Discover the Best Cash Advance Apps

Hey, you know that feeling when payday is just a little too far away? We’ve all been there, right? Exactly where cash advance apps swoop in. Like a financial superhero for those moments when you’re caught between paychecks. They’re the tech-savvy solution for immediate dough needs—no cape required.

Here’s the deal: By the time you’re done with this read, you’ll be a mini-expert on these nifty apps. We’re talking the whole nine yards—from spotting a reliable payday loan service to understanding the fine print like APRs and loan repayment terms, minus the headache.

Whether it’s curiosity or a pressing financial need that brought you here, we’ve got the scoop on how these apps work, the dos and don’ts of online borrowing, and tips for responsible cash flow management. Buckle up; it’s time to deep dive into the world of instant financial fixes.

The Top Cash Advance Apps To Try

| Apps | Cash Advance | Interest Rates | Fees | Repayment Terms | Banking Services | Credit Monitoring | Extra Features | App Store Rating |

|---|---|---|---|---|---|---|---|---|

| Brigit | Up to $250 | None | Monthly subscription | On payday/set date | None | Yes | Budgeting, financial insights | 4.8 |

| Varo | Up to $100 | None | No monthly fees | Set date/deposit occurs | Full banking suite | No | High-yield savings, early deposit | 4.9 |

| Payactiv | Varies on hours worked | None | Fees may apply | By next payday | None | No | Bill pay, savings tools | 4.8 |

| Empower Finance | Up to $250 | None | Subscription for premium | Automatic on payday | Banking, budgeting | Yes | Auto Savings, alerts | 4.7 |

| Earnin | Up to $100 per period | Optional tips | No mandatory fees | On next payday | None | No | Balance Shield, Health Aid | 4.7 |

| MoneyLion | Up to $250 | None | No fees for core features | On payday/deposit occurs | Full suite with RoarMoney | Yes | Investment accounts | 4.7 |

| Dave | Up to $100 | Optional tips | $1/month membership | On next payday | Budgeting tools | No | Side hustle jobs | 4.8 |

| SoLo Funds | Set by peers | Peer-set | Tips optional | Peer-agreed | None | No | Community, own terms | 4.4 |

| Klover | Up to $100 | None | No subscription fees | On next payday | None | No | Insights, points system | 4.7 |

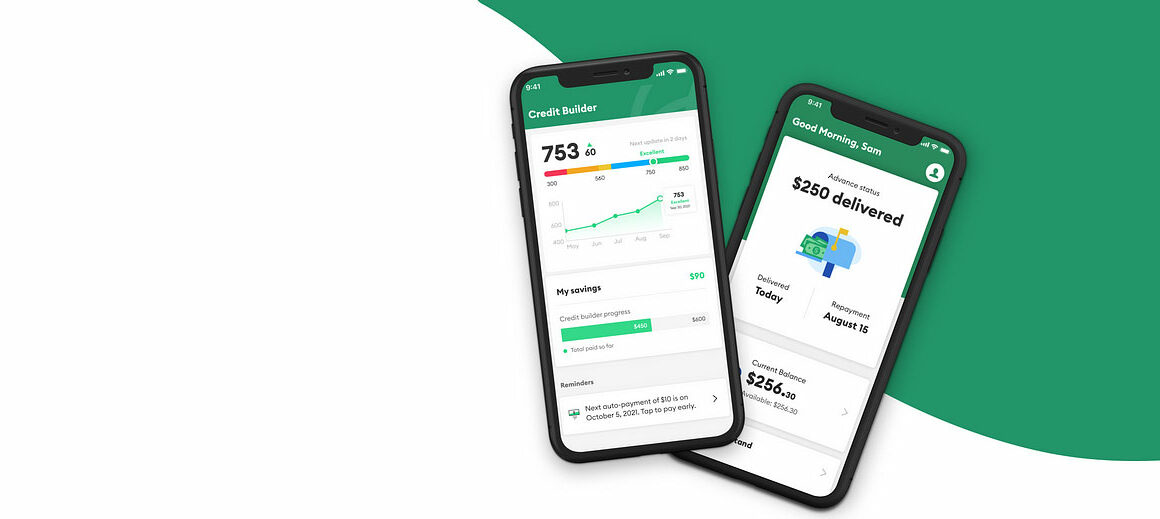

Brigit

Brigit is like that buddy who’s got your back when your wallet’s light. This app is a lifesaver, stepping in with a quick cash advance before the dreaded overdraft kicks in.

Best Features

- Automatic advances to avoid overdraft fees

- Budgeting tools to keep your spending in check

- Credit monitoring for a financial health check-up

- No interest rates, just a simple monthly fee

What we like about it: It’s the brains of the operation—the smart alerts that give you a heads-up before money trouble starts. That kind of foresight? Pure gold.

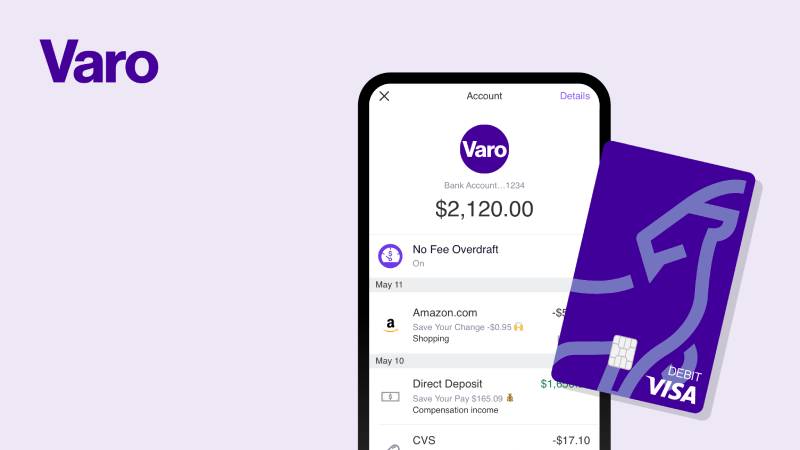

Varo

Varo’s the full package: a bank account that offers cash advances with no fuss. It’s like your financial command center, ready to launch a rescue mission for your budget with app-based banking.

Best Features

- No monthly account fees

- High-yield savings account

- Quick direct deposit options

- In-app cash advance feature

What we like about it: High-yield savings got us buzzing. Who doesn’t want their money to work a little harder for them?

Payactiv

Payactiv is like getting a sneak peek at payday. Your hard-earned cash, available before the paycheck clears the bank—because sometimes the due date can’t wait.

Best Features

- Access wages before payday

- Bill payment services right from the app

- Savings and budgeting tools

- Uber and Amazon connectivity for in-app purchases

What we like about it: Their Earned Wage Access puts you in control. No more clock-watching till payday—it’s your money when you need it.

Empower Finance

Empower Finance keeps it real with cash advances that have your back in a pickle and smart tools that help you stay on top of your bucks.

Best Features

- Customizable alerts for low balance warnings

- Subscription canceling feature to cut unwanted fees

- Budgeting categories to watch your spending

- Automatic Savings to grow your stash without stress

What we like about it: Subscription snooping is clutch. It spots those sneaky fees for stuff you forgot you’re paying for.

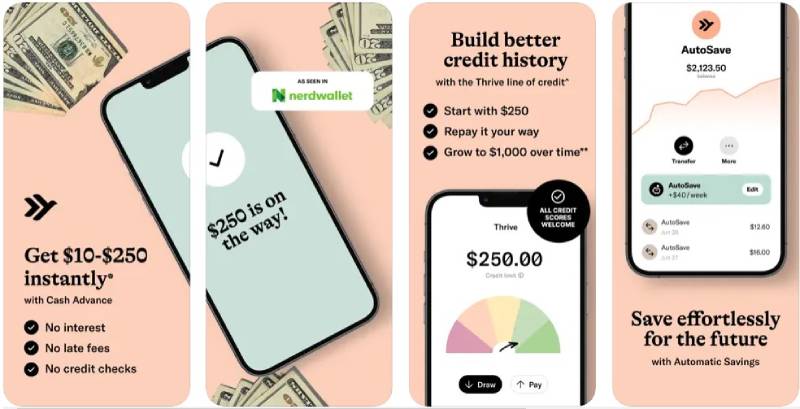

Earnin

Earnin is all about that in-the-moment moola, giving you a piece of your paycheck when your budget’s slim and payday’s a dot on the horizon.

Best Features

- Cash out based on hours already worked

- Tipping system instead of mandatory fees

- Balance Shield to prevent overdrafts

- Health Aid to negotiate medical bills

What we like about it: Roll with Earnin, and it’s like your payday’s playing catch-up with your life. Grab what you’ve earned, no borrowing against the future.

MoneyLion

MoneyLion roars onto the scene, offering not just cash advances but a full financial suite to get your dough rising and your budget under control.

Best Features

- “Instacash” advance at 0% APR

- RoarMoney bank account for all your finance needs

- Investment account feature for growing your stack

- Financial tracking and credit builder loans

What we like about it: That “Instacash” advantage—it’s like finding a no-interest oasis in a desert of high rates.

Dave

Dave’s like the chill friend who spots you some cash, no drama involved. It’s a gentle nudge to your funds, so you’re not left stretching pennies ’til payday.

Best Features

- Budgeting tool predicting upcoming expenses

- Low balance alerts

- Option to tip for service, no mandatory fees

- Side hustle feature to find extra gigs

What we like about it: Budgeting that predicts the future? Almost. Dave’s got that sixth sense for your bills, keeping surprises off your statement.

SoLo Funds

SoLo Funds is the community vibe—peer-to-peer lending that’s about people helping people. Got a bit extra? Loan it out. Wallet’s tight? Request a few bucks.

Best Features

- Peer-to-peer lending platform

- Set your own terms for loans

- No hidden fees; it runs on tips and donations

- Loan and donate with a community feeling

What we like about it: You’re joining a circle of trust. It’s lending and borrowing with a personal touch, not just cold, hard transactions.

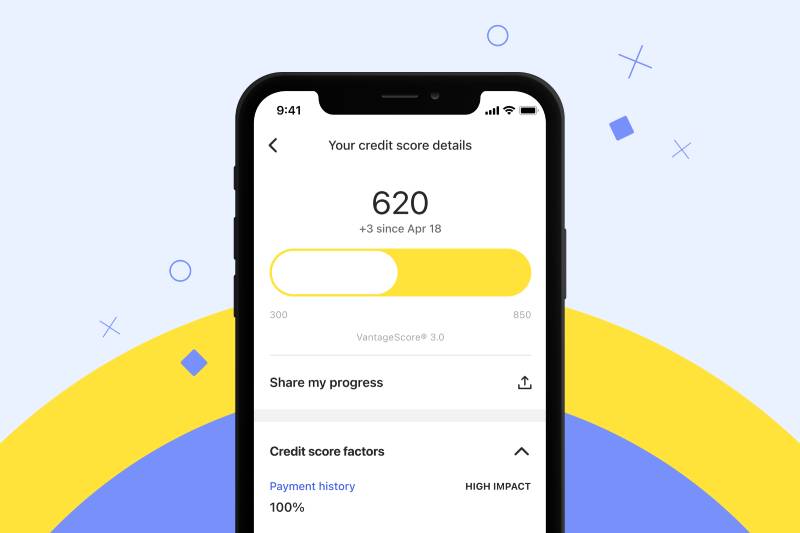

Klover

Klover’s your quiet support in a financial crunch, offering cash advances with zero interest to tide you over. No noise, just help when the budget balks.

Best Features

- No interest cash advances

- Simplified sign-up with minimal info

- Direct integration with your paycheck

- Bonus features like spending insights and points system

What we like about it: Their simplicity steals the show. No interest, no worries, just the boost you need, and you’re good to go.

Comparison of Cash Advance Apps

Now that we’ve surfed through the individual apps, let’s throw them in the ring and see how they fare head-to-head.

Interest Rates and Fees

A biggie for many! While some apps like Earnin work on a tip system, others, like Possible, operate with interest in mind. Always, and I mean ALWAYS, read the fine print. The best cash advance apps aren’t just about quick cash; they’re about affordable cash.

Loan Amounts and Repayment Schedules

From tiny advances to cover that unexpected pizza night to more substantial amounts for bigger emergencies, these apps have a range. And how they want it back? Varies. Some want it by your next paycheck, while others are chill with installments.

Speed of Funding

Time is money, pals. When you’re in a crunch, you want that cash ASAP. Most apps are pretty swift, but some are Usain Bolt level fast.

Subscription Fees and Other Costs

Some apps are free to use, while others come with a monthly tag. And then there are those sneaky hidden costs. Be on the lookout, be informed, and choose wisely.

How to Use Cash Advance Apps Responsibly

Alright, it’s not all fun and games. With great power (read: cash) comes great responsibility. As we navigate the galaxy of best cash advance apps, let’s touch down on the planet of responsibility. Here’s the lowdown:

Avoiding Overdependence

Cash advance apps? Cool. Relying on them every month? Not so cool. They’re like your favorite spicy sauce – best in moderation. Depending on them too much can set you in a loop of perpetual borrowing, which is kinda like being stuck in a bad rom-com. Fun at first, but then…

Understanding the Terms and Conditions

Alright, I get it. T&Cs are the equivalent of watching paint dry. But trust me, a quick scan can save you from hidden traps. It’s like reading the rules before a game night. You don’t want to be that person who messes up the game, right?

Planning for Repayment

Remember, borrowed cash isn’t a gift. It’s like borrowing a sweater from a friend. You gotta give it back (and preferably in good condition). Set reminders, mark your calendar, do a little repayment dance. Whatever it takes to ensure you’re not caught off guard.

The Future of Cash Advance Apps

Let’s gaze into the crystal ball, shall we? What does the future hold for our favorite best cash advance apps?

Trends and Innovations

Tech’s evolving faster than we can say “cash advance.” Expect more integrations, like tying up with your fave online stores or offering personalized financial advice. Maybe they’ll even sync up with your smart fridge to warn you before an impulsive ice-cream purchase (kidding, or am I?).

Impact of Regulations

The financial world’s a stage, and regulations play a starring role. As cash advance apps grow in popularity, expect more scrutiny. This could mean more safety nets for users, but maybe some added hoops for the apps.

Potential Challenges and Opportunities

The road ahead? It’s got bumps and green lights. On one hand, there are challenges like gaining user trust and dealing with competition. But on the other, there’s massive potential, from global expansions to diving into areas like investment and insurance.

FAQ about best cash advance apps

How do cash advance apps work?

They’re like emergency funds in your pocket. You download the app, punch in some details, and link your bank account. Then, based on your earnings or paycheck info, they let you borrow a bit of cash. When payday hits, they take what you borrowed plus any fee or interest.

Are these apps safe to use?

Generally, yes. But like any financial move, you gotta play it safe. Check for encryption, read privacy policies, and make sure it’s a reputable app. Better safe than sorry when it comes to your bank info and personal data.

Is the money instant?

Often, but not always. Some apps offer lightning-fast transfers, while others might take a business day or two. It depends on the app’s mechanics and your bank’s processing times. Check the fine print so you’re not left hanging when you need cash stat.

What’s the catch with these apps?

Here it is: fees and tips, they can add up. Some ask for a “tip” to skip the interest, others charge a monthly subscription, and there might be extra charges for quick money transfers. Read up, so you’re not caught off-guard by what’s in the terms and conditions.

How much can I borrow?

Not the jackpot, lemme tell you. Usually, it’s a small amount, maybe a couple hundred bucks, tied to what you earn. It’s meant to cover a tight spot, not big-ticket spends. Always confirm the limit with the app so you know the deal.

Will they affect my credit score?

Most won’t ping your credit, which is sweet. That said, some might report late repayments. If they don’t mention credit checks, it’s worth asking directly. Knowing can save you from unwanted surprises on your credit report.

What happens if I can’t repay in time?

Let’s keep it real: It can get messy. Some apps charge late fees or increase your interest rate. Reach out to customer support before you hit a snag, and they might work out a plan. Pro tip: plan ahead to avoid this jam.

Are interest rates high?

Typically, yes—higher than your traditional bank loan. Remember to eye those APRs. Some apps disguise high costs as small, upfront fees. Break out a calculator and do the math on those “small” numbers over a year; trust me.

Can I use multiple apps at once?

Technically? Sure. Wisely? Eh, it’s complex. Juggling several apps can be a fast track to a debt spiral. If you’re taking advances from Peter to pay Paul, that’s a red flag, my friend. One at a time is a smarter play.

How do I pick the best app?

Do your homework. Compare interest rates, fees, borrowing limits, and user reviews. The best fit depends on your pocketbook’s needs. Plus, consider extra features like financial planning tools or advance payment services. Your choice should be as informed as possible to avoid any regrets.

Conclusion on the best cash advance apps

Alright, let’s wrap this up.

Checking out cash advance apps is a bit like dipping your toes in a pool before a swim. You want to know what you’re getting into, right?

Quick cash solutions can be tempting, like super tempting. But always, and I mean always, hit pause and check out those details. From loan repayment terms to sneaky fees, knowledge is your power.

You’re looking for a lifeline, not a anchor. Think about it. Those few bucks today could mean a headache tomorrow if you’re not sharp on the interest rates or the app’s loan approval process.

So, take care. Make smart choices. And if you need a nudge in the right direction, remember this talk. These bite-sized loans should be life-savers, not budget-breakers. Stay woke, stay wise, and keep your finances tight. Peace out.

If you liked this article about the best cash advance apps, you should check out this article about apps like Ingo.

There are also similar articles discussing apps like Zogo, apps like Rocket Money, apps like Self, and apps like Upside.

And let’s not forget about articles on apps like Revolut, apps like Ualett, apps like Zebit, and apps like Bright Money.

- Top React Native Libraries for App Development - May 9, 2024

- Angular’s Applications: What is Angular Used For? - May 9, 2024

- Drive and Earn: Essential Apps Like Doordash - May 8, 2024