Explore the Best Apps Like Afterpay for Shopping Smarter

Ever found yourself at checkout, eyeing your cart total with a mix of desire and dread? Buy now, pay later platforms, like Afterpay, have flipped the script, empowering shoppers with flexible payment plans and blissful budget control. But what if you’re looking for an alternative spin?

This pixel-packed piece breaks it down. You’re about to navigate the bustling intersection of e-commerce and savvy spend management—where zero-interest financing meets digital wallets.

By the end, expect a clear map of the top apps like Afterpay, complete with pit stops at the financial lending app hotspots.

With the rise of financial technology, the hunt for the ultimate checkout companion has evolved into a lively dash through installment payment services.

Here, I’ll lift the digital curtain on the players transforming how we click, budget, and breathe easy when indulging in those gotta-have-it moments.

No filler, just the good pixels—by the close, money management won’t just be smarter; it’ll borderline sparkle.

Apps Like Afterpay

| Apps Like Afterpay | Interest-Free? | Credit Check | Payment Terms | Special Features |

|---|---|---|---|---|

| Klarna | Yes | Soft | Pay in 4 installments, or within 30 days | Pause payments, Price drop alerts |

| Affirm | No | Soft & Hard (for some plans) | 3 to 36 months | Customizable payment schedules |

| Sezzle | Yes | Soft | 4 installments over 6 weeks | Reschedule payments twice for free |

| PayPal Pay in 4 | Yes | Soft | 4 installments over 6 weeks | Integration with PayPal balances |

| QuadPay | Yes | Soft | Pay in 4 installments over 6 weeks | Automatic payments every two weeks |

| Zip (prev. QuadPay) | Yes | Soft | Pay in 4 installments, bi-weekly | No late fees on the first missed payment |

| Splitit | Yes | None | Flexible, set by the user | Uses available credit on credit cards |

| Payright | No | Hard | Up to 36 months | Longer-term, higher-value purchases |

| Humm | Yes (for small purchases) | Soft | Up to 10 installments | Two tiers: Little things & Big things |

| PayPal Credit | Yes (for purchases over $99 if paid in full in 6 months) | Hard | Up to 24 months | Special financing offers |

| Go Cardless | N/A | N/A | Direct debit service | One-off & recurring payments |

| Perpay | Yes | Soft | Up to 8 installments | Purchase through marketplace only |

| ViaBill | Yes | Soft | Pay in 4 installments | No monthly fees |

| Zebit | No | Soft | Up to 6 months | Market with up to 5,000 products |

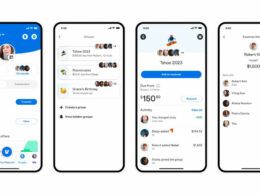

Klarna

Klarna is like your shopping wingman that steps in to split the bill. It offers a smooth shopping experience with multiple payment plans, including an interest-free ‘Pay in 4’ option or a 30-day payment window with no extra cost.

Best Features:

- Multiple payment options

- Interest-free payments

- In-app shopping directory

What we like about it: It’s not just about being able to split that total amount; it’s the on-the-fly shopping directory that really brings the extra flair. A universe of brands awaits at your fingertips, and Klarna makes it easy to manage all your transactions in one place.

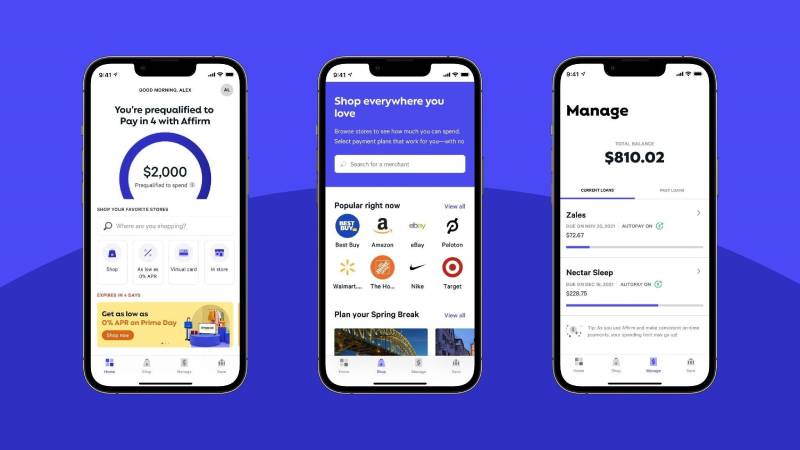

Affirm

Description Consider Affirm the personal financial assistant to guide you through responsible buying. It’s more flexible, offering various payment plans that can stretch up to 36 months, with some plans accruing interest similar to traditional credit.

Best Features:

- Custom payment schedules

- Transparent fees

- No late fees

What we like about it: With Affirm, it’s the transparency that takes the cake. You know exactly what you will pay upfront, no hide and seek with extra costs, enabling you to budget smarter and breathe easier.

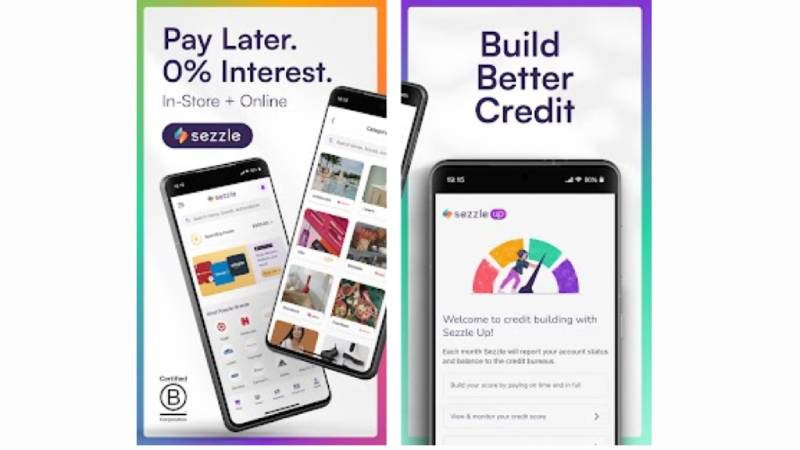

Sezzle

Sezzle breaks that big purchase into four smaller, manageable chunks, paid over six weeks, without charging you interest. It’s all about building smart spending habits with a twist of leniency.

Best Features:

- Interest-free installments

- Option to reschedule payments

- Promotes responsible spending

What we like about it: The rescheduling flexibility is a game-changer. These days, it’s about expecting the unexpected. Sezzle gets that and offers a way out if the due date swoops in at a bad time.

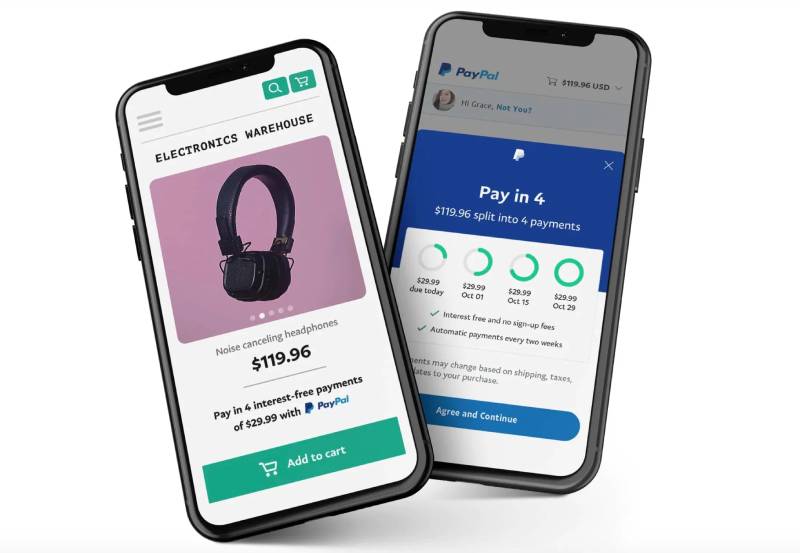

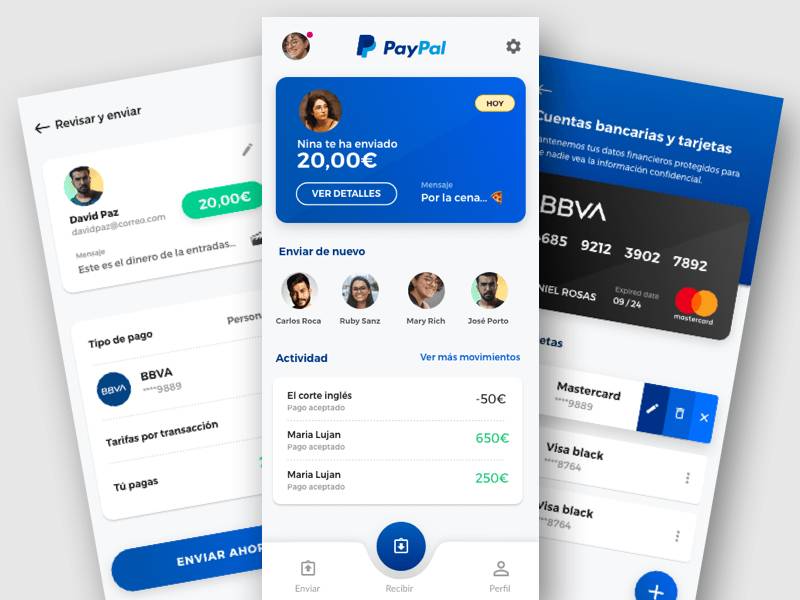

PayPal Pay in 4

Description Imagine you could splurge a little on that gotta-have gadget and worry about the tab later. PayPal Pay in 4 is the bro here, letting you break down that expense into four payments over six weeks, with zero interest.

Best Features:

- No interest

- Seamless integration with your PayPal account

- Automatic payments

What we like about it: Its tight-knit relationship with your PayPal wallet simplifies life. No new account setups; it’s all part of the PayPal family. Easy-peasy.

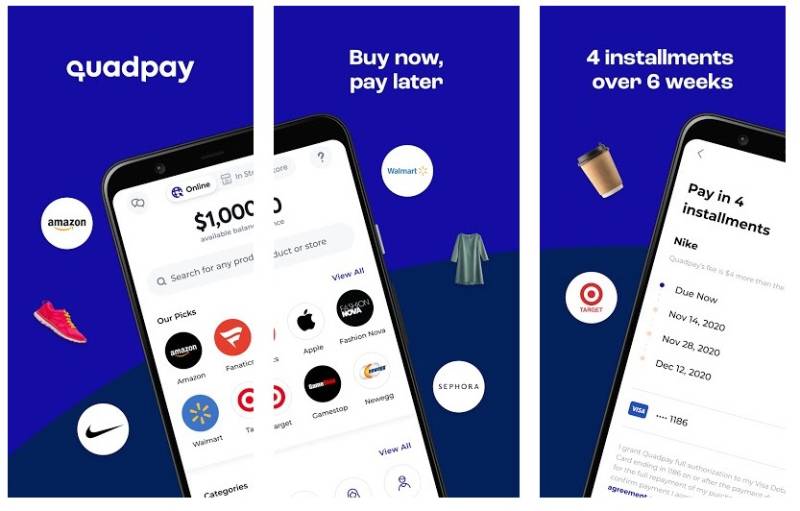

QuadPay

QuadPay, which is now part of Zip, is your financial sidekick when cash flow is more like a trickle. It carves up your bill into four slices over six weeks, no interest.

Best Features:

- Bi-weekly payments

- No impact on credit

- User-friendly app

What we like about it: We’re big fans of the predictability here. Payments happen like clockwork every two weeks—set, forget, and no surprises.

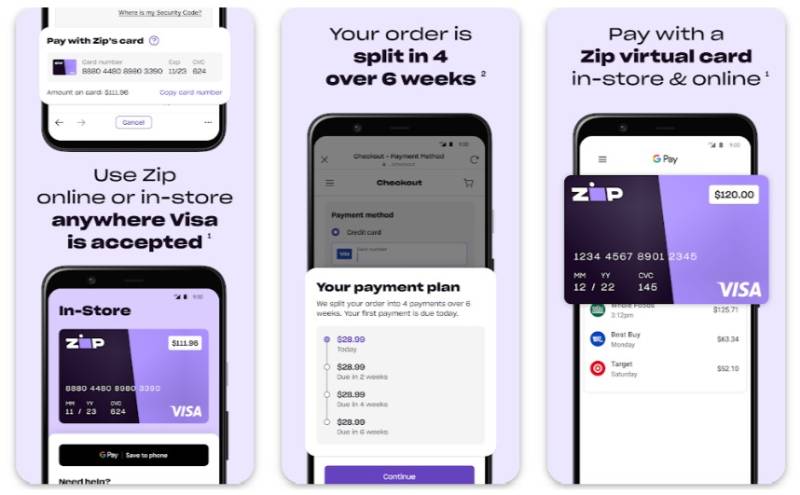

Zip

Zip (formerly QuadPay) takes that ‘treat yourself’ moment and spreads the love over six weeks with four payments. Keeping the financial pinch to a minimum is their mission, and they excel at it.

Best Features:

- Four easy installments

- Simple sign-up

- No hidden fees

What we like about it: The first missed payment without a late fee is the standout. Everyone trips up now and then, and Zip’s got your back when you do, without the penalty strike.

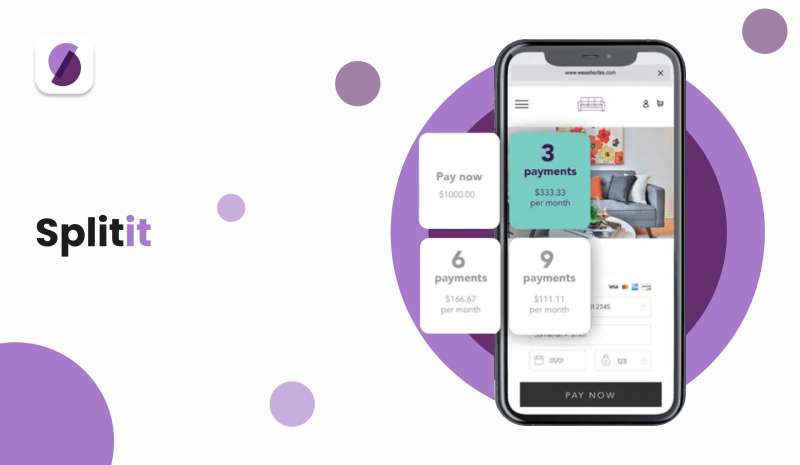

Splitit

Splitit isn’t just your run-of-the-mill payment splitter. It takes the existing credit on your card and turns it into a payment plan paradise, letting you decide the terms.

Best Features:

- Customizable plans

- No credit checks

- Uses existing credit lines

What we like about it: The way Splitit plays it cool with the credit you’ve already got—that’s innovative. No need for new accounts; it keeps your wallet streamlined and the control in your hands.

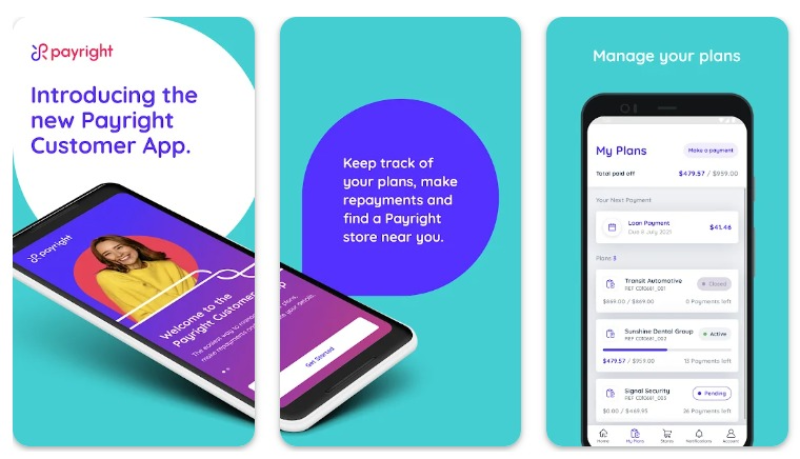

Payright

Say hello to Payright, the sophisticated cousin in the BNPL family designed for those bigger, heftier purchases. This app’s spirit is all about long-term, bite-sized payments that make sense for the more significant investments.

Best Features:

- Payment plans up to 36 months

- Tailored for big purchases

- Prompt approval process

What we like about it: It’s the focus on the larger-than-life buys that standout. When it’s time for the heavy-hitters, Payright comes to the plate, ready to make it manageable.

Humm

Think of Humm as the flexible friend, the one who gets that not all purchases are equal. With ‘Little things’ for the everyday and ‘Big things’ for the grander wishes, Humm adjusts to your needs.

Best Features:

- Tiered purchase categories

- Up to 10 installments

- No interest for ‘Little things’

What we like about it: Their two-tier system is the star. Whether it’s a quick essential or a big splurge, they’re ready to adapt, making it simple to keep tabs on what matters.

PayPal Credit

Description When PayPal Credit steps into the room, it’s about getting some extra muscle for your shopping spree, with the option to pay over time. This one’s akin to a credit line, dressed up in PayPal’s slick interface.

Best Features:

- Special financing on purchases over $99

- Integration with PayPal

- Deferred interest

What we like about it: The hefty perk? Six months of grace on interest payments for those bigger splurges, provided you clear the bill. It’s hefty breathing room right there.

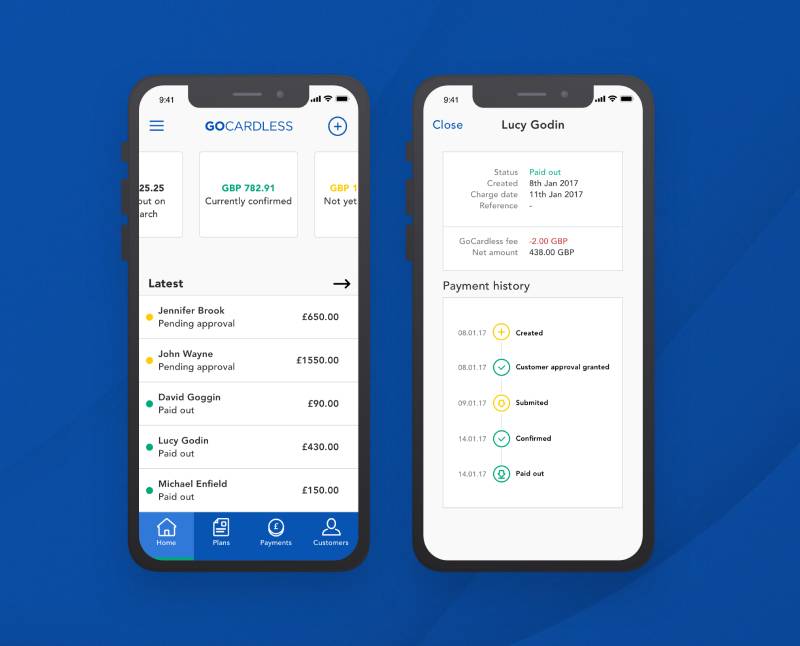

Go Cardless

Think of Go Cardless as the maestro of direct debits; it’s all about simplifying recurring payments for businesses and customers alike. A little different from the rest, but the principle of easy payments shines through.

Best Features:

- Perfect for recurring payments

- Low transaction fees

- International direct debits

What we like about it: It’s not just for one-time shopping trips; it’s the ongoing subscriptions that get the seamless treatment. Users looking for the set-and-forget payment experience find it here.

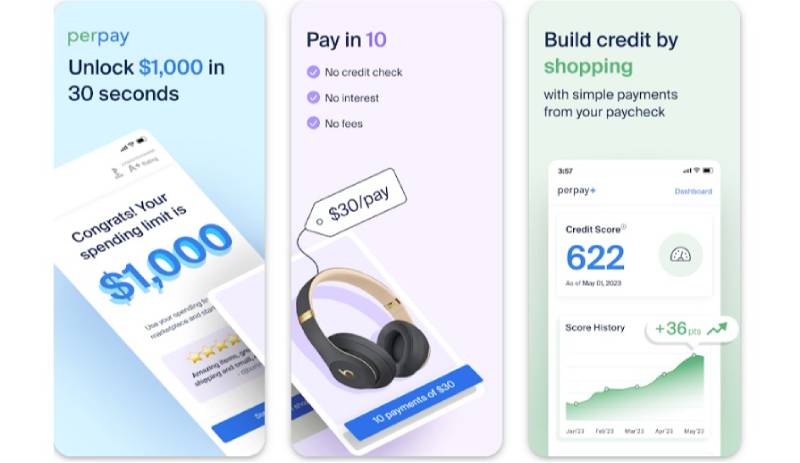

Perpay

Perpay is a niche slice of BNPL convenience, giving you a marketplace full of products you can pay off through simple payroll deductions. It’s all about ease, with a dash of budgeting brilliance.

Best Features:

- Payroll deduction payments

- Access to an exclusive marketplace

- No credit checks

What we like about it: The highlight here is buying power based on income, straight from your paycheck. It’s a guilt-free slide into spending without the usual post-purchase blues.

ViaBill

ViaBill is your interest-free, four-stage rocket to financial maneuverability. Aimed at keeping your bank balance in the green, it splits payments equally over four months, with zero fees to keep you cruising smoothly.

Best Features:

- Monthly installments

- No interest charged

- Transparent payment terms

What we like about it: What’s not to like about no monthly fees? Budgeting becomes a whole lot more like a steady, predictable road trip rather than a tumultuous trek.

Zebit

Description Zebit sets up an entire marketplace where you can buy now and pay later, all with the goal of no interest and no membership fees. It’s aimed toward those wanting a more extended payback window for their goods.

Best Features:

- Interest-free financing

- Up to six months to pay

- A vast selection of products

What we like about it: The marketplace itself makes Zebit shine. You’re not just getting a payment plan arrangement; you’re getting a shopping experience crafted for that zero-interest promise.

FAQ On Apps Like Afterpay

How Do Apps Like Afterpay Work?

Buy now, pay later: hello, financial freedom in an app. These gems let you snag goods today, then pay over time. Typically, they slice the total into bite-size, often interest-free payments. Dead simple: pick an app at checkout, get instant approval, enjoy now, pay as you go.

Are There Any Fees Associated with These Apps?

No one likes fees, but they’re part of the game. Usually, using these apps is free, as long as you stick to the payment schedule. Miss a date, though, and you could get hit with a late fee. Always read the fine print—it’s like your financial fairy godmother.

Can Using BNPL Apps Affect My Credit Score?

That depends. Some apps do a soft credit check, which doesn’t ding your score. Others might not check at all. But, if you’re late on payments or default, that could lead to trouble with your credit. Rule of thumb: pay on time, keep your score fine.

What Happens if I Miss a Payment?

Missed a payment? Expect a nudge from the app, sometimes a fee. Most are pretty accommodating though, offering grace periods or rescheduling options. Best advice: get ahead of it—contact customer service, explain the hiccup, and navigate a plan forward together.

Are There Purchase Limits with BNPL Apps?

Absolutely, there’s a cap. But it’s like your favorite burger joint; it varies. Some apps set a fixed ceiling, others flex depending on your financial health. Getting approval for larger amounts often requires a solid track record, so keep it clean.

What Types of Purchases Can I Make with BNPL Apps?

From snazzy sneakers to techie treats, BNPL apps cover a lot. Most ally with online retailers, bringing a sea of goodies to your fingertips. Be warned though: not everything’s eligible. Retailers often set the rules, so check if your must-have item makes the BNPL cut.

Can I Return Items Purchased with BNPL Apps?

Return policies chime with the retailer’s tune, not the payment app’s. If you need to send something back, process the return through the store. Once sorted, the app adjusts your balance or refunds as needed. Keep tabs on the transaction—just like you would with your Netflix watchlist.

How Secure Are BNPL Services?

Safety first, always. BNPL apps are armored up with bank-level encryption. But remember, cybersecurity is a two-player game. Protect your account like it’s a treasure map—complex passwords, shh on the sharing, and always stay on guard for phishing scams.

Are BNPL Apps Better Than Credit Cards?

It’s like comparing a croissant to a donut—both sweet, depends on the craving. BNPL apps offer structured, interest-free payments, while credit cards bring perks like points and protection. Your choice hinges on your financial diet: immediate payback structure or long-term credit building with potential interest.

How Do I Sign Up for a Buy Now, Pay Later Service?

Signing up’s a breeze. Just choose your BNPL knight in shining armor when checking out online, fill in the sacred digits—name, email, payment details—and voilà, you’re set. Some might ask for a down payment right then, others, not till later. Quick, painless, and ready to roll.

Conclusion

And there we have it, the grand tour of the buy now, pay later landscape, leaving no stone or app unturned. We’ve dipped our toes in the waters of flexible payment plans and glided through the nuances of interest-free credit apps. We’ve seen how these pioneering platforms stand as sentinels of spending savvy, guardians against the traditional tidal wave of credit gotchas.

In wrapping up, it’s clear: apps like Afterpay are more than digital curiosities—they’re bona fide budgeting sidekicks. They’ve reshaped the contours of consumer financing, offering a bridge over the often-troubled waters of impulsive spending.

So, armed with insight on payment installment software and a better grasp of financial technology‘s fine print, make your next checkout a strategic play. Be smart. Stay aware. And may your shopping savvy be as strong as your spending game. No matter which app you choose, remember: balance is key, in payments and life.

If you liked this article about apps like Afterpay, you should check out these articles also:

- Apps Like Kora: 9 Great Cash Loan Options For You

- The Best Apps That Make You Money

- 11 Apps Like Brigit For Your Financial Needs

- Top React Native Libraries for App Development - May 9, 2024

- Angular’s Applications: What is Angular Used For? - May 9, 2024

- Drive and Earn: Essential Apps Like Doordash - May 8, 2024