Delay Payments Smartly: 11 Apps Like Deferit

Bills on your mind? They cling like shadows, constant companions to our financial comings and goings. Apps like Deferit aren’t just about delaying the inevitable; they’re safety nets for your cash flow, liberators of your bank balance.

Dive into an era where installment payment platforms transform how we tackle those pesky monthly expenses.

It’s not just wishful thinking—it’s the fintech revolution at your fingertips. Imagine wielding the power to sift through expenses without the sweat of due dates breathing down your neck.

This article is your key to unlock a world where financial management tools and budget-friendly payment apps become your allies.

Become savvy at not just meeting, but mastering your bills—breaking them down into digestible, manageable morsels.

By the time you reach that last paragraph, you’ll be equipped with a treasure trove of alternatives, each dissected for ease, reliability, and of course, that ever-important budget fit. Ready to revolutionize your bill payments? Let’s dive right in.

Top Apps Like Deferit

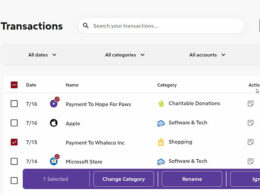

| Apps Like Deferit | Interest/Fee Structure | Payment Schedule | Credit Check | Geographical Availability |

|---|---|---|---|---|

| Afterpay | No interest; Late fees may apply | Four equal installments, due every 2 weeks | No | Available in US, Canada, UK, Australia, and New Zealand |

| Splitit | No interest or fees | Choose your own schedule, up to 24 months | No | Global, varies per merchant |

| Klarna | No interest on Pay in 4; Interest may apply for longer-term financing | Pay in 4, or monthly financing | Soft credit check for Pay later; Hard credit check for financing | Available in 17 countries, including US, UK, and regions in Europe |

| Sezzle | No interest; Late fees may apply | Four installments, due every 2 weeks | Soft credit check | Primarily US and Canada |

| Zilch | No interest; A small fee for “Buy Now, Pay Later” if you choose to pay over 6 weeks | Payment over 6 weeks (25% upfront, then bi-weekly) | No | Available in the UK |

| Zip | No interest on Zip Pay; Interest may apply for Zip Money | Weekly, fortnightly, or monthly installments | Soft credit check | Available in Australia, New Zealand, US, UK, South Africa, Mexico, and more |

| Affirm | No interest or fees for some loans; Interest may apply depending on the merchant and purchase | Monthly payments, up to 36 months | Yes | Available in the US |

| Laybuy | No interest; Late fees may apply | Six weekly payments | Soft credit check | Available in New Zealand, Australia, UK |

| Perpay | No interest or fees; Mark up on item prices | Bi-weekly installments deducted from paycheck | Soft credit check | Available in the US |

| Brighte | No interest payment plans; Fees may apply | Repayment terms vary by plan | Credit check required | Available in Australia |

| LatitudePay | No interest; Late fees may apply | 10 weekly payments | Soft credit check | Available in Australia and New Zealand |

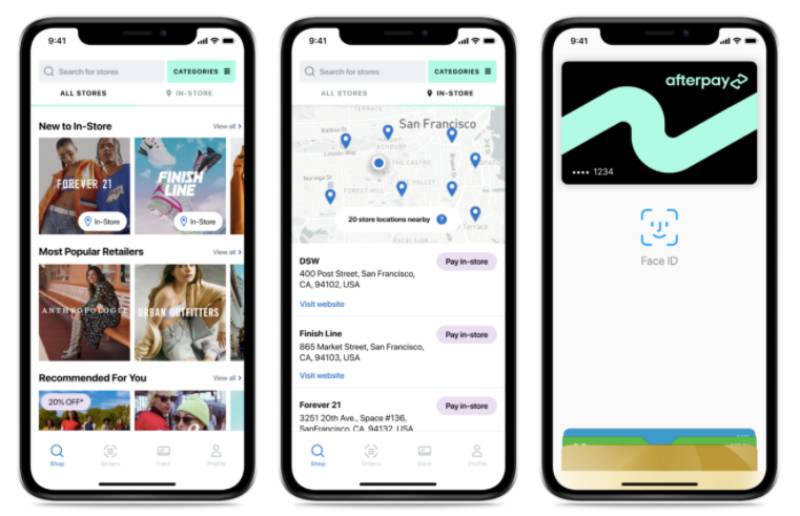

Afterpay

Take control of your expenses with Afterpay, and kiss those full-price upfront payments goodbye. It’s all about stress-free shopping where you snag your must-haves today and split the cost into four easy peasy payments.

Best Features:

- Pay in 4 installments

- Zero interest if paid on time

- Wide network of retailers

What we like about it: The real game-changer? No interest, as long as you stick to the schedule. Plus, Afterpay’s huge list of partners means you can use it for everything from that killer wardrobe update to tech gadgets galore.

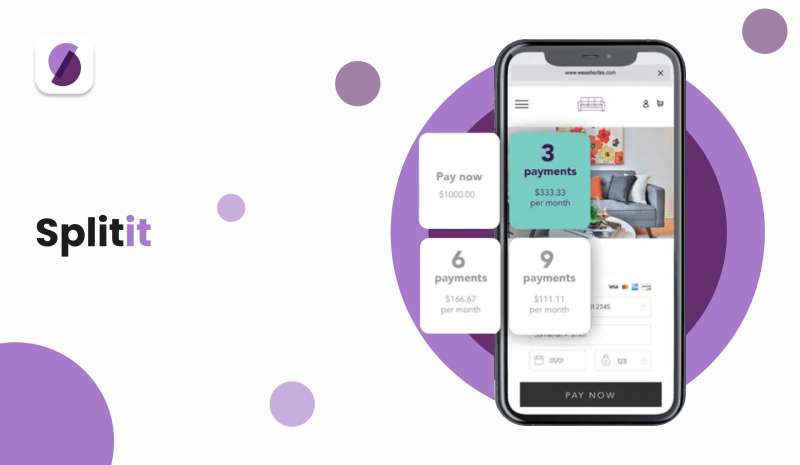

Splitit

Say hello to Splitit, the smooth operator of installment payments. It’s the nifty tool that takes your credit card and slices up those purchases, making big buys feel like a walk in the park.

Best Features:

- Uses existing credit card

- No credit checks

- No new accounts needed

What we like about it: Your hitch? No need for new accounts or credit checks. Just straight-up splitting that amount on your current card. Talk about keeping it simple!

Klarna

Ready for a payment plan with some serious flex? Klarna’s the name, and kicking payment pain to the curb is the game—with options to pay now, later, or over time.

Best Features:

- Flexible payment options

- Pay now or in installments

- Instant approval decisions

What we like about it: The wow factor? “Pay in 4” has to be it. It’s satisfaction at checkout with a side of “I’ve got this”.

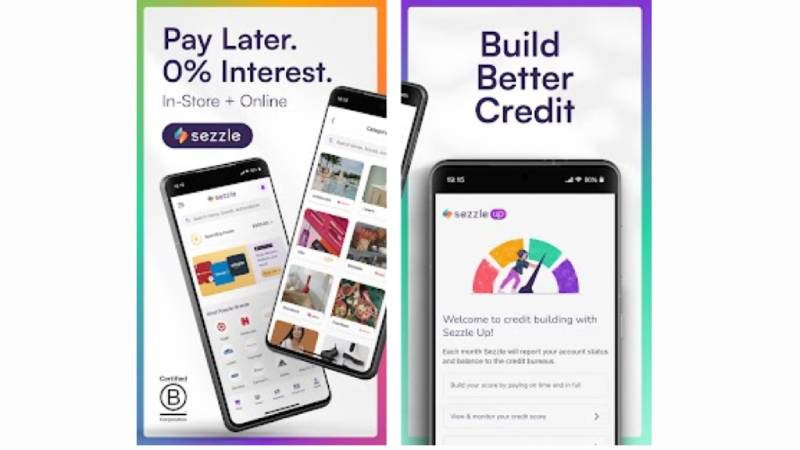

Sezzle

Meet Sezzle, your new budget BFF. With it, snap up what you want and shake off the worry of paying all at once. It’s finance but fun-sized.

Best Features:

- Interest-free payments

- Responsible spending limits

- User-friendly app

What we like about it: Big fan of responsible spending? Sezzle nails it, making sure you stay in your financial lane while splurging smart.

Zilch

Get in the loop with Zilch, the newbie on the block turning heads by making bill payments feel like…well, zilch. Grab your gear now, and tackle the cost in bitesize chunks.

Best Features:

- Pay over 6 weeks

- Cashback rewards system

- Straightforward setup

What we like about it: Who doesn’t heart cashback? Spend and earn with Zilch, and watch those perks pile up.

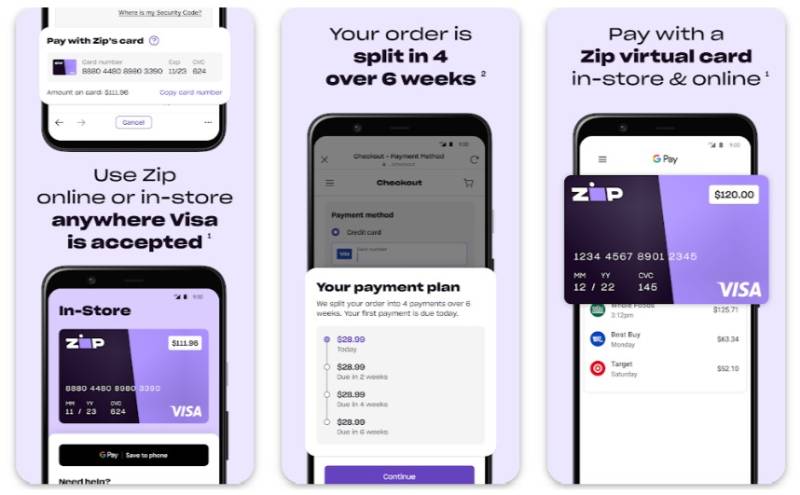

Zip

Ready to zip through checkout? With this app, it’s all about snagging what you need without the wallet whiplash. Plus, having more time to pay? Count us in.

Best Features:

- Two flexible payment products

- Manageable repayment plans

- Low monthly fees

What we like about it: That two-for-one deal—Zip Pay for nugget-sized buys and Zip Money for the big-ticket items.

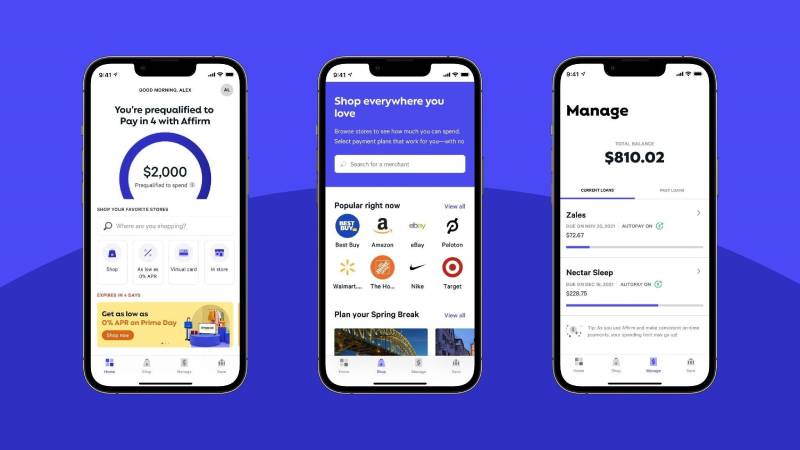

Affirm

Affirm is the straight talk of financing. It’s the go-to for those no-nonsense payment plans that keep you clued in with the full price—no sneaky business.

Best Features:

- Transparent payment terms

- No hidden fees

- Choose your payment schedule

What we like about it: Love a good no-surprises relationship with your payment plan? Affirm’s clear-cut terms have got your back.

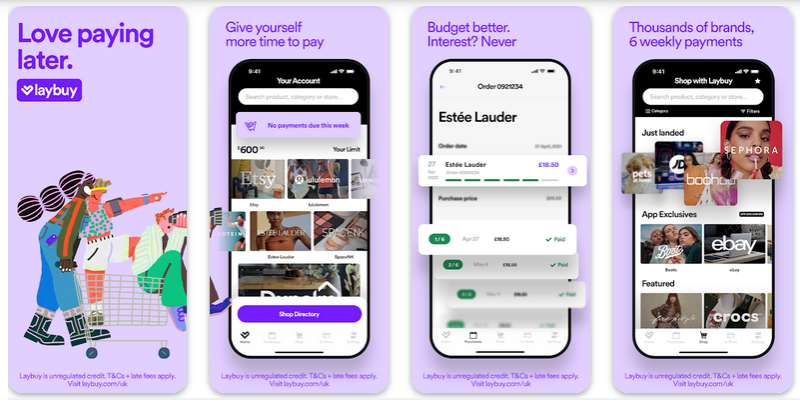

Laybuy

Hop on the Laybuy train for that ‘spread-the-cost’ kinda living. Gone are the days of money mayhem—you can scoop up your stuff and dice the price tag into six parts.

Best Features:

- Split into 6 weekly payments

- Instant approval online

- Global shopping options

What we like about it: Laybuy’s strong suit has to be that six-way split. It’s like making payments on payday, every time.

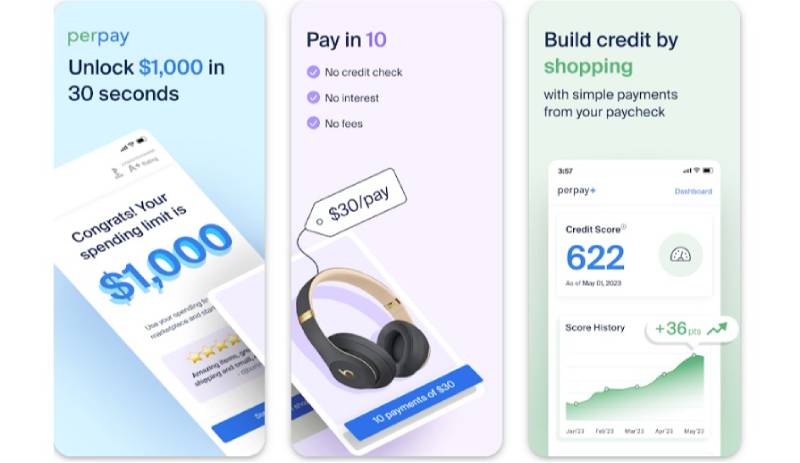

Perpay

Check out Perpay, where your paycheck morphs into a magic wand. It’s not just shopping; it’s getting your financial act together with purchases that match your paycheck rhythm.

Best Features:

- Directly from paycheck deductions

- No credit checks

- Build credit history

What we like about it: It’s all about matching payments with payday. Plus, building credit while buying? Smart move!

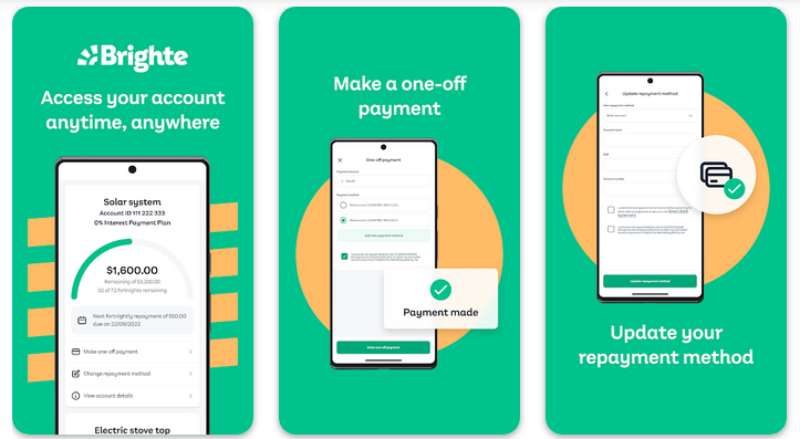

Brighte

Brighte’s shining a light on home upgrades. Think of it as your wallet’s wingman, helping you nail those energy-efficient makeovers with payment plans that are as smooth as your new LED lights.

Best Features:

- Zero-interest payment plans

- Dedicated to home improvements

- Green energy options

What we like about it: For all the eco-warriors—Brighte’s focus on green energy solutions is totally the bee’s knees.

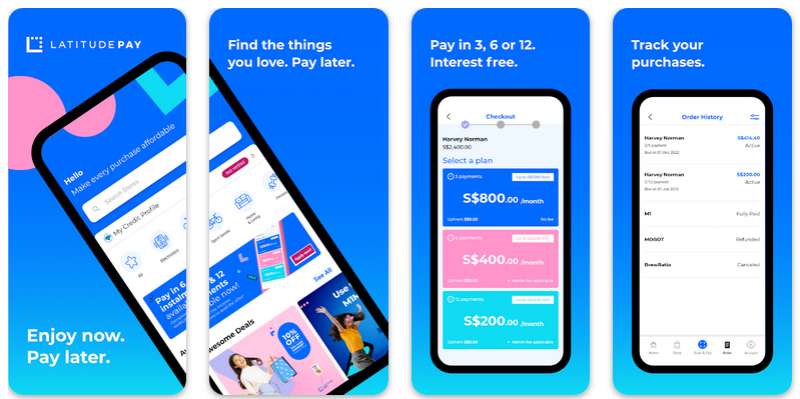

LatitudePay

With LatitudePay, it’s ten weeks, ten payments, but infinite shopping bliss. This app’s taking the stress out of splurging by cutting up that lump sum into easy slices.

Best Features:

- 10 weekly payments

- No interest

- Quick sign-up process

What we like about it: Ten shots to clear the bill? That’s the stuff of weekly-budgeting dreams.

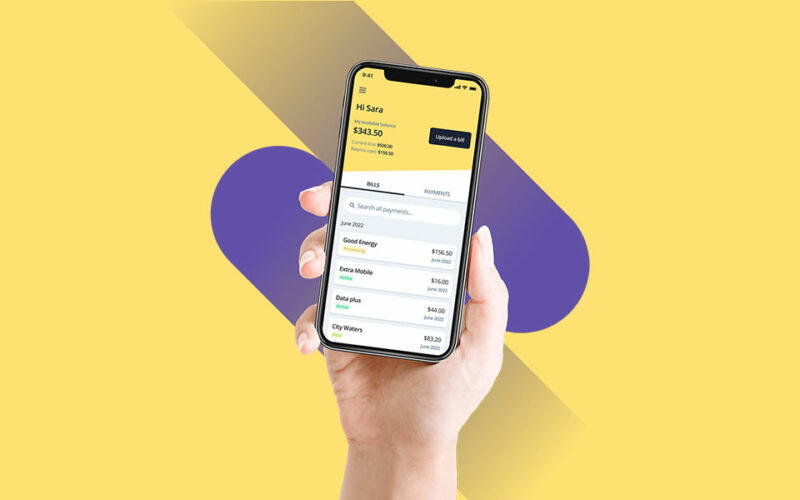

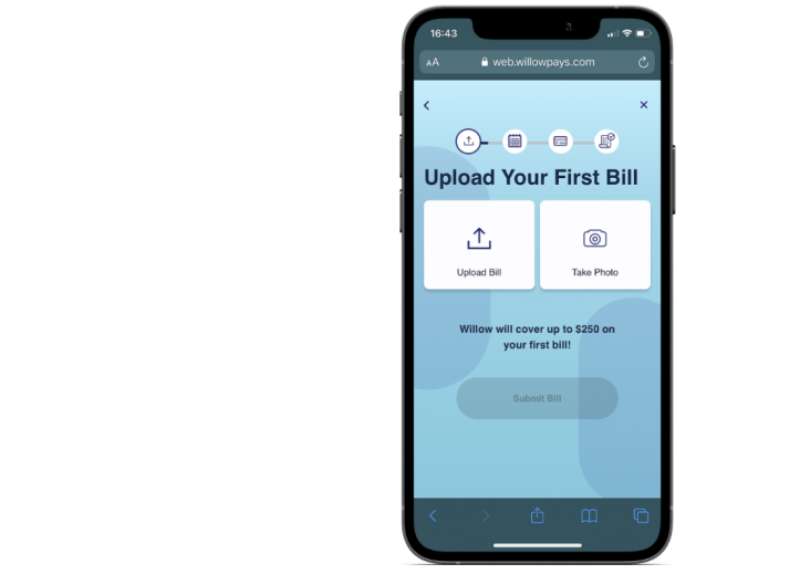

Willow Pays

Slide into smooth spending with Willow Pays. Your go-to for gliding through those payments without the sting, it’s another reason to hit ‘Add to Cart’ without a smidge of guilt.

Best Features:

- Transparent fees

- Manageable installments

- Hassle-free checkout

What we like about it: Willow Pays? Oh, she’s got that transparent fee thing down pat. We’re talking clear skies, no foggy costs.

FAQ On Apps Like Deferit

How do Apps like Deferit Work?

Think of these apps as a buffer for your bills. They front the cash to cover your expenses up front. You, on the flip side, pay them back in installments. It’s a dance with due dates—and these apps lead the tango, smoothing out your cash flow with stress-free choreography.

Are these Payment Plan Apps Safe to Use?

Safety’s a top priority, absolutely. These financial apps encrypt your data tighter than Alcatraz. They’re constantly updating their security measures, making sure your financial info stays under lock and key, typically following the same regulations as banks.

What are the Fees Associated with these Apps?

Fees vary like flavors in an ice cream shop. Some apps charge interest, others a flat fee per bill. What’s key is they lay it all out—no hidden nasties. It’s always a plan: know what you’re paying, when, and why, so no surprises.

Can Using Deferred Billing Solutions Affect My Credit Score?

Here’s the rundown: some might, others don’t. Several apps perform soft checks that don’t ding your credit score. Others might be more involved. It’s like choosing a hiking trail—some are easy on the feet; others, well, they’re a climb. Check their policy first, got it?

What Kind of Bills Can I Pay with these Apps?

It’s a smorgasbord. Utilities, phone bills, perhaps that Netflix subscription? They’ve got you covered. Each app has its menu of payable bills—varying from broad to specific. It’s the buffet of bill organizers: plenty to choose from, but always check what’s on offer.

Do I Need a Certain Credit Score to Use Installment Payment Platforms?

Credit score requirements, if any, are usually as relaxed as a Sunday morning. Most of these apps are about accessibility. They often skip the hard credit checks to not bruise your score. It’s inclusiveness at its best, catering to those with slim credit files.

How Quickly Can I Get Approved by a Bill Payment Service?

Approval speeds can be like fast food—almost instant. You sign up, they do a lightning review, and boom, you’re set to start managing those bills. Speed, though, can depend on the app’s backend processes. Most aim for quickness; nobody likes waiting, right?

Can I Use Multiple Payment Plan Apps Simultaneously?

It’s a free market, friend. Juggle apps like oranges if that’s your jam. Just remember, with more apps comes more responsibility. Don’t let it turn into a circus act. Keep track of who gets what and when—expense management is still your act to perform.

How Do These Apps Differ from Traditional Credit Cards?

It’s the tailored suit versus off-the-rack argument. These apps are the tailored fit for bill payments, sometimes interest-free with set repayment schedules. Credit cards? They’re more general-purpose but watch out for higher interest if you’re carrying a balance. It’s specific versus versatile.

What Happens If I Miss a Payment with a Deferred Payment App?

Most will nudge you with a reminder, as gentle as a tap on the shoulder. Miss it, and they might charge a late fee, milder than a bee sting. Defaulting is a different tune: it could harm your credit score or lead to account suspension—avoidable with timely communication.

Conclusion

And there it is. We’ve cruised through the ins, the outs, and the sideways of apps like Deferit. It’s more than merely pushing off payments. It’s about financial empowerment, expense tracking, and harnessing control over your cash flow.

Takeaways?

- These bill payment services are tailored financial cushions, buffering the ebb and flow of your bank account.

- Safety is paramount; rest assured, the financial apps we’ve dissected are Fort Knox with their encryption.

- Understand the fees. No two apps play the same tune, and your wallet’s the one calling the shots.

Craft your financial narrative. With the budgeting software and short-term financing scoops served up, you’re now the captain steering through the stormy seas of monthly bills, anchored by the beacon of savvy money management.

Embrace the calm.ennent payment platforms**, flare up financial flexibility, stamp out stress overdues. Let’s call it a wrap. You’re geared up, ready to redefine your engagement with the nitty-gritty of life’s ledger.

If you liked this article about apps like Deferit, you should check out this article about apps like Klarna.

There are also similar articles discussing apps like Affirm, apps like Empower, apps like Ibotta, and apps like Flex Rent.

And let’s not forget about articles on apps like Chime, apps like Grain Credit, apps like Kikoff, and apps like Remitly.

- Unlocking Efficiency: Top CSS Generators To Try - May 4, 2024

- What Is Rust Used For? A Guide to Its Applications - May 4, 2024

- Simplifying Video Editing: Creative Apps Like Kapwing - May 3, 2024