Credit Management: Financial Health Apps Like Experian

Imagine the last time you checked your credit score: the anticipation, the anxiety. Now, picture a world where tracking your financial health is as simple as scrolling through a newsfeed.

Apps like Experian have revolutionized how we manage our personal finances, evolving from a luxury to a nearly indispensable tool in our digital wallets.

In this fast-paced digital era, staying on top of your credit means more than just a good number; it’s about safeguarding your identity, mapping out your financial journey, and making informed decisions.

As someone deeply entwined in the fabric of the web, I understand the significance of robust and intuitive financial apps.

The virtual cosmos brims with options beyond the familiar blue of Experian, each with its suite of credit monitoring, identity theft protection, and budgeting superpowers.

By the end of this article, you’ll have unlocked a treasure trove of knowledge on alternative apps, each a key to empowering your financial dialogue. From the Credit Karma app to Mint’s budgeting assistance, I’ll guide you through the digital landscape.

Understanding these tools is not just about maintaining a score; it’s about taking control. Let the exploration commence.

Apps Like Experian

| Service/Product | Credit Reports | Credit Scores | Identity Theft Protection | Personal Finance Tools | Pricing |

|---|---|---|---|---|---|

| Experian | Yes | Yes | Yes (with ID protection subscription) | Limited | Free basic access; premium services subscription-based |

| SmartCredit | Yes | Yes | Yes | Yes | Subscription-based |

| Mint | No | Yes | No | Yes | Free (offers in-app product recommendations) |

| Credit Karma | Limited (focus on TransUnion and Equifax) | Yes | Yes | Yes | Free (revenue from targeted offers) |

| myFICO | Yes | Yes (focus on FICO scores) | Yes (with paid plan) | Limited | Various paid options |

| Mint Money Manager | See Mint | See Mint | See Mint | See Mint | See Mint |

| TransUnion | Yes | Yes | Yes (with paid plan) | Limited | Free basic access; premium services subscription-based |

| CreditWise | No (provides a TransUnion VantageScore) | Yes | Limited | Limited | Free (exclusively for Capital One customers) |

| WalletHub | No | Yes | No | Limited | Free |

| ClearScore | Yes (focus on Equifax) | Yes | No | Yes | Free |

| Credit Sesame | No | Yes | Yes | Yes | Free, with premium services subscription-based |

| IdentityForce | Yes (as part of monitoring) | Yes (as part of monitoring) | Yes | Limited | Subscription-based |

| MSE Credit Club | Yes (focus on Experian) | Yes | No | Limited | Free (UK-based) |

| Aura | Yes | Yes | Yes | Limited | Subscription-based |

| FICO | See myFICO | See myFICO | See myFICO | See myFICO | See myFICO |

| Self | No | Yes | No | Yes (Credit Builder Account) | Subscription-based; includes credit builder loan |

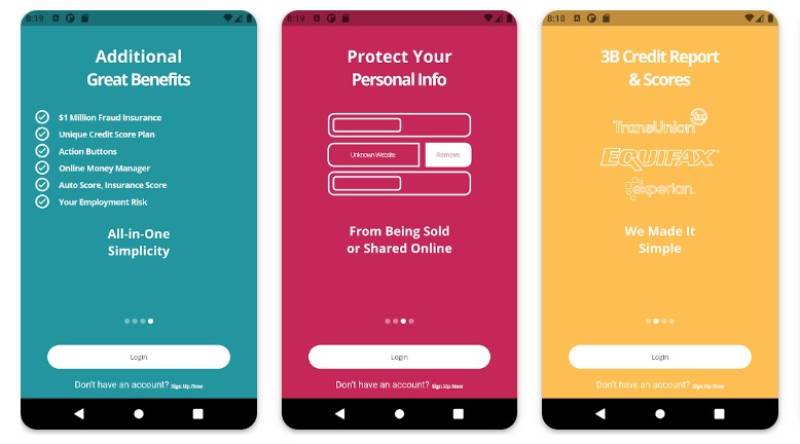

SmartCredit

SmartCredit offers a dual experience as both a credit advocate and defender. As an intermediary, it connects with financial decisions by offering action buttons to resolve discrepancies directly with creditors. It metamorphoses raw data into actionable intelligence, equipping users for credit and identity navigation.

Best Features

- Action buttons for quick dispute resolution

- Score tracker and predictor

- Identity theft insurance

What we like about it:

SmartCredit’s action buttons are a standout, transforming credit management into a proactive quest rather than a passive observation. Simplifying the process is the charm that engages its users.

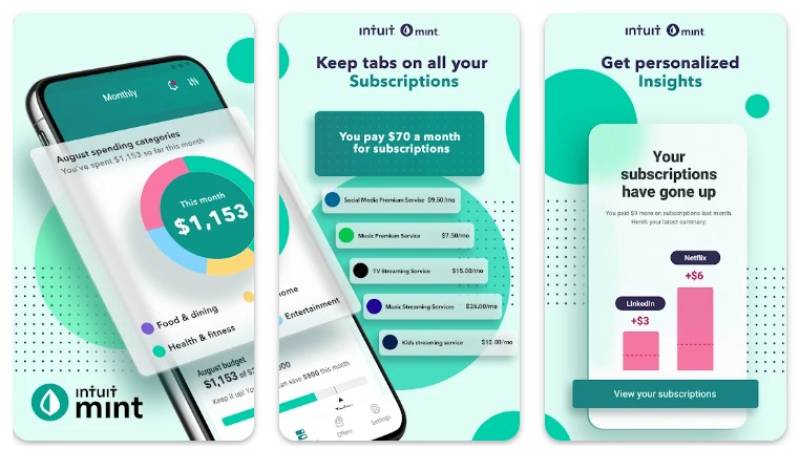

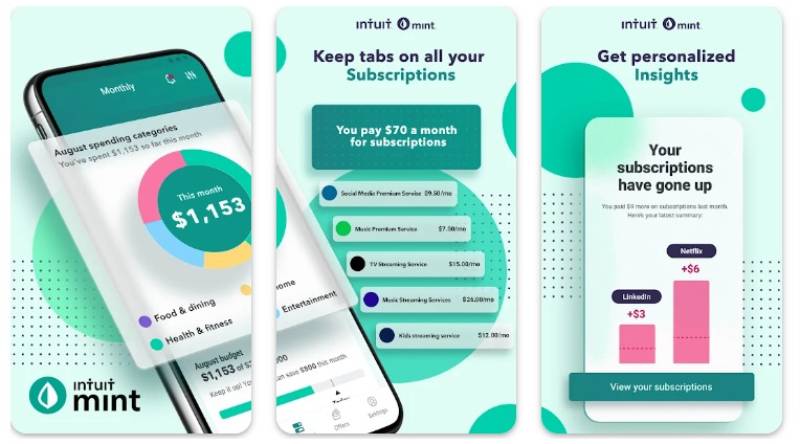

Mint

Mint weaves budgeting and credit checks into a seamless tapestry. A herald of financial planning tools, this app stands sentinel over expenditures, budgets, and bills with real-time updates, a holistic financial dashboard that wraps complex data in simplicity.

Best Features

- Real-time budget tracking

- Bill payment reminders

- Credit score alerts

What we like about it:

The real-time budget tracking Mint offers keeps users in sync with their financial heartbeat, ensuring they never skip a beat.

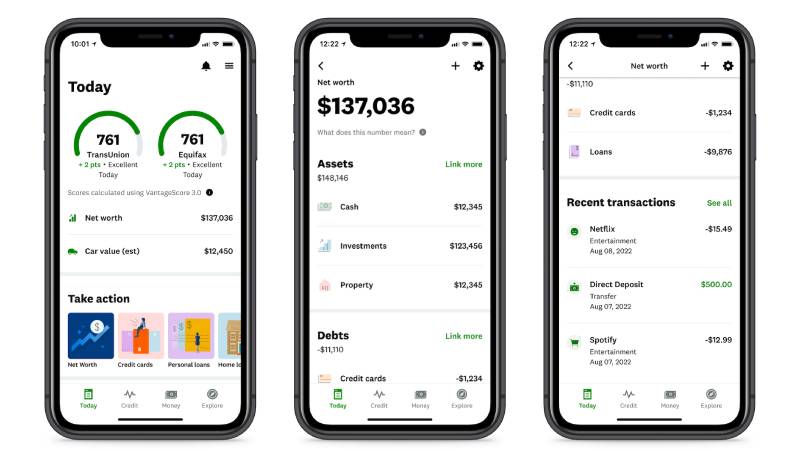

Credit Karma

Credit Karma is the scribe of credit lore, offering knowledge not just in numerical scores but in context-rich advice and opportunities. It’s a sage in the realm of credit report analysis, retailing not only insights but also opportunities like personalized loan and credit card offerings.

Best Features

- Free credit reports

- Tax filing services

- Customized loan and credit card recommendations

What we like about it:

Users particularly extol Credit Karma’s tax filing service, adeptly entwining credibility and generosity, making tax season less daunting.

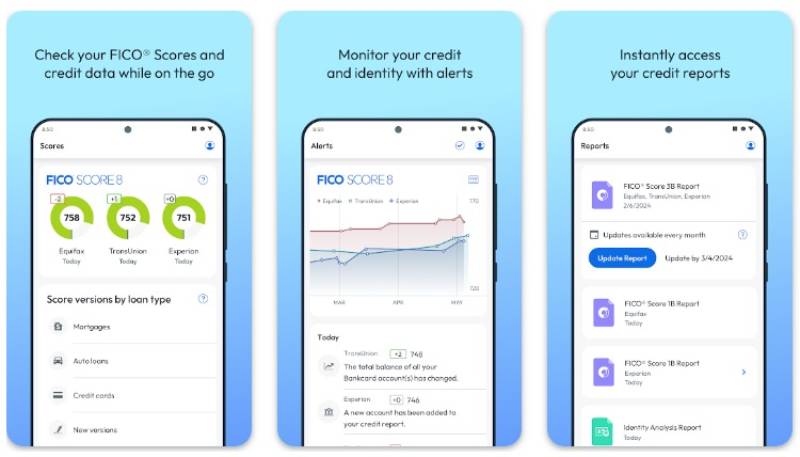

myFICO

myFICO, as the herald of the FICO score – the gold standard in credit ratings, imparts the wisdom of credit scores with precise granular detail. The app provides an in-depth voyage through your credit history, underlying factors, and tangible steps for improvement.

Best Features

- Detailed FICO score breakdown

- Score monitoring from all three bureaus

- Alerts on score changes

What we like about it:

The detailed FICO score breakdown makes myFICO the North Star for users aiming to dissect and improve their credit ratings with surgical precision.

Mint Money Manager

Mint Money Manager is the architect of personal finances, constructing a robust framework for users to track their earnings, investments, and spending. All elements in the financial firmament find a place in its design, providing a blueprint for monetary success.

Best Features

- Investment tracking

- Customized tips for saving money

- Comprehensive financial overview

What we like about it:

The investment tracking tool is a beacon that users laud for its capacity to illuminate the path to financial growth and stability.

TransUnion

TransUnion stands as a bastion in the triad of major credit bureaus. It offers not just glimpses into credit scores, but a truer understanding through tailored offers and preventive strategies against fraud – making it a steadfast guardian in an unreliable world.

Best Features

- Credit Lock Plus

- Unlimited score and report updates

- Personalized credit and debt analysis

What we like about it:

TransUnion’s Credit Lock Plus is the bastion securing its standing, affording users the power to wield control over their credit files.

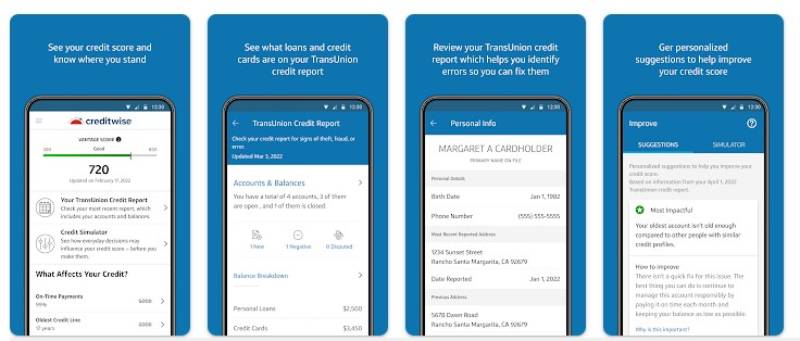

CreditWise

CreditWise from Capital One navigates the credit realm with user-friendly design and alert-oriented operations. Free to all, not just cardholders, it scans the digital horizon for changes to credit information, ensuring users stay abreast of their financial portrait.

Best Features

- Dark web scan

- Social Security number tracking

- Credit simulator

What we like about it:

The credit simulator stands out, a tool that lets users anticipate financial maneuvers’ impact on their credit scores to chart a more intentional course.

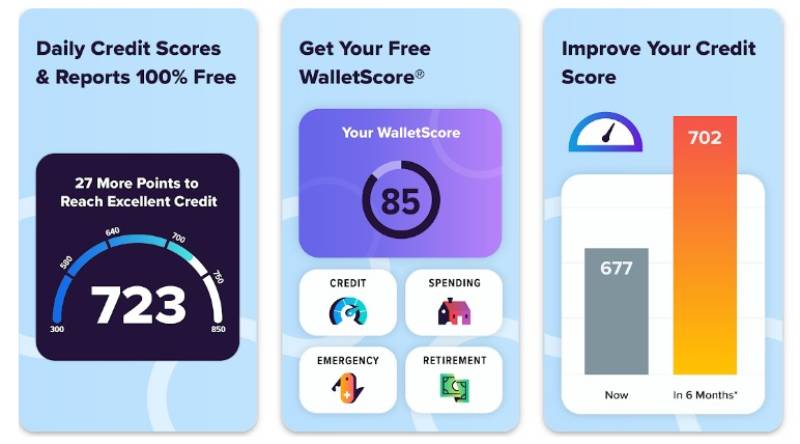

WalletHub

WalletHub is the oracle of daily credit score updates, keeping the rhythm of your financial pulse steadfast and strong. With unyielding vigilance, it monitors your score, bearing insights and comparison tools to foster informed financial choices.

Best Features

- Daily updated credit scores

- 24/7 credit monitoring

- Financial planning tools

What we like about it:

Daily updates on credit scores are WalletHub’s crown jewel, ensuring no event, however minute, escapes the vigilant eye of the user.

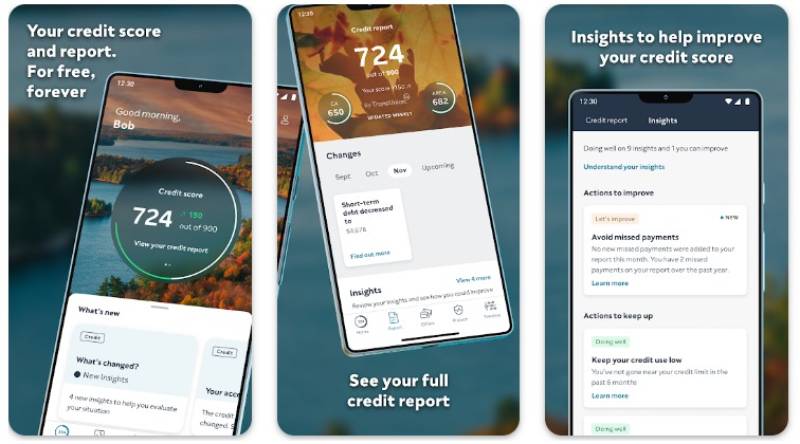

ClearScore

ClearScore is the clarion in the convoluted credit system, delivering clear, transparent credit reports and scores. It’s a herald of empowerment through annual credit reports and tailored product recommendations, drawing back the curtain to reveal the control users have over their credit destiny.

Best Features

- Clear user interface

- Personalized offers based on credit score

- Simple, actionable financial advice

What we like about it:

Clarity reigns supreme with ClearScore, particularly praised for its uncluttered interface, making navigation and comprehension a refreshing breeze.

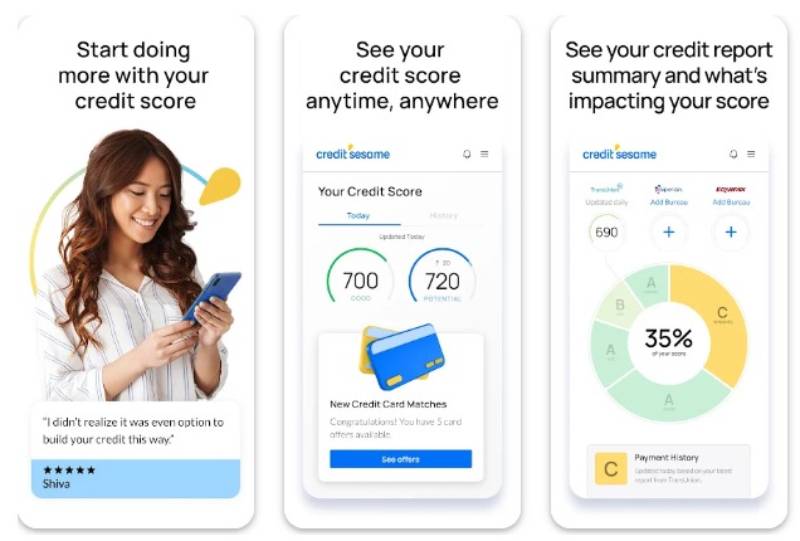

Credit Sesame

Credit Sesame seeds the soil of financial wellbeing with a vigilant watch over your credit garden. Free to all, it fosters a debt-free future with personalized tips, wrapped in a commitment to affordability through no-cost identity protection – a faithful financial companion.

Best Features

- No-cost credit score and Sesame Cash

- Mobile app for credit score checks on the go

- Identity theft protection

What we like about it:

The free identity theft protection service is the gem in its crown, offering peace of mind as a fundamental, accessible right.

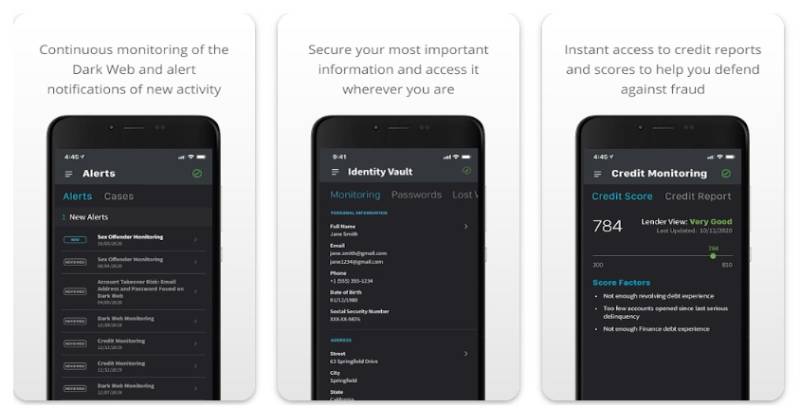

IdentityForce

IdentityForce patrols the perimeters of personal information with an eagle’s focus. Premier in identity theft protection, it brings tools for proactive monitoring, alert systems, and advanced threat intelligence to the palm of your hand, ready to defend at any suspected breach.

Best Features

- Real-time fraud alerts

- Advanced fraud monitoring

- $1 million identity theft insurance

What we like about it:

The $1 million identity theft insurance is the shield guaranteeing a safety net, ensuring that users feel secure in the app’s protective embrace.

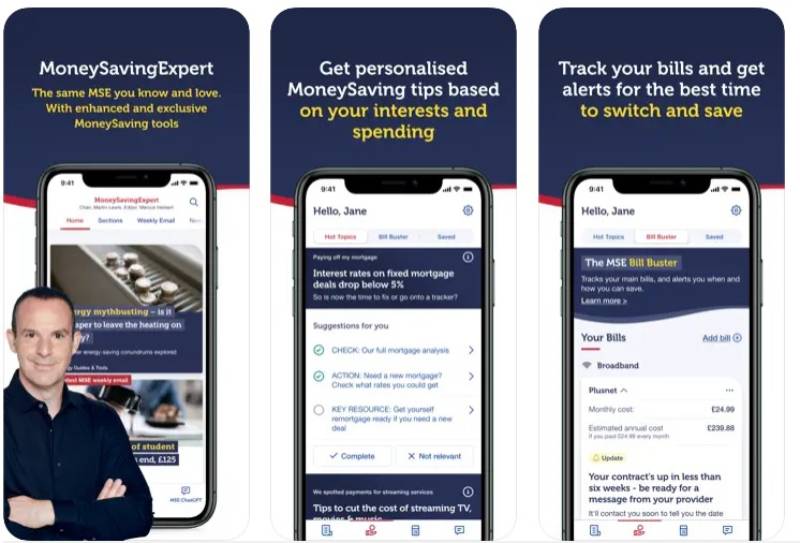

MSE Credit Club

MSE Credit Club, birthed from Money Saving Expert’s financial acumen, isn’t just an app; it’s a community of empowered users. Thriving on clarity and education, it beams a spotlight on your credit score and proposes actionable roadmaps toward a brighter financial future.

Best Features

- Credit score updates

- Personal credit hit rate

- Money-saving advice

What we like about it:

Personal credit hit rate is the celebrated feature, charting the likelihood of credit approval and demystifying the often opaque credit decision-making process.

Aura

Aura resonates with a protective aura, dedicated to shielding every facet of your financial identity online. It’s a watchtower, meticulously surveilling threats to personal information whilst offering proactive measures and comprehensive identity theft insurance.

Best Features

- VPN for safe browsing

- Financial transaction monitoring

- Identity theft insurance

What we like about it:

The inclusion of a VPN for safe browsing highlights Aura’s commitment to comprehensive digital safety, ensuring users have armor in all arenas.

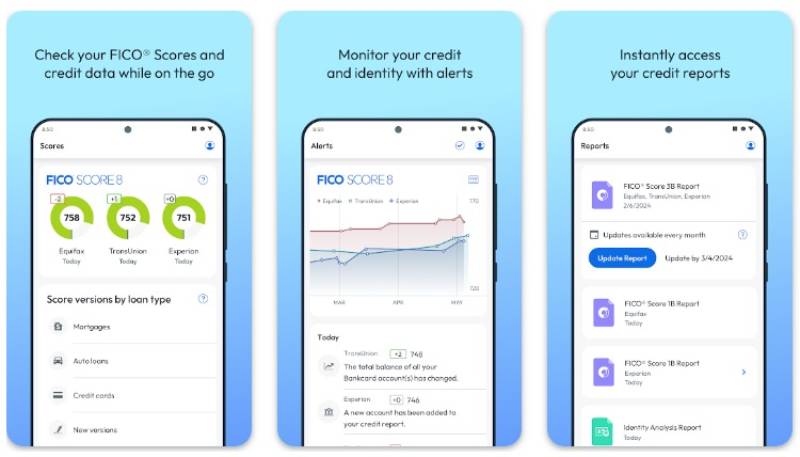

Fico

Fico, the titan behind the numerical measure that dictates financial trust, renders an ostensibly complex number digestible. It extends beyond a simple score, offering deep dives into credit report analysis and education for forward-thinking financial health cultivation.

Best Features

- Official FICO score

- Detailed score analysis

- Financial health education

What we like about it:

Offering the official FICO score, the standard by which many lenders measure creditworthiness, gives Fico its authority and trust in users’ eyes.

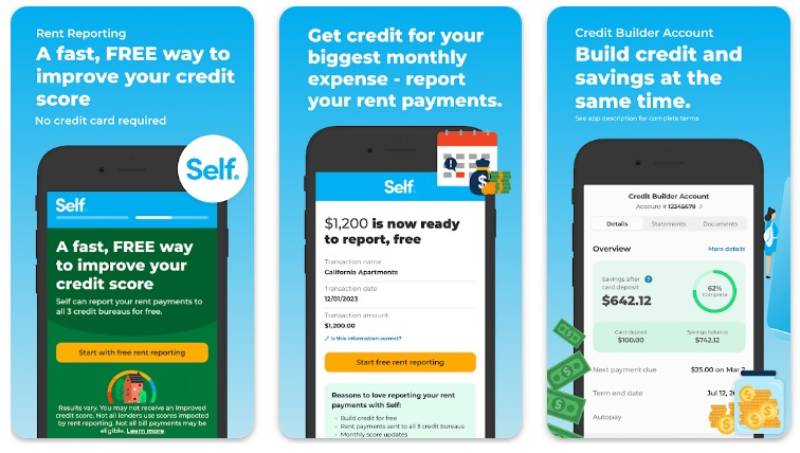

Self

Self crafts a narrative where a robust credit history is a tale within everyone’s grasp. It’s not just an app; it’s a foundational credit-building loan aid. With Self, fostering a future of financial growth runs parallel with a today of committed learning and guidance.

Best Features

- Credit Builder Account

- Self Visa Credit Card

- Credit history tracking

What we like about it:

The Credit Builder Account is especially celebrated, offering a structural pathway for users to construct a credit history with the patience and care of an artisan.

FAQ on Apps Like Experian

What exactly do apps like Experian do?

Apps that orbit a star like Experian are financial constellations offering more than just credit score checks. They’re guardians, hoisting shields of fraud alerts and identity theft protection, while also assisting with personalized financial insights.

They’re your credit’s allies, your financial decisions’ consultants.

How secure are these credit monitoring apps?

Picture them as digital fortresses. These apps employ robust security measures like military-grade encryption, regular audits, and, often, two-factor authentication to safeguard your data.

Trust is their cornerstone, with the backlink profile of their security being as strong as the walls of Troy.

Are these apps offering free services actually free?

A complex tapestry indeed. Many apps tout free services, but it’s organic traffic in their ecosystem. They may offer fundamental features gratis, financed by ads or premium tiers that unlock more advanced functionalities like credit report analysis or intricate budgeting tools.

How accurate are credit scores on apps similar to Experian?

The pulse of your financial health is shown with precision. These apps often fetch scores from major bureaus, ensuring that what you witness is a mirror of your true credit standing. Yet, some navigate by different stars, using proprietary algorithms to cast their credit score checker light.

Can I improve my credit score with these apps?

They’re more than passive watchers—they’re tutors, too. By flagging potential credit report inaccuracies, proposing debt management strategies, and offering personalized tips for FICO score improvement, they empower users to hold the reins of their credit destiny firmly within their grasp.

Will using multiple credit monitoring apps hurt my score?

A walk through this digital forest won’t leave a trail. Checking your own credit score through these apps is a soft inquiry, which means it’s entirely your secret and has no impact on your credit.

They’re like silent scouts, leaving no footprint in your technical SEO audit.

Do credit monitoring apps help with identity protection?

Wearing the cloak of identity protection, these apps vigilantly stand guard, ready to sound the alarm if suspicious activity arises.

Features like real-time alerts and dark web surveillance act as your personal watchtower against the specters of identity theft.

How often are the credit scores updated in these apps?

Time dances to various tunes across platforms. Some apps refresh your score monthly, while others offer daily updates.

The cadence of these updates forms part of the user experience, with some rhythms aligning better with the beat of your personal financial journey.

Can I use these apps to report an error on my credit file?

Indeed, for error battles, they’re your faithful squires. While these apps don’t fix errors directly, they serve as beacons, highlighting discrepancies and guiding through the credit dispute resolution process with the might and right of an SEO audit.

What other features do finance apps like Experian offer?

Beyond your credit landscape, they traverse the full domain of personal finance. They offer budgeting assistance, model potential loan scenarios, and deliver insights that aid in crafting your broader financial strategy with the precision of metadata optimization.

Conclusion

Embarking on a journey through the galaxy of apps like Experian, the convergence of creativity and technology reveals itself. Today’s odyssey unearths a trove of digital allies, from Credit Karma’s insights to Mint’s budgeting prowess, each offering a constellation of tools to navigate your financial universe.

- The labyrinth of credit score checkers and identity theft guardians has been charted.

- Insights into the realm of free credit monitoring now lace our digital tapestry.

- The fortresses of data security stand unwavering, while the user experience remains firmly nestled in the cockpit of our exploration.

Within the intricate web of personal finance, we’ve identified not merely utilities but partners that guide with a torch of clarity against the obscure night. As the curtain falls on this cybernetic theater, one’s empowered to wield these apps with wisdom and fortitude, charting a course toward financial enlightenment that is as unique as the patterns within a kaleidoscope.

If you liked this article about apps like Experian, you should check out this article about apps like Afterpay.

There are also similar articles discussing apps like Venmo, apps like PayPal, apps like Robinhood, and apps like Acorns.

And let’s not forget about articles on apps like Credit Karma, apps like Mint, apps like Coinbase, and apps like Apple Pay.

- How much does android app development cost? - June 17, 2024

- E-commerce Excellence: Build Stores with Apps Like Shopify - June 16, 2024

- Efficient Coding with JavaScript Comma Operators - June 16, 2024