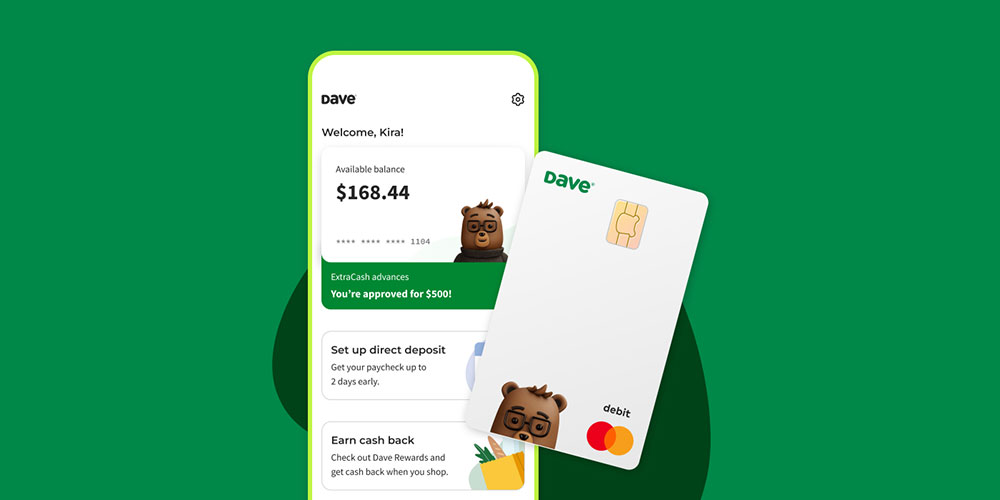

Picture this: Your wallet’s on a diet, thin and light. Your bank account’s gasping for a cash infusion till payday hits. Money apps like Dave have swooped in like financial superheroes, arms loaded with budgeting tools and cash advances, making the payday wait seem like old news.

In a click-and-swipe age, an emergency fund may seem as outdated as flip phones. But the need for a safety net?

Timeless.

We’re diving deep into the digital realm of instant cash and smart budgeting. Our mission: to revolutionize your financial wellness, harness the power of fee-free banking, and help you sidestep those dreaded overdraft fees.

By the tail end of this digital expedition, you’ll be clued into how these apps can pad your pockets, manage your moolah, and even offer a paycheck sneak peek. Gearing up with knowledge about microloans and salary advances is not just wise; it’s wealth.

Get ready — we’re unpacking how these nifty tools keep your financial health in check, from the safety of your smartphone.

Detailed Review of Top Cash Advance Apps Like Dave

Given the current interface, I can’t create actual tables, but I can provide a comparative markdown list that organizes the information in a tabular form, which you can then convert to a proper table in your desired tool or format (such as Microsoft Word, Excel, Google Docs, etc.).

| App Name | Cash Advance | Budgeting | No Fee Banking | Interest Bearing Savings | Credit Building | Investment Options | Extra Features |

|---|---|---|---|---|---|---|---|

| Empower | Yes | Yes | No | No | No | No | Financial Advice |

| Varo | No | Yes | Yes | Yes | No | No | Early Direct Deposit |

| Earnin | Yes | No | No | No | No | No | Overdraft Alerts |

| MoneyLion | Yes | Yes | Yes | Yes | Yes | Yes | All-in-One App |

| Brigit | Yes | Yes | No | No | Yes | No | Overdraft Prediction |

| Albert | Yes | Yes | No | No | No | No | Financial Advice |

| Payactiv | Yes | Yes | No | No | No | No | Bill Payment Services |

| One @ Work | No | Yes | No | Yes | No | No | Paycheck Auto-Save |

| Klover | Yes | Yes | No | No | No | No | Rewards System |

| Possible | Yes | No | No | No | Yes | No | Flexible Repayments |

| Branch | Yes | Yes | Yes | No | No | No | Wage Tracking |

| DailyPay | Yes | No | No | No | No | No | Integration with Payroll |

| Cleo | Yes | Yes | No | No | No | No | Chatbot Assistant |

| Chime SpotMe | Yes | Yes | Yes | No | No | No | Fee-Free ATMs |

What we like about them:

- Empower: Personalized budgeting tools

- Varo: No monthly maintenance or overdraft fees

- Earnin: Access to earned money instantly

- MoneyLion: Suite of financial services

- Brigit: Overdraft predictions to avoid fees

- Albert: Access to real financial experts

- Payactiv: Access to earned wages before payday

- One @ Work: Organizes money into different ‘Pockets’

- Klover: Simple cash advances with no interest

- Possible: Short-term loans with flexible repayments

- Branch: Integrates workplace features with financial tools

- DailyPay: Offers instant access to earned wages

- Cleo: Interactive financial assistant

- Chime SpotMe: Overdraft protection without fees

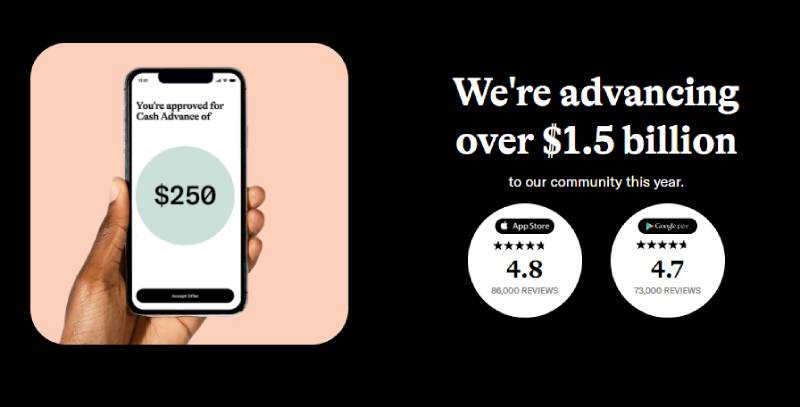

Empower

Tired of checking your bank balance with one eye closed? Empower throws you the financial toolkit you didn’t know you needed. It’s like having a mini-economist in your pocket, getting smart alerts about your spending and offering quick cash advances when your budget’s on the brink.

Best Features:

- Automated savings

- Budgeting categories

- Subscription-based cash advances

What we like about it: Empower’s personalized budgeting tools adapt to your spending habits, making it easier to stash cash without feeling the pinch.

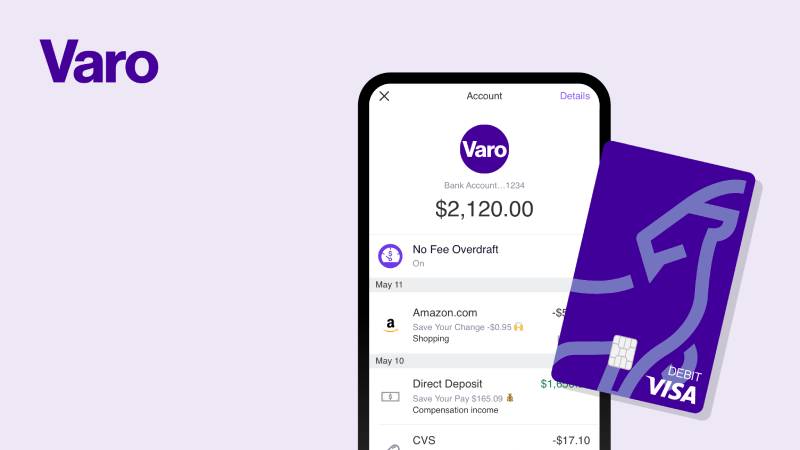

Varo

Varo is the buddy that nudges you towards a heftier piggy bank, offering fee-free mobile banking without the hassle of traditional banks. Merging daily spending with saving smarts, Varo helps you keep an eye on the prize – financial freedom.

Best Features:

- No monthly fees

- High-interest savings

- Early direct deposit

What we like about it: Zero fees. That’s right – no monthly maintenance, no overdraft fees, nada. It’s financial wellness with freedom attached.

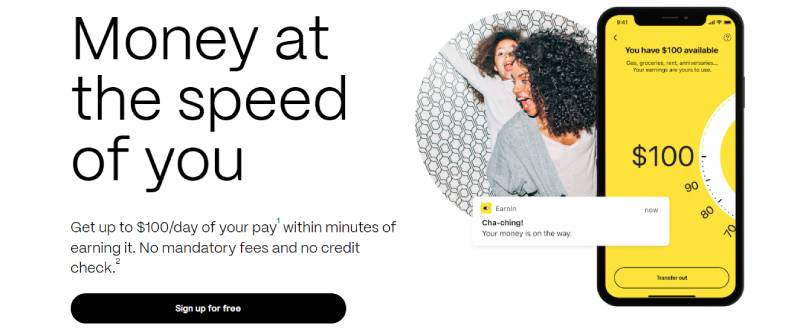

Earnin

Imagine a world where payday waits for you, not the other way around. Earnin’s all about giving you access to your paycheck advance on your terms, cashing in on hours already worked, and skipping those late fees because life happened a bit faster than payday.

Best Features:

- Cash out earnings instantly

- Overdraft alerts

- Tipping feature instead of fees

What we like about it: Instant cash advances. Bills don’t wait, and neither should you. Access your earned money with lightning speed.

MoneyLion

MoneyLion roars onto the scene, stacking up perks like a Swiss army knife of finance. From low-interest loans to investment options, it’s got the muscle to push you towards a plumper wallet and a savvier financial stance.

Best Features:

- All-in-one financial app

- Easy loans with low APR

- Robo-investing options

What we like about it: Its suite of services. Borrow, save, invest, and even earn rewards – it’s your money, diversified.

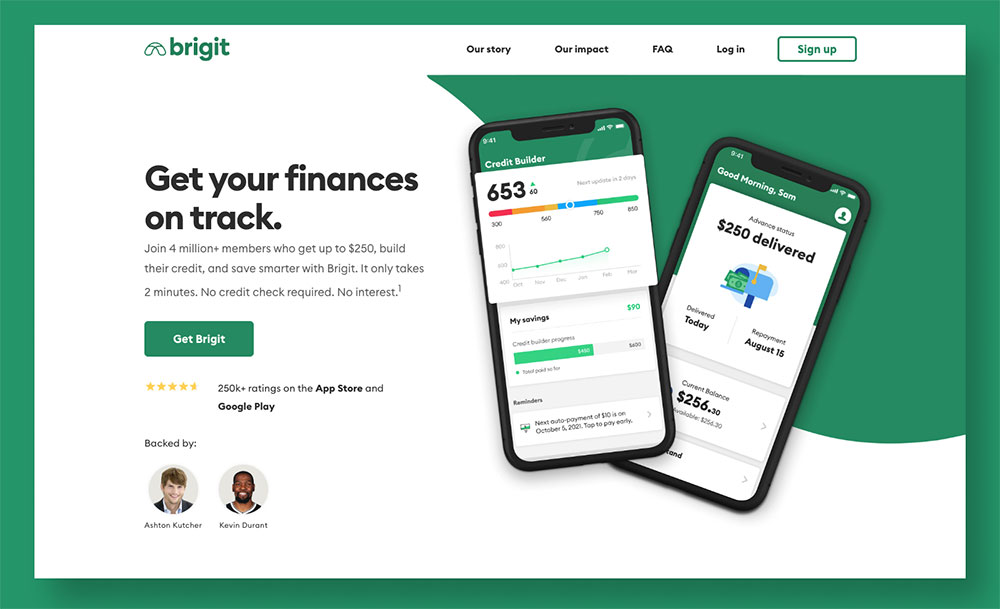

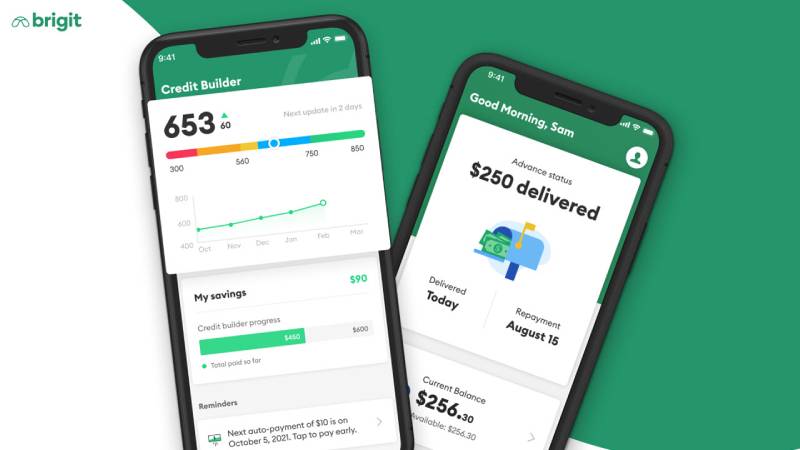

Brigit

Need a bridge over troubled water (or just until next payday)? Brigit’s your construction crew, laying down planks with cash advances and budgeting support to keep you financially afloat.

Best Features:

- No-interest cash advances

- Overdraft predictions

- Credit building

What we like about it: Brigit’s overdraft predictions. Say goodbye to “Oops, didn’t see that coming” and hello to smart, proactive finances.

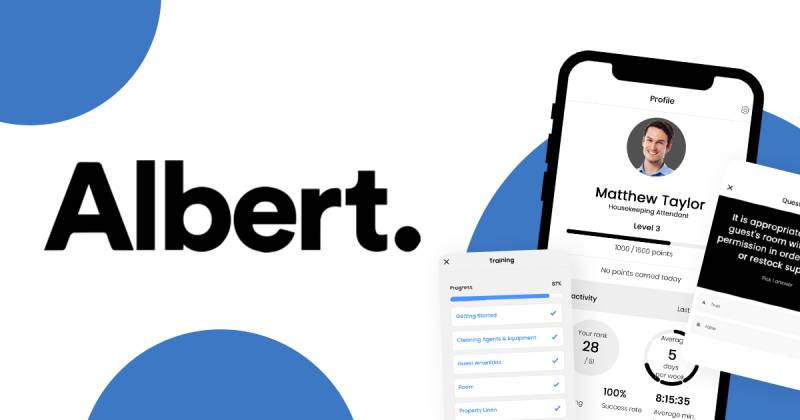

Albert

Albert’s like that super-organized friend who has their life in color-coded folders, but for your money. Smarter saving, simple budgeting tools, and nifty cash advances help you rule over your finances with an iron (but friendly) fist.

Best Features:

- Automated savings

- Financial advice from real pros

- Instant cash advances

What we like about it: Albert brings real human guidance to your money dilemmas. It’s nice to have someone (or something) to talk to.

Payactiv

Clock out and cash in. Payactiv bends time, getting your earnings to you when you want. It’s not a loan; it’s your money, early. Add in bill pay services and savings features, and you’ve got a financial time machine in your pocket.

Best Features:

- Earned wage access

- Bill payment services

- Savings and budgeting functions

What we like about it: Earned wage access. Payactiv flips the script on payday, handing you the reins to your own earnings.

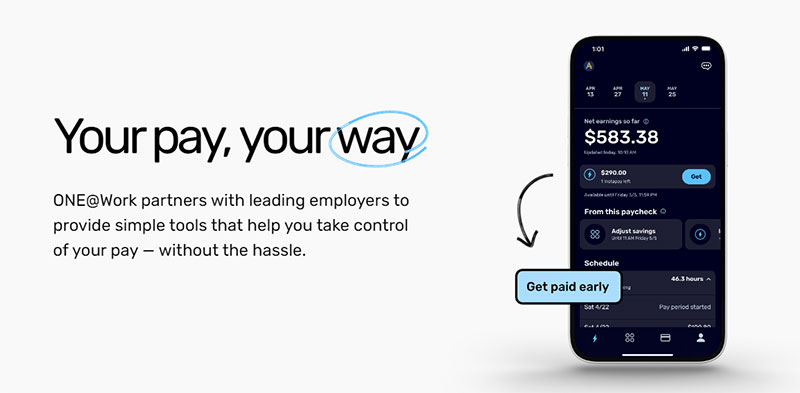

One @ Work

One @ Work marches to the beat of its own drum, saying “Mix it up!” to your dollars. It combines spending, saving, and sharing all in one sleek digital space, topped with some sweet interest rates to help your savings grow.

Best Features:

- Pockets for organizing money

- High-yield savings

- Paycheck Auto-Save feature

What we like about it: Pockets aren’t just for pants. One’s unique way to segment your funds makes money management almost fun. Almost.

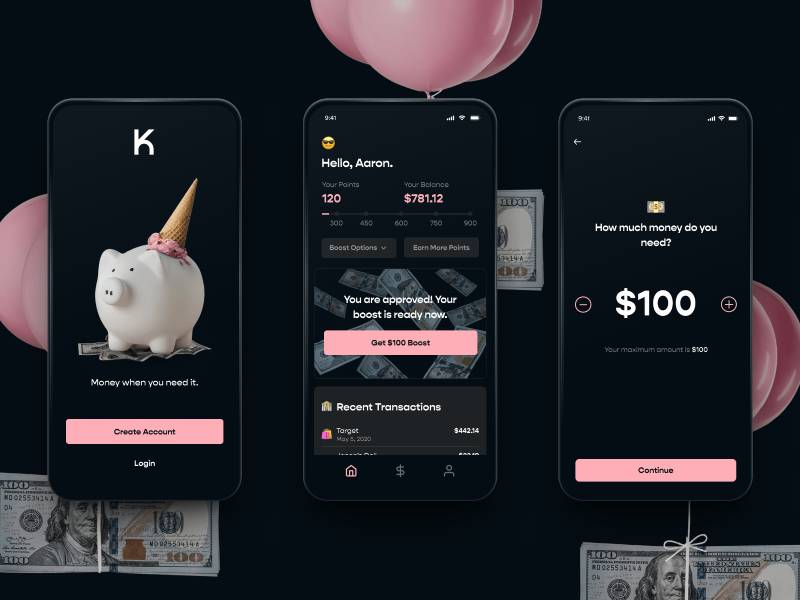

Klover

Ever wished for a money fairy? Klover might be the closest thing, offering boosts to your bank account with quick cash advances and budgeting insights that keep you on track without complex fees or money magic tricks.

Best Features:

- Zero-interest advances

- Spending insights

- Rewards system

What we like about it: The dash of simplicity. Klover’s zero-interest policy on advances keeps things straightforward. No strings. No stress.

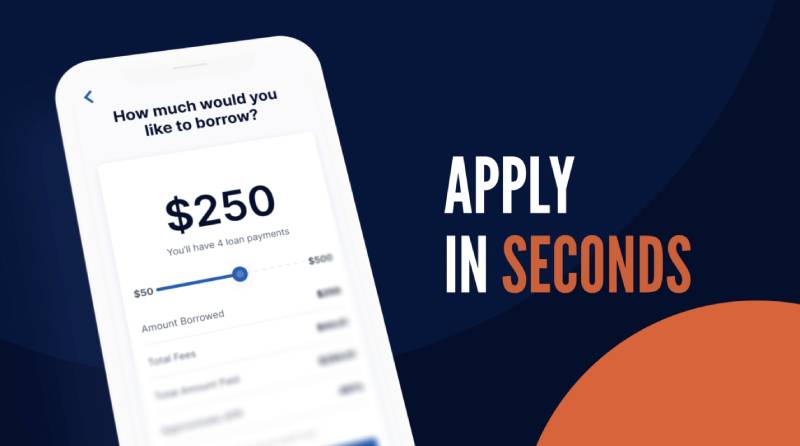

Possible

Tight spots and rough patches meet their match with Possible. It dishes out short-term loans like a considerate friend, understanding that sometimes life tosses a curveball you didn’t quite catch.

Best Features:

- Short-term installment loans

- Flexible repayments

- Helps build credit

What we like about it: Flexibility. Possible lets you repay on a schedule that doesn’t leave you scrambling for couch change.

Branch

Branch doesn’t just handle your money; it branches out into your work life. This app is all about financial perks at work, bringing paycheck advances and shift management into a smooth cocktail of workplace convenience.

Best Features:

- Wage tracking

- Fee-free checking

- Instant paycheck access

What we like about it: It’s the work-life blend. Branch knows your job and money are buddies, so it helps them play nice.

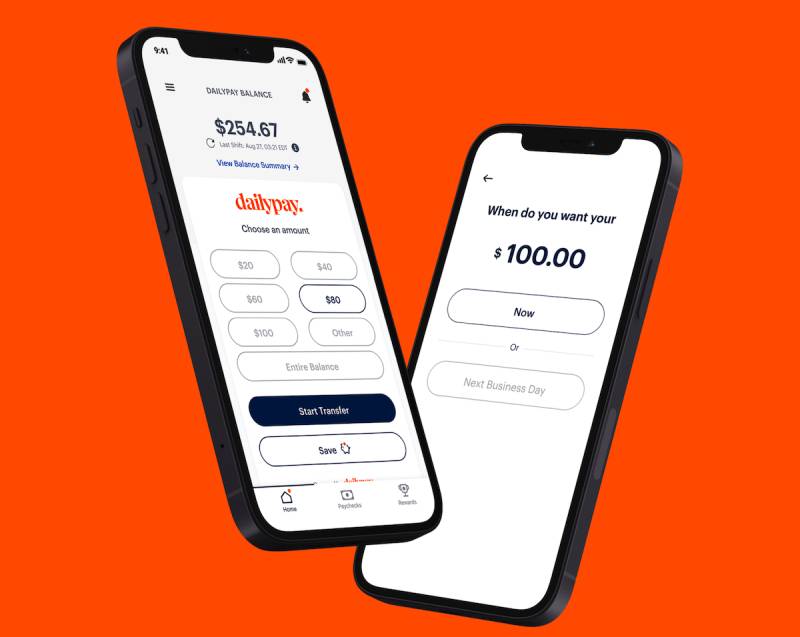

DailyPay

DailyPay says “Why wait?” to your earnings, believing every day can be payday. It’s the ninja of financial planning apps, sneaking up and offering you instant access to your hard-earned dough without fuss or muss.

Best Features:

- On-demand pay transfers

- Transparency in fees

- Integration with payroll systems

What we like about it: It’s cash flow management made easy. DailyPay empowers you with the choice of when to get paid. Period.

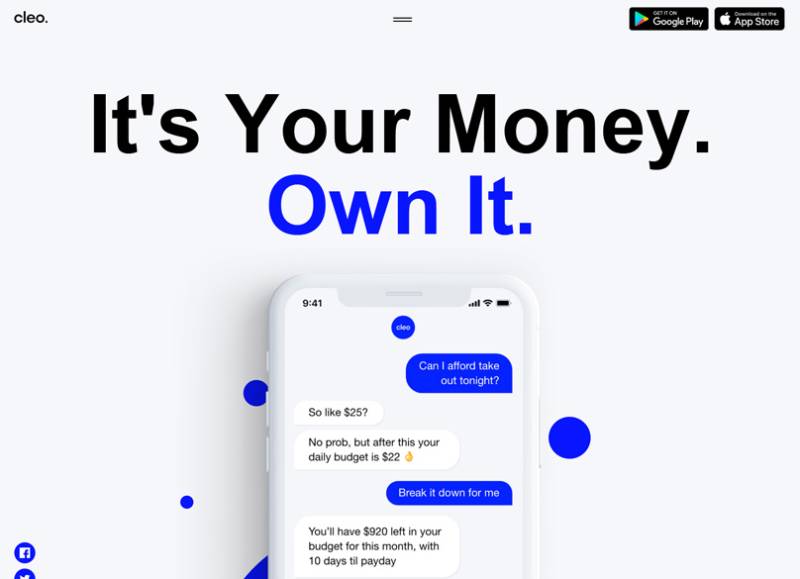

Cleo

Sassy savings? Check. Budgeting banter? Check. Cleo brings personality to your finances with a chatbot that makes money chats engaging, even when it’s dishing out tough love on spendy habits.

Best Features:

- Interactive budgeting assistant

- Savings goals you can bet on

- Cash advance options

What we like about it: The chatbot – it’s like texting a friend who’s really good with money and isn’t afraid to tell it like it is.

Chime SpotMe

Chime SpotMe is more like a financial wingman, stepping in to cover you when your spending overshoots. It won’t charge you for the favor, either. Just smooth, overdraft protection to keep you on the up and up.

Best Features:

- No overdraft fees

- Fee-free ATMs

- Automatic savings features

What we like about it: The overdraft protection. Chime’s got your back, spotting you some cash with neither fuss nor fees, and that’s gold.

FAQ about money apps like Dave

What exactly are money apps like Dave?

They’re your digital piggy banks, your financial pals. Think of them as apps that give you a budgeting toolkit, with features like instant cash advances and expense tracking. They float you a few bucks when your account’s dry and payday’s a mirage on the horizon.

How do these apps help if I’m low on cash before payday?

You’ve got a bill due, and your account’s mocking you with single digits. These apps offer a paycheck advance with minimal or no fees. It’s not a loan that’ll snowball; it’s just your money, served up early. You pay it back when your salary lands.

Are there fees for using a money advance app?

Mostly, nope. Many aim to be fee-free banking buddies. But stay sharp – some might ask for a subscription or suggest tipping for their service. No hidden fees, they say, but always double-check. Ain’t nobody got time for nasty surprises.

Is my bank info safe with these apps?

Top-notch security — that’s their promise. We’re talking encryption levels that would take a supercomputer ages to crack. Still, always do your due diligence. Read up on their privacy policies and don’t share your passwords. Common sense is the best line of defense.

Will using these apps affect my credit score?

Breathe easy. They’re like silent partners; credit score monitoring isn’t their gig. Your credit stays untouched when you nab a quick cash boost. But as with all things money, use them wisely. Don’t let that slip into habit cuz debt wearing different pants is still debt.

How fast can I get a cash advance?

Flash. Lightning. Super Sonic. Pick your speed metaphor, that’s how quick it can be. Some offer immediate cash advances that hit your account faster than you can say “I’m broke.” Others might take a day. Check their FAQs for the nitty-gritty.

Can these apps help me budget better?

Absolutely. They’re like having a financial planner stuffed in your phone. Track expenses, categorize splurges, and get nudges towards smarter spending. Over time, you might just find yourself saving more without even trying. It’s the sneak attack approach to financial wellness.

Are there limits to how much money I can advance?

Yep. Think more “emergency cab ride” than “new couch” money. Limits keep the loan repayment terms manageable and prevent the spiral into debt. These aren’t your wild short-term loans; they’re safety nets for when life throws a curveball.

What happens if I can’t repay the advance on time?

These apps are often understanding, not loan sharks. Repayment terms are fair, and if you stumble, they’ll work with you. Communication’s key. And whether it’s a subscription service or a one-off help, honesty about your funds keeps everyone happy.

Do money apps offer any features besides cash advances?

For sure. Budgeting tools and financial health check-ups for starters. Some might even throw in perks like savings accounts with competitive interest or rewards for healthy financial habits. They’re multipurpose – your financial Swiss army knife in slick app form.

Conclusion on apps like Dave

So, we’ve zipped through the digital alleyways of money apps like Dave. Fascinating, huh? These snazzy sidekicks, with their cash advances and budgeting tools, are revamping the way we handle those dollar bills.

- They’re not just about giving you cash when chips are down; they’re your financial wellness coaches.

- Think of them as smart wallets that don’t just store money but actively help you avoid those sneaky overdraft fees.

- And privacy? They’ve got it locked down tighter than your favorite pair of jeans.

Wrapping things up, it’s all about financial control at your fingertips. Whether it’s steering clear of payday panic or cracking the code on savings goals, these apps are revolutionizing money management.

So, ready your thumb, tap “download,” and step into the savvy sphere of proactive financial planning. With these apps, your financial big picture could look not just brighter, but downright dazzling.

If you liked this article about money apps like Dave, you should check out this article about apps that pay you to walk.

There are also similar articles discussing apps like MoneyLion, cash advance apps that work with Chime, cash advance apps that don’t use Plaid, and apps that pay instantly to Cash App.

And let’s not forget about articles on apps like Cash App, apps that make you money, apps like Brigit, and apps like Solo Funds.

- Professional Video: Cinematography Apps Like FiLMiC Pro - April 26, 2024

- Optimizing Your Shopify Store for Maximum Dropshipping Success - April 26, 2024

- Python Explained: What is Python Used For? - April 26, 2024