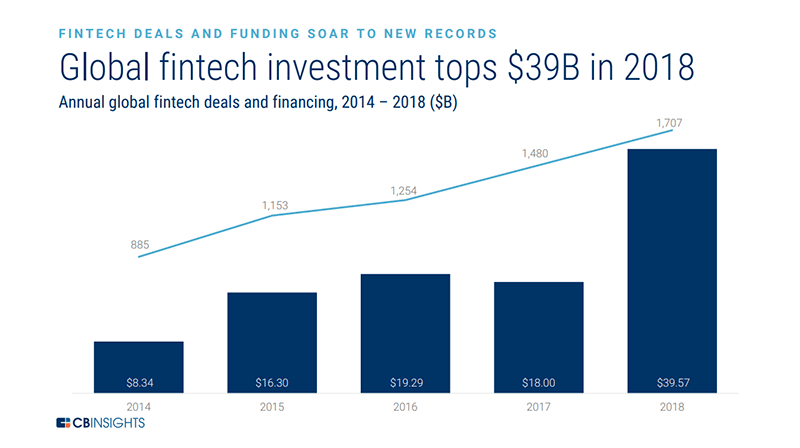

Financial technology is on the rise, and competition is high. With the constant development of new fintech apps and features, it is important to cover the current and future ones that are currently developing.

At TMS we regularly follow the newest technology, so we have decided to take a look at the features popular fintech apps already have and what’s expected in the future.

Lured by growth forecasts, many financial firms, and software development companies have announced fintech projects. Here at TMS, we’ve taken a hard look at market realities and future technology.

Here’s what our research tells us about the state of the fintech industry and the exciting technologies that will give users more flexibility and control.

Fintech has reduced transaction costs by minimizing the middleman commissions. Mobile apps, in particular, have brought financial services to formerly unbanked people. Fintech apps make finance easier and more accessible to everyone.

Customers are now choosing online transactions over banks. Fintech is finding new applications in loans, insurance, crowdfunding, and money transfers – both instant and international.

Fintech is a crowded and intensely competitive market. Many of today’s hopeful startups will be gone tomorrow. Want to be a survivor? Then make sure your fintech app does a great job of implementing the six key principles and features below. But even before that, keep in mind one fundamental rule, valid for Fintech as well as other apps, that surprisingly many entrepreneurs forget: start with a focus on solving a single pain point, and make sure customers are willing to pay for the solution.

Innovation is never adopted just for the sake of it – make sure you solve some significant problem for your target audience, and your solution is valuable enough. It’s not absolutely necessary to invent something new – you can as well do something that’s already being done by others, but better in some specific way – faster, cheaper, more convenient, with fewer steps, etc.

Here are features that every fintech app needs to have:

1. Simplicity

Fintech delivers unprecedented power to users, giving them access to advanced services so they can manage many of their own financial operations.

The most successful fintech apps are those that deliver maximum flexibility and advanced services on a platform that’s easy to use.

Savvy developers are focusing on high-reliability services that streamline common operations.

The idea is for apps to be simple analytical tools that compile financial data, display transaction histories, and allow users to create financial programs with a simple interface.

Every fintech app should have real-time analytics and statistics that track finances, helping users and their companies recover revenue.

Apps for financial fraud detection also need to include ID analytics to assess user risk.

Online P2P-Lending platforms, like Lending Club, make the processes of money borrowing and private debt deal investments much easier compared to the standard bank credit application, so the popularity of service is no surprise.

2. Customers Come First

The real promise of fintech is that it can put customers in charge of their own finances, empowering them to set, pursue, and track their financial goals.

The best apps offer an excellent user experience. They’re much simpler and more convenient than dealing with banks.

Mobile platforms have set high expectations for UX. Users expect to be able to set up reminders and payment schedules for recurring billing transactions.

They expect a robust notification system that alerts them to unusual transactions. Apps must track log-ins, card payments, money transfers, ATM withdrawals, and other activity so users can quickly zero in on danger signals like denied transactions. This data allows users to detect security lapses and fraudulent account activity.

And since we’re talking about mobile devices, fintech apps should be able to tie into international location technology and help users find nearby ATMs and bank offices at home or on the road.

Take Revolut as an example – they really put the end customer in the center of things. Apart from not having to invest time into visiting banks in person, customers can also get radically better rates for banking services, which is probably the secret of its breakthrough growth

3. Innovation

Winning fintech apps will be those that continue to incorporate innovations. Some apps will innovate by expanding the range of financial services they handle, while others will innovate by tapping into user data maintained by mobile systems and popular applications.

User management is one area ripe for innovation. Mobile platforms are incorporating biometric scans and other advanced methods of controlling access. These advanced measures should be part of fintech apps as well.

Form management is another area that will help make apps more accessible and easy to use.

What else is on the horizon? How about risk assessment features that let users and lenders assess deals?

Those assessments can be even more on-target if the data is drawn from appropriate, approved access to the user’s account history.

For example, WealthFront leverages innovative technologies that replace the classic investment and wealth management advisers. Its large database and machine learning algorithms will allow you to manage your personal financial plan through a simple mobile app.

4. Multi-tier functionality and fast transactions

As fintech apps find their way onto the PCs and smartphones of more users, service providers must be prepared to manage multi-tier access and keep up with thousands, tens of thousands or more concurrent sessions, all while maintaining user-pleasing response times.

Applications for insurance and loans should have options for tracking commissions. This feature allows users to track their progress toward hitting sales goals and bonuses while boosting motivation – and sales.

Apps that incorporate or work with workflow engines will allow users to generate necessary documents and financial instruments on the fly.

A great example would be TransferWise with its monthly process today being above £3 billion in transactions between 71 countries and 1300 routes. And they can still process each transaction in one day in most cases.

Source: www.cbinsights.com

5. Integration

The best fintech applications integrate with existing applications for bill-paying, transactions, user-account maintenance, and other tasks.

Integration can make a fintech app much more useful, but it complicates application development, as coding teams and testers must establish, test, and maintain integration with third-party applications and data sources on multiple platforms.

For example, Trulioo is built purely as a B2B service for fintech platforms, but many other services use it to verify the customer’s identity and perform anti-money laundry checks.

6. Security

Fintech applications must address data security and privacy issues.

Users must be confident that the data they share with a fintech app will be secure. Fintech companies help ensure data security with regulation and compliance, but they must also respond immediately and appropriately to cyber threats and attacks.

Security is so important in fintech app development, it often makes sense to hire companies to create, audit, or certify security and identity-management measures. Typical security measures include:

- a lockout after failed login attempts,

- reentering of password when editing card or address details.

- displaying only the last three digits of card numbers.

Fintech futures

The fintech industry will continue to make finance easier and more accessible to more people. It will continue to expand into new financial areas such as payments, savings management, and loans.

Fintech apps will be more efficient, more secure, more flexible, and more appealing as the industry adopts new technologies like blockchain, biometrics, and API integration.

Customized Data Analytics

Many industries need to deal with Big Data. That’s especially true of the financial industry. User demand and the changing technological landscape ensure that developers of future fintech apps must include features to analyze financial data and create reports for the user.

This feature already exists in many fintech apps, but it will grow significantly more powerful and flexible to make tracking and accessing the history of financial activities much easier.

Currently, report management gives users reports and summaries for all their activities.

In the future, users will be able to see transaction reports that are divided into categories, which will help them determine how much they spend in each category.

And with options for saving goals, users will be able to choose from suggested goals, add custom goals, and establish timelines to save money for future investments.

As loans and credit card models integrate more closely with fintech apps, improved analytics will help users understand and comprehend data with visual representations and suggestions.

This will give users better insight into their spending, saving, and investment habits.

Cryptocurrency and Blockchain

Blockchain already become a mainstream innovation in fintech. The technology offers great transparency at the cost of minimal time, yet it still has a great potential to be applied in the fintech apps.

The advantage of blockchain is that it records, validates, and administers every single transaction. No one can tamper with the transaction record.

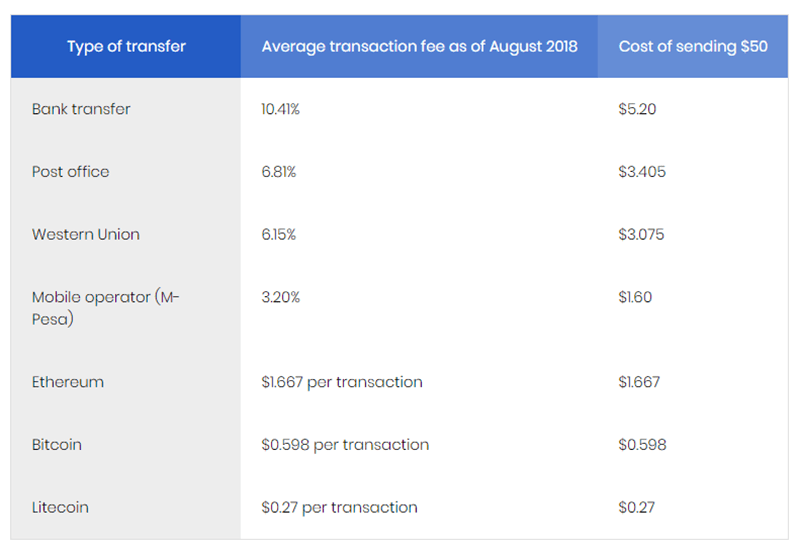

Blockchain technology can help fintech firms improve P2P payments and eliminate high transaction fees for local and especially international payments. The blockchain will help everyone involved in the transaction save time and money.

The figures are from the World Bank and BitInfoCharts.

In addition, blockchain supports fast, secure data-sharing across platforms without recourse to intermediaries like banks and insurance companies.

This could bring some turmoil to the finance industry but ultimately it will make transactions more secure and more efficient for everyone.

The potential of blockchain technology is hugely transformative.

Artificial intelligence leaves the labs

The majority of modern fintech apps are slowly introducing artificial intelligence features into their software.

Some apps already rely on complex algorithmic processes that determine how much users spend or how much they can afford to save.

Advanced machine learning, automated customer processes, and chatbots will provide intelligent banking services to users and improve customer service.

The AIs will be designed to improve operational efficiency and accuracy, freeing up bank resources and allowing finance professionals to focus on more profitable activities.

[activecampaign form=25]

Personalization

Artificial Intelligence will provide smart answers and suggestions to users based on their spending and investment habits. That’s one way AI personalization will help financial services providers be more interactive with customers.

Artificial intelligence will be extremely useful with the personalization of investment services and offering personalized recommendations.

Voice-Assisted Banking

Artificial intelligence for voice recognition and generation is nearly omnipresent today, with personal virtual assistants like Google Assistant, Siri, and Cortana and smart speakers like Google Home, Apple HomePod, and Amazon Echo and free text to voice generators like Murf and Speechify.

Voice banking is already popular, and we are rapidly approaching the time when we will be able to use virtual assistants for banking transactions.

This will remove the need for annoying bank calls. Customers will be able to solve their problems by discussing issues with vendors’ online bots.

The bots currently deployed in fintech are in charge of messaging and simple problem solving, but advancements in AI technology will widen their field of use.

Virtual reality

VR is an interactive computer-generated experience that allows users to be present and interact within a simulated environment.

Fintech firms are slowly exploring the idea of VR and how to implement VR for payments, data visualization, and other services.

Automation

AI will allow developers to create fintech apps to automate more repetitive and manual tasks.

AI will help users make immediate decisions about their money – where to put it, approving loans and interest rates, what to do with overdrawn accounts, and so on. AI can even take over notification management so you receive only notifications that require your intervention.

Biometric security

Security is essential to fintech apps. Well-publicized cyber attacks erode user confidence when using online payment methods.

Companies are beginning to replace or augment unreliable and inconvenient password-based security systems with fingerprint input.

Future apps will include additional biometric authentication options such as facial recognition, which has proved to have better reliability.

Apart from facial recognition, a biometric technology that will identify users by their heartbeats is developing. By using your wristband or smartwatch, you will be able to log into your app just by letting the watch measure your heartbeat.

And if that is not enough, palm-vein biometrics are also in development. The idea is similar to fingerprint recognition. To authorize access or payment, you simply scan your hand over the reader.

Third-party authentication apps

Two-factor authentication is a good way of securing digital accounts. The most common two-factor authentication is via SMS, but there are also third-party apps that can serve as protection for fintech apps.

Google Authenticator, LastPass Authenticator, Microsoft Authenticator, and Authy use QR codes or tokens to authorize users.

Additionally, there are apps that rely on using the network and mobile operator components to securely authenticate users.

API integration

Application programming interfaces are used by software applications to interact with each other, define rules and standards of these interactions, list of commands and expected results.

APIs allow building large applications by integrating multiple platforms, without having to re-build certain functionalities for each and every application all over again. A modern online application or SaaS may be integrated with dozens of APIs from the same ecosystem without the end user even knowing it.

For example, API integration is what lets fintech developers tap into the geolocation service on a mobile platform to tell users where to find a nearby ATM.

In terms of fintech, APIs are already heavily used to provide partially automated due diligence, KYC/AML processes; and APIs of platforms like IBM Watson are more and more used to simplify building AI and machine-learning-based solutions.

The Future of Banking

In many ways, fintech apps have decreased customer reliance on banks. As fintech companies make their apps more useful, they’ll handle more and more of users’ needs. Some disruption of banking seems inevitable.

That’s one reason that banks are rushing their own fintech projects to market and partnering with fintech companies to deliver enhanced convenience and access to users.

Banks that resist fintech will slowly become less relevant.

Users – especially younger users – will become increasingly reluctant to sign on with banks if they can’t use fintech tools to monitor funds and make transactions.

The future is bright

Fintech is already revolutionizing the market, but many of its most useful and appealing features are just beginning to emerge.

Artificial intelligence will make a significant impact on the development of fintech. It will affect personalization, automation, and security, improving apps for the better.

With the removal of transaction fees, Cryptocurrency will significantly improve payments and attract more users.

If you are looking to make a fintech app let’s have a constructive chat and see what we can do together.

- What Are Third-Party Cookies and How They Work - April 20, 2024

- How Do Websites Detect Adblock? It’s Quite Simple, Actually - April 14, 2024

- Financial Software Development Companies You Should Know - April 11, 2024