide you through a jungle of jaw-dropping alternatives to Kora, pinpointing personal finance apps that could be your next digital wallet buddy or your savvy savings sidekick. By the end of this stroll, you’ll be armed with a treasure trove of prime picks to keep your finances flowing smoothly.

Ready? Let’s kick those financial goals into high gear!

Apps Like Kora That You Should Check Out

| App Name | Interest on Cash Advance | Access to Earnings | Banking Services | Special Features |

|---|---|---|---|---|

| Brigit | None | Yes, with membership | No | Overdraft predictions, Budgeting tools |

| Earnin | None (Tips Optional) | Instant | No | Balance Shield, Health Aid |

| MoneyLion | None | Yes | Yes, RoarMoney | Investment, Cash-back, Personal loans |

| Albert | None | Yes | Yes | Savings bonus, Finance expert access |

| Empower | None | Instant | Yes | Automated savings, Empower Card |

| Dave | None | Instant | Yes | Budgeting, Side hustle feature |

| Chime | None | Early with direct deposit | Yes | Fee-free overdraft (SpotMe), Automatic savings |

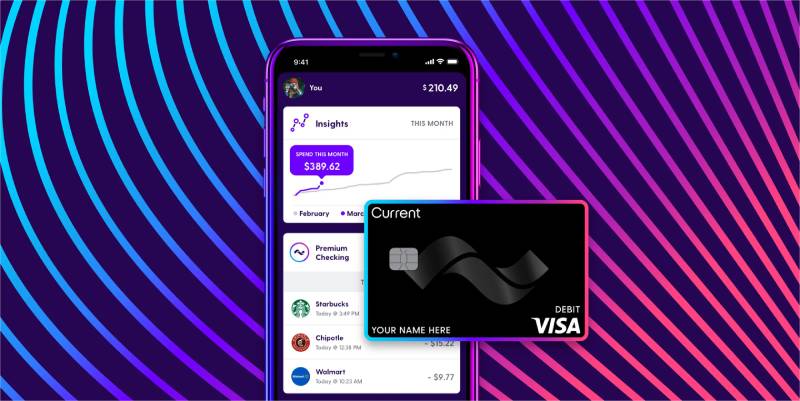

| Current | None | Early with direct deposit | Yes | Points on purchases, Teen accounts |

| Klover | None | Yes, with points system | No | Financial insights, Boosts for advances |

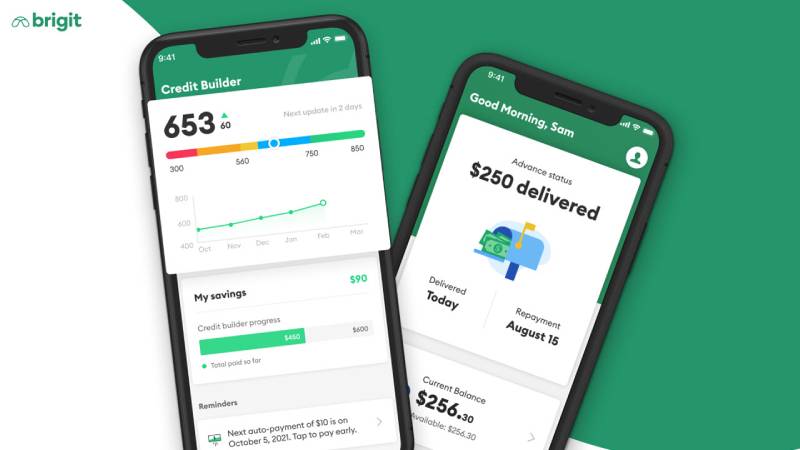

Brigit: Flexibility to Choose Repayment Date

| Feature | Description |

|---|---|

| Cash Advances | Get instant cash advances up to a certain limit without interest, helping in financial emergencies. |

| Overdraft Predictions | Smart alerts to warn you of potential overdrafts, helping avoid unnecessary fees. |

| Credit Monitoring | Regular updates and insights on your credit score, fostering better financial health. |

| Financial Planning | Tools and analytics for budgeting, tracking expenses, and understanding spending patterns. |

| Automatic Savings | Options to automatically set aside money, aiding in building savings effortlessly. |

| Easy Repayment | Flexible repayment options for cash advances, tailored to your pay schedule. |

| No Hidden Fees | Transparent fee structure with no hidden costs, ensuring clarity in financial dealings. |

| Security and Privacy | Strong measures in place to protect your financial data and personal information. |

| User-Friendly Interface | Intuitive and easy-to-navigate app design, making financial management accessible. |

Pros and Cons

Thumbs Up:

- Flexibility Galore: Pick your repayment day. You’re the boss.

- Notifications: Get heads-ups before your account takes a hit.

Thumbs Down:

- Membership Fee: Yeah, the cool vibes come with a price tag.

- Limited Advance Amount: Might not save you from bigger financial storms.

What Makes Brigit Stand Out?

User-Friendly Interface

First things first, Brigit is super easy to use. I mean, you don’t need to be a finance guru to navigate this app.

Its interface is clean, straightforward, and, honestly, pretty intuitive. Perfect for anyone who wants hassle-free access to their finances.

Advance Cash, No Sweat

Ever been in a pinch for cash before payday? We’ve all been there. That’s where Brigit shines with its salary advance services.

You can get a cash advance in no time, and the best part? It’s interest-free. Yup, you heard that right.

Smart Alerts to Keep You on Track

Budgeting can be a drag, but Brigit makes it a breeze. The app sends you smart alerts about your spending habits, upcoming bills, and even gives you a heads-up if you’re at risk of overdrawing your account. It’s like having a little financial guardian angel.

Brigit’s Unique Features

Budgeting Made Easy

With Brigit, you don’t just track expenses; you get a complete breakdown. It’s not just about knowing where your money goes – it’s about understanding your spending patterns.

This insight can be a real eye-opener and a life-changer.

Credit Score Monitoring

Worried about your credit score? Brigit’s got you covered. The app offers credit score monitoring, keeping you in the loop about your financial health.

It’s a great way to stay informed and make smarter financial decisions.

Instant Loan Applications

Need a quick loan? Brigit simplifies the process. The app’s instant loan application feature is straightforward, with no hidden fees.

It’s transparency at its best, ensuring you know exactly what you’re signing up for.

Why Brigit Could Be Your Financial Game Changer

Emergency Fund Access

Life’s full of surprises, and not all of them are pleasant. Brigit provides emergency fund access, giving you a financial safety net for those unpredictable moments.

It’s reassuring to know you have a backup when you need it most.

No More Overdraft Fees

Overdraft fees are the worst, right? Brigit helps you avoid them with its intelligent alerts and cash advances.

It’s like an early warning system for your bank account, keeping those pesky fees at bay.

Building a Better Financial Future

Brigit isn’t just about solving today’s money problems. It’s about paving the way for a better financial future.

With tools for budgeting, saving, and credit score improvement, it’s your partner in financial wellness.

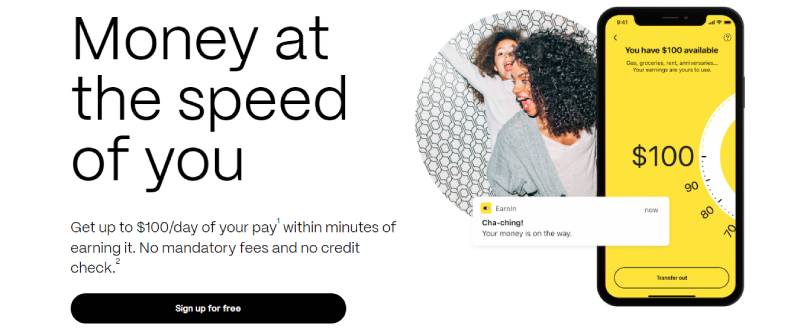

Earnin: Best for Hourly Wages Loan

| Feature | Description |

|---|---|

| Early Pay Access | Access your earned wages before payday, giving you financial flexibility when you need it most. |

| Balance Shield | Alerts and protections against low bank balances, helping prevent overdraft fees. |

| Cash Out Feature | Withdraw a portion of earned wages instantly, offering a lifeline in urgent financial situations. |

| Tip Jar | A savings tool that allows you to set aside money easily, supporting your personal savings goals. |

| Health Aid | Assistance with negotiating medical bills, aiming to reduce costs or set up manageable payment plans. |

| No Mandatory Fees | Operates on a tipping model, allowing you to pay what you think is fair, with no mandatory fees. |

| Financial Calendar | A tool to track your earnings and spending, helping you manage your finances better. |

| Secure Transactions | Prioritizes the security of your financial data with robust encryption and privacy measures. |

| User-Friendly Design | An intuitive and easy-to-navigate interface, making managing finances straightforward and stress-free. |

Pros and Cons

Yays:

- Direct to Your Account: No detours.

- Lightning Speeds: For when you need cash, like, yesterday.

Nays:

- Depends on Your Job: Must have an electronic timekeeping system.

- Daily Limits: There’s a cap on the cash-out.

Breaking Down the Barriers of Traditional Paydays

Access Your Earnings Early

Ever been stuck in that annoying gap between paydays? Earnin says ‘no more.’

With this slick app, you can access your earned money way before your actual payday. It’s all about giving you control over your finances, on your terms.

No More Overdraft Headaches

We’ve all felt that sting of overdraft fees. Earnin’s got your back here. It helps you keep an eye on your bank balance and alerts you.

This means you can take action before those fees even think about showing up.

How Earnin Stands Out in the Crowd

It’s All About Empowerment

Earnin isn’t just an app; it’s a financial empowerment tool. It’s changing the way we think about our paychecks. Traditional payday?

That’s old news. Earnin’s reshaping the rules, making sure you get access to your money when you need it.

Safety First

Worried about security? Don’t be. Earnin takes your privacy seriously. Your data’s locked down tighter than Fort Knox. Peace of mind? Check!

The Features That Make Earnin Shine

Lightning Speed Cash Outs

Need cash, like, now? Earnin’s got you. Quick cash outs mean you’re not left hanging when you need money the most. It’s like having a financial fast lane.

Tip Jar for Your Savings Goals

Saving money can be tough. Earnin makes it easier with its Tip Jar feature. It’s like a digital piggy bank for your future goals. No pressure, no fees, just you saving at your own pace.

Health Aid for Your Medical Bills

Healthcare costs can be a nightmare. Earnin’s Health Aid feature is here to help. Just submit your medical bill, and the team will negotiate to reduce the amount or find you a better payment plan. It’s like having a financial health advocate.

Balance Shield for Overdraft Protection

Earnin’s Balance Shield is like a financial guard dog. It watches over your bank account and gives you a heads up if your balance dips low. Say goodbye to overdraft surprises.

MoneyLion: Best for Multiple Features

| Feature | Description |

|---|---|

| RoarMoney Account | A unique banking experience with early paycheck access and cashback rewards. |

| Investing Made Simple | User-friendly investment tools allowing portfolio customization suited for beginners and pros alike. |

| Financial Tracking | Advanced tools for monitoring and analyzing your spending and savings habits. |

| Credit Builder Plus | A program designed to help improve your credit score through responsible borrowing and repayment. |

| Early Pay Access | Option to access a portion of your earned wages before the scheduled payday. |

| Cashback Rewards | Earn cashback on everyday purchases, turning spending into earning. |

| Security and Privacy | Robust security measures to ensure the safety and privacy of your financial information. |

| Financial Insights | Personalized insights and advice to help you manage your finances more effectively. |

| Easy-to-Use Interface | An intuitive and straightforward app design, making financial management accessible and stress-free. |

Pros and Cons

High-Fives:

- Versatile: More than just a cash advance app.

- Grow While You Borrow: Boost that credit score.

Oh-No’s:

- Fees on Some Features: Some goodies aren’t free.

- Membership Requirements: You’ve gotta commit to get the good stuff.

Breaking the Mold: More Than Just an App

Empowering Your Financial Journey

MoneyLion isn’t just another finance app. It’s like your personal finance assistant that’s got your back 24/7.

We’re talking real-time tracking, budgeting tools, and some serious financial insights. It’s all about making your money work for you.

All About That Financial Wellness

Wellness isn’t just about hitting the gym. Your wallet needs a workout too, and MoneyLion’s here to flex those financial muscles.

From savings account integration to investment tracking, this app’s got the tools to get your finances in tip-top shape.

Features That Set MoneyLion Apart

RoarMoney: Banking Reimagined

Imagine a bank account that’s not just a place to stash your cash. RoarMoney brings you features like early paycheck access and cashback rewards. It’s like your bank account, but on steroids.

Investing Made Simple

Always thought investing was for the Wall Street types? Think again. MoneyLion brings investing to your fingertips, making it super easy, whether you’re a newbie or a pro. Build your portfolio, your way.

Financial Tracking At Its Best

Ever wonder where your money goes each month? With MoneyLion, tracking your spending is a breeze. It’s like having a financial detective that helps you spot where you can save more and spend smarter.

Why MoneyLion Roars Louder

No More Payday Blues

Say goodbye to counting days until payday. With MoneyLion’s salary advance options, you can access your earned cash early. It’s about time your pay schedule worked around you, not the other way around.

Credit Builder Plus

Credit scores can be tricky, but MoneyLion makes it easier. The Credit Builder Plus program is like a gym membership for your credit score, helping you build it up with ease.

Safety and Security

Worried about online security? With MoneyLion, your data’s as safe as houses. Top-

Albert: Best for No Late or Overdraft Fees

| Feature | Description |

|---|---|

| Smart Savings | Automatically sets aside small amounts for savings, making saving effortless and consistent. |

| Instant Cash Advances | Provides access to a portion of your paycheck early, offering a financial buffer in urgent situations. |

| Automated Investing | Simplifies investing by managing your portfolio based on your preferences and risk tolerance. |

| Intuitive Budgeting | Offers easy-to-understand budgeting tools, helping you track and manage your spending effectively. |

| Real Human Advice | Access to financial experts for personalized advice, combining tech efficiency with human insight. |

| Customizable Goals | Set and track financial goals, whether it’s saving for a vacation, a car, or building an emergency fund. |

| Robust Security | Ensures the safety of your financial data with strong security measures and encryption. |

| Financial Insights | Provides smart insights and analyses of your financial habits, aiding in better financial decision-making. |

| User-Friendly Interface | Designed for ease of use, making financial management accessible and stress-free for everyone. |

Pros and Cons

Cheers:

- No Nasty Fees: Late fees? Albert doesn’t know her.

- Automation: It keeps an eye out for you.

Boos:

- Monthly Tip for Extras: Some features need a lil’ extra.

- Advance Limit: Don’t expect to fund a shopping spree.

Making Finance Fun and Easy

Your Personal Finance Genius

Albert’s like that friend who knows all about money stuff. It keeps things simple, breaking down the finance jargon into easy bites. Budgeting, saving, even investing – it’s all laid out, no headache involved.

Smart Savings Without Trying

Saving money can feel like a chore, right? Not with Albert. It sneakily tucks away small amounts. Before you know it, you’ve got a nest egg growing. It’s like magic, but it’s just Albert being clever.

Features That Make You Go ‘Wow’

Instant Cash Advances

Short on cash? Albert’s got you. With its cash advance feature, you can borrow a bit from your next paycheck. No interest, no stress. It’s your money, just a bit sooner.

Investing on Autopilot

Investing sounds serious, but Albert makes it a no-brainer. You pick your comfort zone, and Albert handles the rest. It’s like having a personal investor in your back pocket.

Budgeting That Actually Makes Sense

Budgets can be baffling, but Albert turns them into something you’ll actually want to check. It’s like a fitness tracker, but for your money. Keeping you in shape, financially speaking.

Albert: Your Financial Buddy

Real Human Advice

Sometimes, you just need to talk to a human. Albert gets that. Got a money question? Ask away. Albert’s team of real-life humans is there to help. No robots, no canned responses.

Security? Top Priority

In a world full of digital risks, Albert takes your security seriously. Your data’s locked down tight. It’s like having a digital Fort Knox for your finances.

All About Your Goals

Albert’s not just about the day-to-day. It’s about your big dreams too. Planning a trip? Saving for a car? Albert’s there to make those goals a reality.

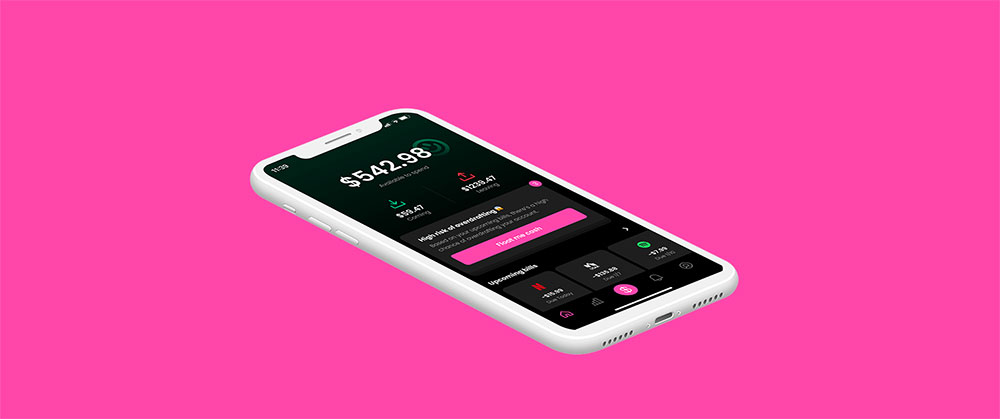

Empower: Best for Instant Cash Advance

| Feature | Description |

|---|---|

| Automated Savings | Smartly calculates and sets aside a portion of your income into savings, simplifying the saving process. |

| Overdraft Protection | Monitors your account to prevent overdrafts and alerts you to low balances, saving on potential fees. |

| Easy Budgeting | Provides simple and effective tools for creating and sticking to a budget, tailored to your spending habits. |

| Instant Cash Advances | Offers the option for quick cash advances to cover expenses before payday, providing a financial cushion. |

| Subscription Management | Identifies and helps manage recurring subscriptions, enabling you to save money on unused services. |

| Customizable Alerts | Sends personalized alerts for important financial activities like large expenses or savings milestones. |

| Robust Security | Ensures top-level security for your financial data, offering peace of mind for your digital transactions. |

| Goal Setting | Allows you to set and track financial goals, helping you focus on long-term financial aspirations. |

| User-Friendly Interface | Designed with an intuitive interface, making financial management accessible and stress-free. |

Pros and Cons

Good Vibes:

- Quick Cash: Like, light speed.

- No Overdraft Fees: Sweet relief!

Not-So-Good Vibes:

- Monthly Fee: Yeah, it’s a thing.

- Certain Criteria for Cash Advances: Gotta tick their boxes.

Keeping It Real with Money

Smart Saving, Effortlessly

Saving money can sometimes feel like climbing a mountain, right? Empower turns that mountain into a walk in the park. It smartly figures out how much you can save, without you having to sweat the details. It’s like having a personal savings coach.

Say Bye to Overdraft Fees

Overdraft fees? No thanks. Empower watches over your account like a hawk and gives you a heads-up if you’re about to dip too low. It’s like having an extra set of eyes on your cash, keeping those sneaky fees at bay.

Features That Make Empower Shine

Budgeting That Doesn’t Suck

We’ve all been there – trying to stick to a budget and getting lost. Empower makes budgeting actually doable, breaking it down into simple steps. It’s budgeting, but without the headache.

Instant Cash Advances

Caught short before payday? Empower’s got your back with instant cash advance options. It’s like a safety net for those ‘just in case’ moments, minus the stress.

Subscription Sniper

Got a bunch of subscriptions eating into your budget? Empower’s like a sniper, spotting those recurring charges and helping you cut down on the ones you don’t need. More cash for you, less for unused subs.

Why Empower is a Game Changer

Customizable Alerts

Stay in the know, always. Empower sends you alerts that actually matter – like big spending, bill reminders, or even when you score a win with your savings. It’s like having a financial newsfeed tailored just for you.

Top-Notch Security

Worried about security? Don’t be. Empower’s got it locked down. Your info’s as secure as it gets, so you can manage your money without a worry in the world.

All About Your Goals

Empower isn’t just for today’s money moves. It’s about helping you reach those big dreams. Saving for a trip? Eyeing a new gadget? Empower maps it out, making those goals not just dreams, but plans.

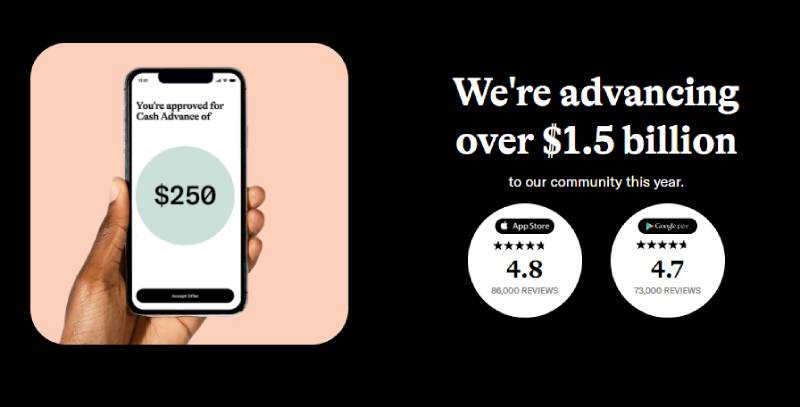

Dave: Best for Small Amount Advances

| Feature | Description |

|---|---|

| Overdraft Protection | Provides alerts to prevent overdrafts, helping you avoid fees and manage your account balance effectively. |

| Instant Cash Advances | Offers the option for small, interest-free cash advances to tide you over until your next paycheck. |

| Budgeting Tools | Easy-to-use budgeting features that help you plan and track your spending, making money management simpler. |

| Side Hustle Finder | Connects you with opportunities to earn extra income through various side gigs and job opportunities. |

| Credit Building | Offers options to help improve your credit score, aiding in your long-term financial health. |

| Robust Security | Ensures the safety of your personal and financial information with strong security measures. |

| User-Friendly Interface | Designed for ease of use, ensuring a seamless and stress-free experience in managing finances. |

Pros and Cons

Yep:

- Low Advance Fee: Like, couch change.

- Helpful Alerts: Dave’s got an eye on your dough.

Nope:

- Limited to the Small Stuff: Big emergencies? Dave might ghost.

Keeping Your Finances On Track, Effortlessly

Overdrafts? A Thing of the Past

Okay, overdraft fees are the worst. But guess what? Dave’s got a radar for them. It gives you a heads-up before you hit that dreaded red zone in your bank account. It’s like having a financial lookout.

Budgeting That Actually Works

Budgets can be tough to stick to, right? Dave turns that around. It helps you plan your spending without making it feel like a chore. It’s like having a friendly nudge, keeping you on track but not in a bossy way.

Features That Make Dave Stand Out

Instant Cash Advances

Short on cash? No worries. Dave offers instant cash advances to give you a bit of breathing room. It’s not a loan; it’s your money, just a bit earlier than usual.

Side Hustle Finder

Looking to make a few extra bucks? Dave hooks you up with side gigs. It’s like having a mini job fair at your fingertips. More cash, less stress.

Smart Budget Helper

Dave isn’t just about managing what you have; it’s about maximizing it. With its smart budget helper, you’re not just tracking; you’re strategizing. It’s your financial game plan, made easy.

Why Dave is Like Your Financial Wingman

No Interest, No Fuss

Dave’s advances? They’re interest-free. It’s like a friendly loan without the awkwardness of asking a friend.

Build Your Credit

Want to give your credit score some love? Dave’s got a path for that. It’s like a workout plan, but for your credit health.

Security is Key

With Dave, your info is locked down tight. It’s like having a digital guard dog for your personal and financial data.

Chime: Best for Overdraft Protection

| Feature | Description |

|---|---|

| No Hidden Fees | Eliminates common banking fees, including overdraft, monthly, and foreign transaction fees. |

| Early Direct Deposit | Allows access to your paycheck up to two days early, providing financial flexibility. |

| Automatic Savings | Rounds up purchases to the nearest dollar and saves the difference, making saving effortless. |

| SpotMe Overdraft Service | Covers overdrafts on debit card purchases without fees, offering a safety net for minor shortfalls. |

| Credit Builder | A credit-building feature that helps improve your credit score through responsible card use. |

| Fee-Free ATMs | Access to a wide network of ATMs without incurring fees, making cash withdrawals more convenient. |

| Real-Time Alerts | Sends instant notifications for transactions and account balances, keeping you updated on your finances. |

| User-Friendly Interface | Features an intuitive and easy-to-navigate design, simplifying financial management. |

Pros and Cons

Wins:

- Generous Overdraft: Go negative without the ouch.

- No Monthly Fees: Keep your money, honey.

Uh-Oh’s:

- Requires Direct Deposit: Strings attached.

Banking, but Better

Fee-Free Living

Ever get annoyed by those pesky bank fees? Chime gets it. That’s why they ditched them. No overdraft fees, no monthly fees, no foreign transaction fees. It’s like a breath of fresh air for your wallet.

Get Paid Early

Waiting for payday can feel like an eternity. Chime changes the game by offering early direct deposit. It’s like a time machine for your paycheck, bringing payday closer.

Features That Set Chime Apart

Automatic Savings Tool

Saving money can sometimes feel like an uphill battle. Chime makes it effortless. Every time you spend, it rounds up your purchases and tucks the change into your savings. Watching your savings grow is like a fun game.

SpotMe for the Oops Moments

We’ve all been short on cash at the checkout line. Embarrassing, right? With Chime’s SpotMe feature, that’s a thing of the past. It covers you on those small overages. No stress, no embarrassment.

Security That’s Top-Notch

Your financial security? Chime’s got it covered. With serious encryption and security measures, your money and data are as safe as houses.

Chime: More Than Just an App

Building Your Credit, Made Simple

Dreaming of a killer credit score? Chime’s Credit Builder is like a personal trainer for your credit. Use it, and watch your credit health flex and grow.

No ATM Fees? Yes, Please!

ATMs can feel like money traps with those fees. Chime’s network of fee-free ATMs is like finding a treasure map where X marks the spot for free withdrawals.

Real-Time Alerts

Stay in the know, always. Chime sends you alerts for every transaction, balance update, or any suspicious activity. It’s like having a financial watchdog.

User Experience that Rocks

Navigating Chime is a piece of cake. It’s designed to be intuitive, clean, and easy. Managing your money feels less like a chore and more like a cool new app to explore.

Current: Best for Overdrive Protection Feature

| Feature | Description |

|---|---|

| Early Direct Deposit | Get your paycheck up to two days faster, enhancing your financial flexibility. |

| No Overdraft Fees | Avoid overdraft fees, making your banking experience more cost-effective and stress-free. |

| Savings Pods | Create individual savings goals within the app, helping you manage and reach your financial targets. |

| Instant Gas Hold Refunds | Eliminates gas station holds on your card instantly, providing immediate access to your funds. |

| Rewards on Purchases | Earn points on everyday purchases and redeem them for cash, adding value to your spending. |

| Budgeting Tools | Simple and effective tools for tracking and managing your spending. |

| Teen Accounts | Offers specialized accounts for teenagers, promoting financial literacy and responsibility. |

| Enhanced Security | Top-tier encryption and security measures to protect your financial information and privacy. |

| Intuitive User Interface | Easy-to-use app design, making financial management accessible and enjoyable. |

Pros and Cons

Loves:

- Quick Access: No lagging behind.

- Spending Insights: Know where the moolah goes.

Not-so-loves:

- Premium Version: Pay to play.

- Some Limits Apply: Read the fine print.

Banking, But Cooler and Smarter

Fast Money Access

Waiting for payday can feel like a marathon. With Current, it’s more like a sprint. Get your paycheck up to two days faster. It’s like hitting the fast-forward button on payday.

No More Fee Nightmares

Fees can be a bummer, right? Current’s got you covered. Say goodbye to those annoying overdraft fees and ATM fees. It’s like having a financial guardian angel.

Current’s Stand-Out Features

Savings Pods

Saving money just got a lot cooler. With Current’s Savings Pods, you can stash away cash for different goals. It’s like having mini savings accounts for all your dreams and plans.

Instant Gas Hold Refunds

Ever been annoyed by those gas station holds on your card? Current makes them vanish instantly. It’s like having a magic wand for your gas purchases.

Earn Rewards on Purchases

Who doesn’t like rewards? With Current, earn points on everyday purchases and redeem them for cash. It’s like getting a high-five for spending your own money.

Current: Making Money Fun

Budgeting That Doesn’t Suck

Budgets can be a drag, but not with Current. It makes tracking your spending so easy, it’s almost fun. It’s like having a financial coach who doesn’t judge.

Teen Accounts for the Young Guns

Got teens? Current’s teen accounts are a cool way to teach them about money. It’s safe, easy, and might just make you the coolest parent around.

Safety First, Always

Your security? Current’s top priority. With top-notch encryption, your money and info are locked down tight. It’s like having a digital fortress for your finances.

Slick and Easy Interface

Navigating Current is a breeze. Its design is all about simplicity and ease. Managing your money feels like scrolling through your favorite app.

Klover: Best for No Interest or Late Fees

| Feature | Description |

|---|---|

| Instant Cash Advances | Provides quick, interest-free cash advances to help you manage until your next paycheck. |

| Easy Sign-up Process | A quick and hassle-free sign-up process, allowing you to start using the app without unnecessary delays. |

| Budgeting Tools | Offers intuitive tools for tracking your spending and setting financial goals. |

| Personalized Insights | Uses your financial data to provide customized advice and insights for better money management. |

| Financial Literacy Resources | Includes educational tools and resources to enhance your understanding of personal finance. |

| Data-driven Perks | Allows you to earn points and rewards based on your data, which can be used for various perks. |

| Robust Security | Ensures top-level security and privacy for your financial data, giving you peace of mind. |

| User-Friendly Interface | Features an intuitive design, making it simple and enjoyable to manage your finances. |

Pros and Cons

Yeahs:

- No Sneaky Charges: Keep what’s yours.

- Fast Cash Outs: No waiting games.

Nahs:

- Tipping Model: Optional but there.

- Requires Regular Paychecks: They wanna see the green.

No More Cash Crunch Woes

Instant Cash Advances

Ever been in a tight spot before payday? Klover gets it. That’s why it offers instant cash advances. It’s like having a financial parachute when you’re free-falling towards an empty wallet.

No Interest, No Strings

The best part? These advances come without interest. It’s like borrowing money from a friend who doesn’t keep count.

Klover’s Cool Features

Lightning-fast Sign-up

Jumping into Klover is a breeze. Sign-up is so quick and easy, it’s almost like you blink and it’s done. No endless forms, no waiting in line.

Budgeting, But Fun

Budgeting can be a drag, but Klover makes it a game. Track your spending, set goals, and watch your financial health improve. It’s like having a fitness tracker, but for your money.

Data-driven Insights

Klover uses your financial data to offer personalized insights. It’s like having a financial guru who knows exactly what you need and when you need it.

More Than Just an App

Boost Your Financial IQ

Klover’s not just about quick fixes. It’s got a bunch of tools and tips to boost your financial literacy. Learn about budgeting, saving, investing – it’s like your personal finance masterclass.

Your Data, Your Perks

With Klover, your data is more than just numbers. It can be turned into points that you can use for cool perks. It’s a win-win – your data works for you, and you get the benefits.

A Safe and Secure Haven

Thinking about security? Klover’s got it locked tight. Your data’s as safe as it can be, giving you peace of mind while you manage your money.

FAQ on Apps Like Kora

How do apps like Kora help with money management?

They’re like a gym buddy but for your wallet. They keep you on track with budgeting tools and daily reminders. Visualize your spending habits, categorize expenses, and watch your savings stack up. It’s all about giving you the reins to your financial health.

What makes a good finance tracker app?

A solid app doesn’t just watch your back; it guides you. Look for user-friendly design, nifty expense management tricks, security that’s tighter than Fort Knox, and insights that hit you with those ‘aha’ moments. Remember, encryption and privacy should be top-notch.

Can these apps actually help me save money?

Absolutely, consider them your personal finance gurus. They poke at you, making sure you’re not overspending and showing you where every dime goes. They teach you the 50/30/20 rule like it’s a lifestyle, helping you categorize into wants, needs, and future dreams.

Are apps like Kora secure for bank syncing?

Today’s Fintech apps have security down to an art form. They use bank-level encryption — the same stuff that keeps your online banking fortress secure. Always double-check their privacy policy, though. Just to be sure you’re the only one privy to your cashflow secrets.

Is it worth paying for a premium money management app?

Depends on your goals! Free versions keep you on track, but if you’re eyeing the broader horizon of wealth management or investment tracking, shelling out a few bucks might open the door to advanced features that could bulk up that net worth even more.

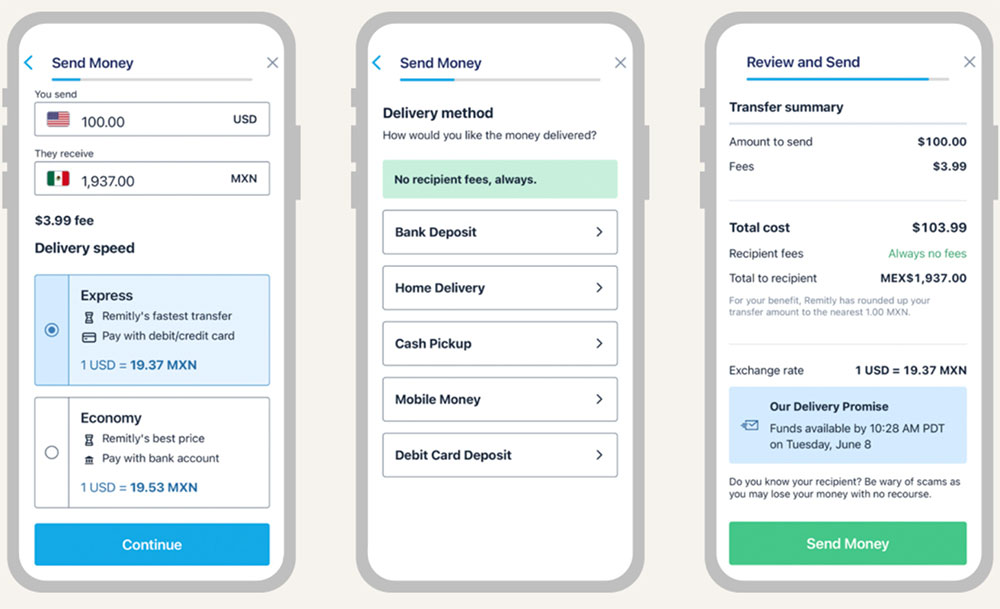

How do finance apps deal with multiple currencies?

World traveler, huh? Well, many apps go globetrotting with you. They’ll juggle your yen, euros, and dollars, updating exchange rates in real-time. Say goodbye to mental math; your digital wallet plays currency chameleon so your globe-trotting adventures stay monetarily savvy.

Do budgeting apps like Kora offer investment advice?

Again, varies by app. Some might flirt with financial literacy, nudging you towards robust savings plans or a diversified investment portfolio. Others stick to ground-level budgeting basics. If you’re hankering for that Warren Buffett vibe, pick an app that talks stocks and bonds too.

Can these apps help with tax preparation?

You bet, some are practically QuickBooks for individuals. They tag tax-deductible transactions, cough up reports, and work hand-in-hand with tax software. Comes April, you’re not drowning in receipts but riding a well-organized wave into tax season, with all your ducks—or should I say dollars?—in a row.

Do personal finance apps like Kora support joint accounts?

Teamwork makes the dream work, right? Several apps embrace this by supporting shared wallets or joint accounts for couples or families. Craft a shared budget, track collective expenses, and high-five each other as you both—or all—march towards mutual financial serenity.

How will finance and budgeting apps evolve in the future?

Think AI financial advisors, real-time wealth management, and personalized money management tactics. Apps will continue to polish their game — beholding your financial future and winking back with cryptocurrency integracies, automated savings algorithms, or even machine-learning-enhanced investment strategies. The future’s bright and financially sound.

Conclusion

So, we dove headfirst into that digital ocean of apps like Kora, swimming through currents of code to fetch you the shiniest pearls in the money management treasure chest. It’s been quite the voyage—spotting those savvy sidekicks eager to become your new finance tracker pals.

- We’ve gabbed about encryption and why your peace of mind is king when syncing bank accounts.

- Touched on how these apps can morph your smartphone into a digital wallet that blueprints your journey to fiscal freedom.

- And we even peeked into the crystal ball to glimpse the future of Fintech applications—think of AI financial advisors and cryptocurrency options.

Whether you’re a budgeting newbie or a financial whiz seeking investment tracking, let’s admit it—the right app can be a game-changer. They’re more than just digital spreadsheets; they’re gateways to financial prowess. So, choose an app that fits snugly into your lifestyle, and watch those savings grow. Ready to take the reins? Your financial future’s looking bright!

If you liked this article about apps like Kora, you should check out this article about apps like Possible Finance.

There are also similar articles discussing apps like Klover, check cashing apps that don’t use Ingo, apps like Albert, and international money transfer apps.

And let’s not forget about articles on apps like FloatMe, apps like Tally, apps like Lenme, and apps like Even.

- Professional Video: Cinematography Apps Like FiLMiC Pro - April 26, 2024

- Optimizing Your Shopify Store for Maximum Dropshipping Success - April 26, 2024

- Python Explained: What is Python Used For? - April 26, 2024