Imagine the pulse of innovation pounding in the heart of the hilly cityscape. At every turn, San Francisco reveals its tech-savvy spirit, but there’s a domain where it truly excels—fintech.

Here, a fusion of finance and technology has birthed an ecosystem of fintech companies with a drive for reinventing the wheel—digitally.

Dive into a realm where personal finance management meets digital wallets, and where payment gateway providers break new ground.

It’s a world layered with the complexities of blockchain networks and the simplicity of user-friendly mobile banking solutions.

By the end of this exploration, you’ll unravel the innovative tapestry that the Bay Area has woven, from venture-backed startups to global leaders pushing the envelope in money transfer services and investment apps.

The crux of this journey? To distill the essence of San Francisco’s fintech landscape, where financial industry disruptors are not just born—they thrive.

Fintech Companies in San Francisco

| Fintech Company | Primary Service | Founded | Noteworthy Feature |

|---|---|---|---|

| Affirm | Buy now, pay later financing | 2012 | No late or hidden fees |

| Plaid | Financial services APIs | 2013 | Connects with 11,000+ institutions |

| Chime | Mobile banking | 2013 | No overdraft fees |

| Stripe | Payment processing | 2011 | Supports 135+ currencies |

| Brex | Corporate credit cards | 2017 | Tailored rewards |

| Credit Karma | Credit and financial management | 2007 | Free credit scores |

| Robinhood | Stock trading platform | 2013 | Commission-free trades |

| Ripple | Blockchain remittance | 2012 | Cross-border transactions |

| Earnest | Personal loans | 2013 | Customized loan terms |

| SoFi | Personal finance | 2011 | Broad financial suite |

| Square | Merchant services | 2009 | Payment + business tools |

| LendUp | Credit and loans | 2011 | Education for financial health |

| Prosper | Peer-to-peer lending | 2005 | Fixed rate, fixed term loans |

| Stash | Personal investment | 2015 | Automated investing |

| Coinbase | Cryptocurrency exchange | 2012 | User-friendly platform |

| Personal Capital | Personal finance software | 2009 | Wealth management tools |

| Tala | Microloans in developing countries | 2011 | Mobile-based loans for the underserved |

| LendingClub | Peer-to-peer lending | 2006 | Investor-financed loans |

| Wealthfront | Automated investment service | 2011 | Low-cost robo-advising |

Affirm

Fasten your seatbelts, folks. With Affirm, the world of buy-now-pay-later is on a roller coaster ride. No late fees, no surprises. Their mission? Bring honest financial products to improve lives. It’s like financial fairness in your pocket.

Plaid

Plaid is like the secret sauce behind your favorite financial apps. It’s the engine under the hood. Securely connecting your bank account to apps you want? That’s their gig. They are the glue that’s holding the fintech world together.

Chime

Say hello to Chime! It’s the free mobile banking app that has your back. Picture no hidden fees, early direct deposits, and an award-winning mobile app. Sounds like a financial dream, right? They’ve got your banking needs sorted.

Stripe

Stripe, guys, is seriously cool. They help businesses accept payments from anyone, anywhere. Stripe’s tech wizardry has turned complicated stuff like transaction processing into a piece of cake. It’s like they’ve solved the puzzle of online payments.

Brex

Brex, folks, is flipping corporate cards and business cash management on its head. They’re making financial systems work for startups and SMEs. Brex’s innovative approach? It’s like breathing fresh air in a stuffy room.

Credit Karma

Credit Karma, y’all, is your go-to guide for credit scores and reports. It’s like having a financial counselor in your pocket. Making financial progress and learning along the way? That’s the Credit Karma way.

Robinhood

Robinhood, gang, is a game-changer. Investing in stocks, options, and ETFs, right from your phone and commission-free? Yes, please! They are making the world of finance accessible to everyone. It’s like they’ve given us the keys to Wall Street.

Ripple

Let’s talk Ripple. They’re speeding up global financial transactions like nobody’s business. Their digital payment protocol makes cross-border payments swift and smooth. It’s like teleportation, but for your money.

Earnest

Earnest is here to shake things up. Refinancing student loans? Simplified. Low-interest personal loans? You got it. It’s like they are tailoring financial products just for you.

SoFi

Imagine a one-stop shop for your finance needs. Loans, insurance, investing, even career advice. That’s SoFi. They’ve got a goal to help you get your money right. It’s like your personal financial assistant.

Square

Square is simplifying commerce for everyone. Small business owner? No worries. Need to make a payment? Easy. They’re making transactions as smooth as silk. Square is like a magic wand for your business.

LendUp

LendUp, peeps, is on a mission to provide anyone with a path to better financial health. Fair and transparent credit? That’s their jam. LendUp feels like a lifeline when you’re navigating through rough financial waters.

Prosper

Next up, Prosper. They’re connecting people looking to borrow money with individuals who want to invest. It’s like a matchmaking service for your finances. Prosper makes personal loans easy and stress-free.

Stash

Stash, folks, is here to break down barriers. Making investing easy and accessible? Check. A personalized approach to finance? Double check. With Stash, financial literacy is fun and engaging.

Coinbase

Coinbase is your golden ticket to the world of digital currency. Buying and selling crypto, secure storage, wallet services—you name it, they’ve got it. It’s like they’ve created a bridge to the future of money.

Personal Capital

Think of Personal Capital as your financial GPS. It helps you understand, manage, and grow your net worth. It’s like having a clear roadmap for your financial journey. All aboard the Personal Capital express!

Tala

Tala, guys, is like a financial superhero for underserved populations. Need a loan but lack a credit history? No problem. They’re expanding financial access and offering a new approach to credit scoring.

LendingClub

LendingClub, y’all, is a peer-to-peer lending platform that’s shaking things up. Need a personal loan or auto refinancing? They’ve got you covered. LendingClub feels like a breath of fresh air in the lending landscape.

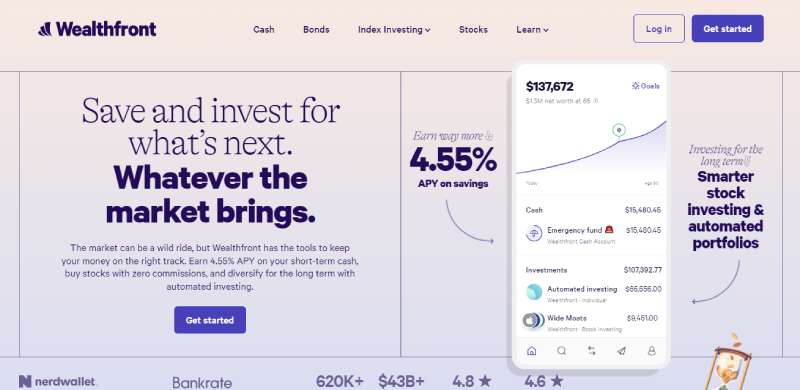

Wealthfront

Wealthfront, gang, is on a mission to make investing easy and accessible. It’s like a virtual financial advisor that grows your wealth while you sleep. With Wealthfront, planning for the future just got easier.

FAQ On Fintech Companies In San Francisco

What’s driving the growth of fintech companies in San Francisco?

It’s like a perfect storm; you’ve got this concentration of tech talent and venture capital right in the Bay Area. Then mix in a forward-thinking mindset. The drive? To completely redefine how we handle our Secure online transactions or even get a loan. It’s innovation at its finest.

Are fintech innovations from San Francisco changing global finance?

Absolutely. Fintechs here are not just playing in local sandboxes; they’re building global castles. Robo-advisors and smart contracts are just the tip of the iceberg. We’re talking about widespread impact, giving birth to technologies every bank or blockchain network wants a piece of.

How do San Francisco fintech companies approach financial regulation?

It’s a dance, really. Fintechs navigate through a web of regulations while pushing the envelope. Fintech regulatory environment? It’s complex, but there’s a spirit of cooperation here. After all, staying ahead of the curve means playing by the rules—innovatively.

What types of fintech services are prevalent in San Francisco?

It’s a buffet of financial innovation. From digital wallets to AI in finance, the variety is astounding. Peer-to-peer lending, financial data analysis, and cryptocurrency exchanges? All present. Fintech’s not just about services, though; it’s about crafting the future of personal finance.

How do fintech startups in San Francisco secure funding?

In this landscape, presenting a groundbreaking idea is key. From there, the numerous venture capital firms and angel investors in Silicon Valley are more than willing to bet on promising fintech entrepreneurship. Funding’s often about the network and the pitch.

What are the challenges faced by fintech companies in the area?

Despite being a technology hub, it’s no cakewalk. High operation costs, stiff competition, securing trust in digital trust and security—all hurdles. Plus, staying aligned with the ever-tightening noose of FINRA regulations and data protection laws. Challenges? Sure, but also opportunities for true disruptors.

How does the fintech scene in San Francisco compare to New York?

Well, think of it as west coast cool meets east coast traditional. San Francisco’s vibe is disruptive, experimental. It’s the home court for financial industry disruptors with a tech-first approach. New York’s got history, institution strength. Both powerhouses, just different flavors.

In what ways do fintech companies in San Francisco promote financial inclusion?

It’s a mission here—deconstructing barriers, bringing financial accessibility to the table. Innovative financial products are popping up, aimed at underserved communities. The goal? Harness technology to level the playing field. Financial inclusion? It’s not a buzzword; it’s the target.

What makes San Francisco attractive to fintech startups?

Here’s the scoop: talent magnet, innovation hub, tech incubators galore. The city is teeming with like-minded thinkers who breathe digital payments and dream in mobile banking solutions. Plus, if you’re in fintech, being absent from San Francisco is like skipping the main act of the show.

How has the pandemic affected fintech companies in San Francisco?

The pandemic, huh? Changed the game—for some, it fueled a turbo boost, for others, a test of mettle. Digital finance solutions have seen a surge in demand. Suddenly, everything’s about secure online transactions and contactless everything. Pandemic problems turned into fintech opportunities.

Conclusion

As our digital tour concludes, the landscape is clear: fintech companies in San Francisco are more than just businesses; they’re revolutionaries in suits with laptops as their weapons. They’re transforming personal finance management, turning investment apps into everyday tools and making concepts like peer-to-peer lending mainstream.

- We’ve witnessed how venture capital fuels their engines, enabling leaps into uncharted financial services innovation.

- We’ve seen these pioneers tackle regulatory challenges while painting a future where financial industry disruptors become the norm.

Silicon Valley isn’t just about tech giants; it’s a melting pot where digital payments and AI fuse to create services that resonate with our modern lifestyle. So here’s to the bold, the tech-savvy, and the disruptors—may San Francisco’s fintech scene continue to astound the globe as a beacon of endless possibility.

If you liked this article about fintech companies in San Francisco, you should check out this article about fintech companies in Los Angeles.

There are also similar articles discussing fintech companies in New York, fintech companies in Singapore, fintech companies in the Bay Area, and fintech companies in the UK.

And let’s not forget about articles on fintech companies in Los Angeles, fintech companies in New York, fintech companies in San Francisco, and fintech companies in Singapore.

- Professional Video: Cinematography Apps Like FiLMiC Pro - April 26, 2024

- Optimizing Your Shopify Store for Maximum Dropshipping Success - April 26, 2024

- Python Explained: What is Python Used For? - April 26, 2024