Imagine a world where every cent, from morning lattes to monthly rent, elegantly flows into a digital ledger — no more crumpled receipts or late-night number crunching. That’s the power of Mint, right? But what if I told you there’s more to discover in the realm of personal finance apps?

In a financial universe brimming with options, choosing the right app to manage your money can feel like navigating a labyrinth. This article is your torchlight.

Revealing the lesser-known contenders in the personal finance app arena, we aim to equip you with an arsenal of Mint alternatives that might just be the financial sidekick you didn’t know you needed.

Ready for a deep dive into savvy budget trackers and expense managers?

By the end of this read, you’ll be acquainted with apps that do more than just watch over your wallet; you’ll find tools that nudge you towards brighter money management, propelling you towards your savings goals with automated precision and insightful financial reports.

From category-based spending aids to net worth calculators; here’s to uncovering the digital companions capable of transforming your financial habits into a harmonious symphony of savings and security.

Apps Like Mint

| Apps Like Mint | Budgeting | Investment Tracking | Bill Payment/Management | Subscription Model |

|---|---|---|---|---|

| Empower | Yes | Limited | Yes | Monthly Fee |

| Quicken Classic | Yes | Comprehensive | Yes | One-Time Purchase |

| Rocket Money | Yes | No | Yes | Monthly/Yearly Fee |

| YNAB | Detailed | No | No | Monthly/Yearly Fee |

| Monarch Money | Yes | Comprehensive | No | Monthly/Yearly Fee |

| Goodbudget | Envelope System | No | No | Free & Paid Tiers |

| EveryDollar | Yes | No | With Plus version | Free & Plus (Paid) |

| PocketGuard | Yes | No | Yes | Free & Paid Tiers |

| Quicken Simplifi | Yes | Yes | Yes | Monthly/Yearly Fee |

| Wally | Yes | No | No | Free & Paid Tiers |

| Albert | Yes | Limited | Yes | Free & Paid Options |

Empower

Empower shakes up the finance app game with a neat combo of tracking spending and offering easy saving tools. It’s like having a savvy financial buddy in your pocket, whispering wise money moves and nudges to save a bit here and there. Plus, you can negotiate bills directly through the app, which is pretty rad.

Best Features

- Automated savings

- Bill negotiation

- Customizable budget categories

What we like about it: The standout? Automated savings – pretty slick at building a nest egg without you lifting a finger.

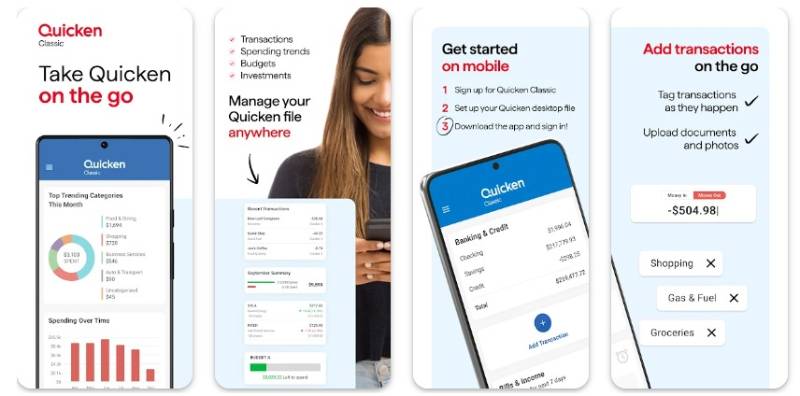

Quicken Classic

Quicken keeps it, well, classic. It’s the granddaddy of budgeting, catering to those who revel in detail and thorough financial planning. With its robust investment tracking, you can play the long game like a pro.

Best Features

- Detailed budgeting

- Investment and retirement planning

- Large repository of financial reports

What we like about it: The rich investment features are a gem, perfect for the detail-oriented planner.

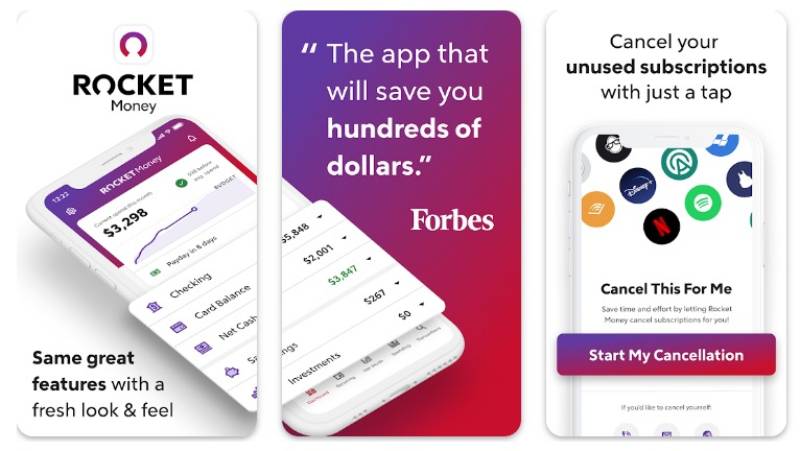

Rocket Money

Rocket Money (formerly Truebill) zips into your financial life and sweeps away those sneaky, unnecessary subscriptions. It brings simplicity to budgeting, ensuring you don’t drip-dry your wallet on forgotten monthly subscriptions.

Best Features

- Subscription management

- Budgeting and expense tracking

- Bill negotiation

What we like about it: Cancellation of subscriptions is the superstar feature here, and it’s a lifesaver.

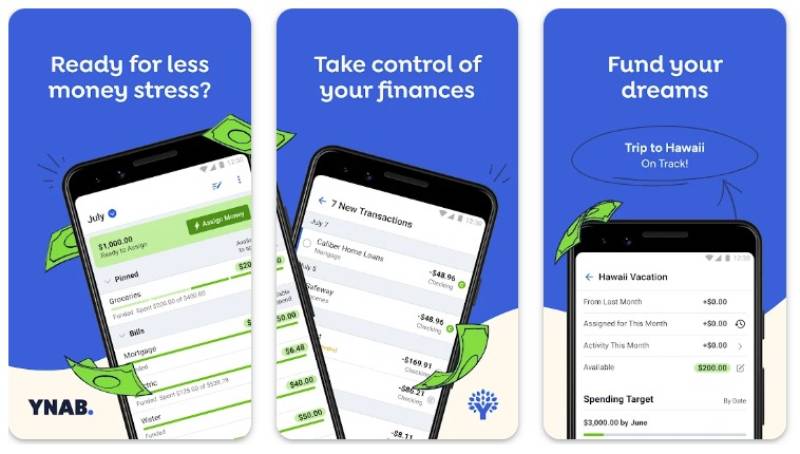

YNAB

YNAB (You Need A Budget) is all about giving every dollar a mission. It’s the app equivalent of a budgeting boot camp, with a cult following that swears by its method. Fresh financial start, anyone?

Best Features

- Proactive budgeting

- Goal tracking

- Educational resources

What we like about it: Its proactive approach – YNAB teaches you to be intentional with every buck.

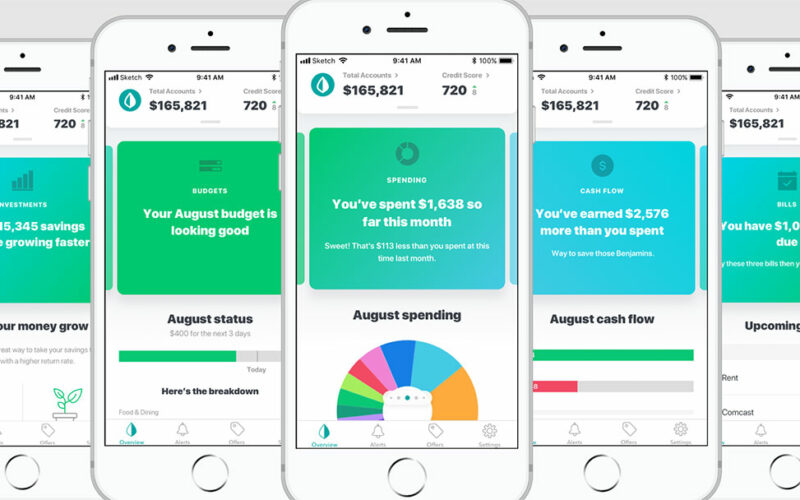

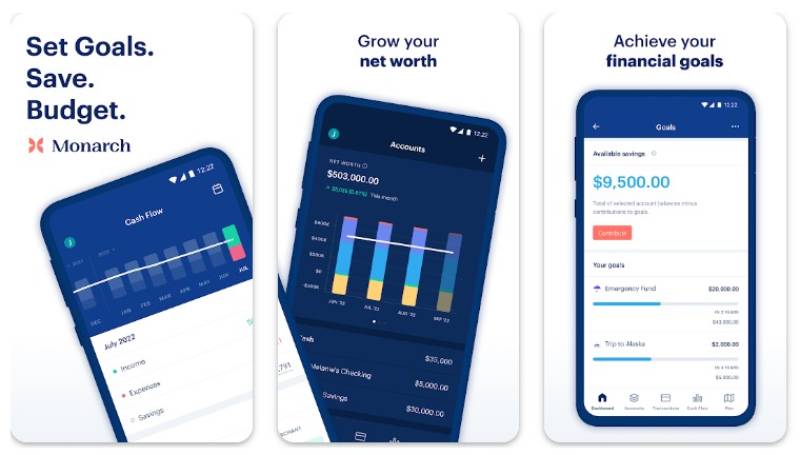

Monarch Money

Here’s where money meets modern tech. Monarch Money goes beyond basics with a sleek interface that simplifies tracking finances. Investment snapshots? Check. Net worth overview? Got it.

Best Features

- User-friendly interface

- Net worth tracking

- Investment management

What we like about it: The holistic financial snapshot this app provides truly makes it monarch of money management.

Goodbudget

Looking for digital envelopes to stash your cash and manage spending? Goodbudget’s your jam. This app takes that old-school envelope system and makes it digital, which is pretty charming.

Best Features

- Envelope budgeting system

- Sync across multiple devices

- Debt tracking

What we like about it: The digital envelope method! It’s simple, proven, and folks love the straightforward approach.

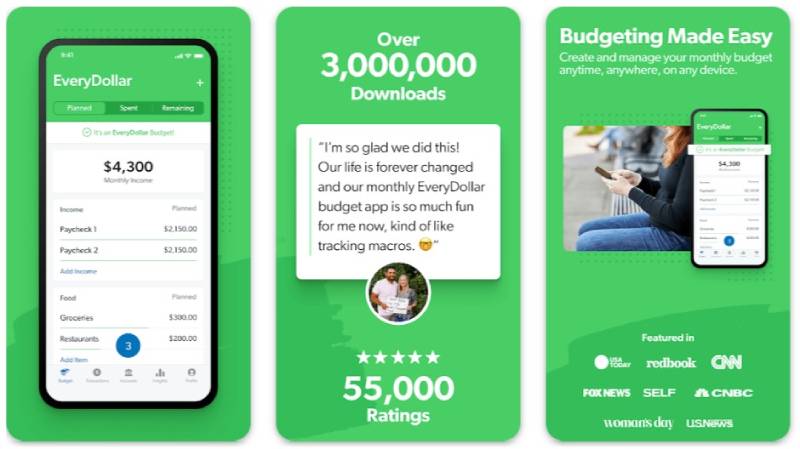

EveryDollar

EveryDollar aims to make every dollar count. Created by finance guru Dave Ramsey, it’s designed to help you achieve financial peace with fuss-free budgeting rooted in zero-based budget principles.

Best Features

- Zero-based budgeting

- Easy expense tracking

- Integration with Ramsey+

What we like about it: Its commitment to zero-based budgeting is ace for keeping spending in check.

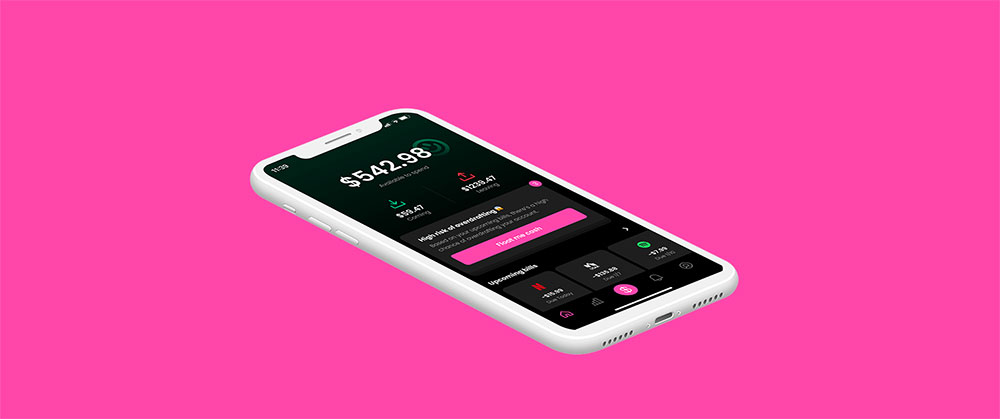

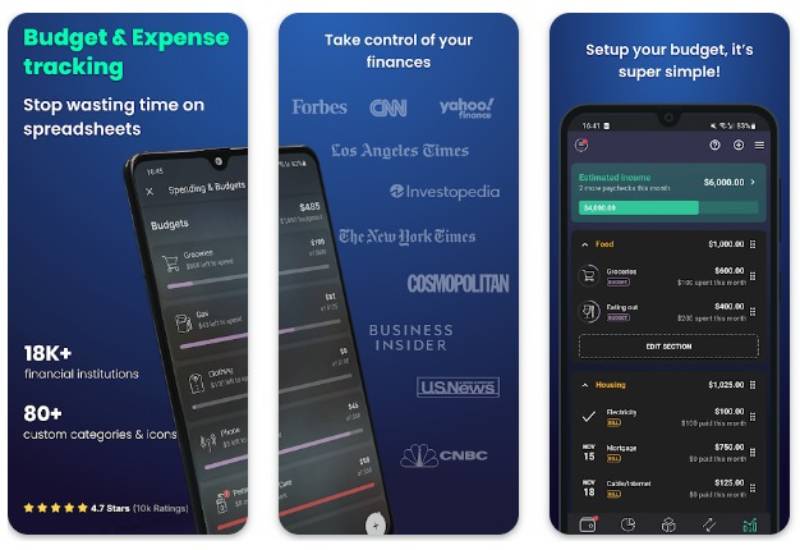

PocketGuard

PocketGuard stands as the watchdog for your wallet, enveloping you in a snug world where you can’t overspend because it’s always on guard, tracking every dime and preventing financial oopsies.

Best Features

- InMyPocket feature to know spending ability

- Bill tracking

- Subscription monitoring

What we like about it: InMyPocket – a unique feature that tells you how much you can safely spend.

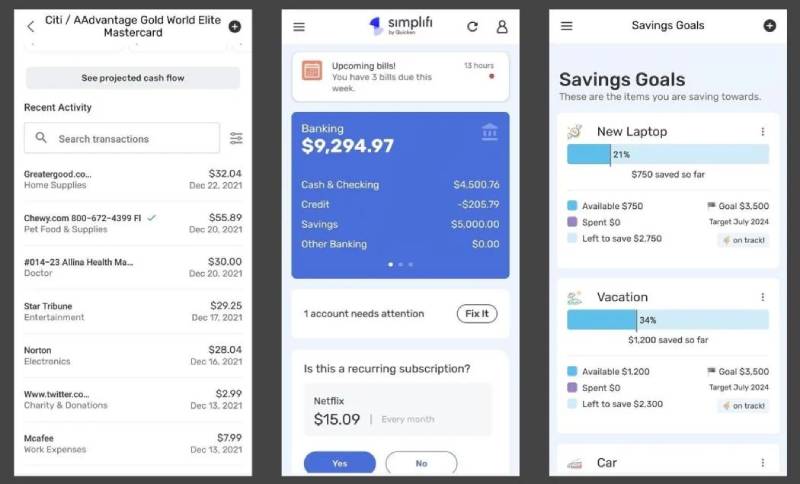

Quicken Simplifi

Simplifi by Quicken does what it says – simplifies. Imagine financial clarity without the clutter. Track your cash, watch your net growth, foresee larger tide waves of spending – all smoothed out.

Best Features

- Simple, intuitive design

- Goal setting and monitoring

- Predictive forecasting

What we like about it: The forecasting – seeing your financial future gets crystal clear.

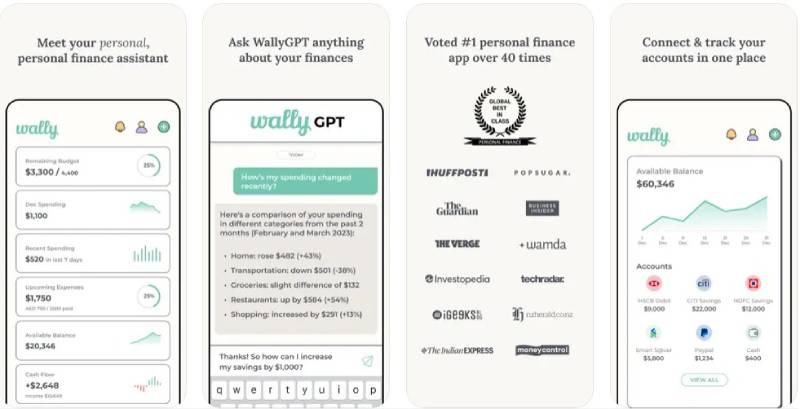

Wally

Let’s talk control. Wally hands it over when it comes to tracking where your funds flow. Designed for the hands-on budgeter, it’s as proactive as a caffeine-fueled Monday.

Best Features

- Comprehensive expense tracking

- User-driven budgeting

- Currency conversion for international travelers

What we like about it: The attention to detail in expense tracking wins gold here.

Albert

Albert whispers financial wisdom like that friend who always seems to have their stuff together. It’s nifty with budgeting and even gives personal advice from human experts – now that’s pretty neat.

Best Features

- Automated savings

- Human financial experts

- Cash bonuses on savings

What we like about it: Access to real human experts who can dish personalized financial advice? Yes, please!

FAQ On Apps Like Mint

Are there any free alternatives to Mint that are just as good?

Absolutely. You’ve got options like PocketGuard and GoodBudget; these aren’t just alternatives but fierce competitors, driving home that awesome low-budget management with a chunk of the bells and whistles that Mint offers, especially for those just starting to dip their toes into managing personal finances.

How secure are apps similar to Mint when it comes to my financial data?

It’s like a digital Fort Knox for your dollars. These apps typically use bank-level encryption technology to keep prying eyes away from your financial insights. Always check for security features before downloading, though – peace of mind is a priceless addition to your financial toolkit.

Can apps like Mint really help me save money?

I swear by them! They’re not just sitting pretty on your phone, you know. These tools are like personal finance trainers, nudging you towards savings goals, trimming the fat on overspending, and helping you spot where you can tighten the belt. All with automated savings features to make it almost effortless.

Will using budgeting apps affect my credit score?

Chill, it’s all good. Just using them? Nope, won’t touch your credit score. Some even offer a credit score check, just a peek, no impact. If anything, by helping you stay on top of your finances, you’re likely to keep your credit score in the green zone.

What features should I look for in a good budget management app?

Let’s break it down: expense tracking, account synchronization, financial goals, and seamless user experience. Bonus points for bill reminders and a solid security framework.

It’s about pushing beyond basics; you want a comprehensive dashboard with intuitive financial reports and maybe even some nifty tax reporting features.

Is it possible to manage investments with apps like Mint?

Spot on, some do. Personal finance isn’t just about today’s coffee budget; it’s the long game—retirement, stocks, bonds. Look for apps that offer investment tracking.

Tools like Personal Capital pivot towards wealth management. Just don’t expect deep, Wall Street-level analysis from every app.

How do these apps make managing finances easier than traditional methods?

Imagine replacing a mountain of paper with a few taps on your smartphone. That’s what they offer. Real-time updates, automated categorization, financial dashboards—all contributing to the “Uh-huh, I’ve got this” feeling.

It’s the difference between steering a tricycle and a sports car on the road to financial savvy.

Do Mint-like apps offer features for tracking investments and net worth?

You bet they do. Your net worth isn’t just a number—it’s your financial fingerprint. Apps with net worth calculators and investment tracking take the grunt work out of crunching numbers, giving you a bird’s eye view of your economic terrain, so you know exactly where you stand.

Can I link all my financial accounts to these types of apps?

Mostly, yes. The beauty lies in bank account integration. Pulling from checking, savings, even your crypto stash if you’re riding that wave. They’re like the ultimate financial hubs. But it’s worth noting, a few outlying accounts or smaller institutions might not always play ball.

How do budgeting apps help with expense tracking and categorization?

Think of it as a financial filter. Say “bye” to manual logging; smart expense manager features automatically sort your Starbucks splurge under “coffee” or “treating myself.” It gives you the clarity to pinpoint where the cash flows, and hey, tighten up those categories to optimize spending patterns.

Conclusion

And so we’ve reached the digital horizon, where the landscape is dotted with apps like Mint that make personal finance less ‘ugh’ and more ‘aha!’.

- We’ve keyed into a world where expense tracking is as simple as a swipe on our screens.

- Where investment tracking and net worth calculation doesn’t require an MBA.

- We’ve embraced apps that hold our hands through the journey towards savings goals.

Picture this: The chaos of receipts fades. The puzzle of budgeting – solved. And those financial goals you thought were mirages? With tools like PocketGuard, GoodBudget, and Personal Capital, they’re suddenly within reach.

Here’s to taking control of finances; to understanding where every penny pirouettes. It’s about pinpointing leaks in the wallet and patching them up, all while eyeing the future with a steadfast gaze. It’s not magic — it’s technology. And in your capable hands, it’s transforming numbers into actionable intelligence. Cheers to mastering money, one tap at a time.

If you liked this article about apps like Mint, you should check out these articles also:

- Earn on Missions: Discover Apps Like Field Agent

- Travel Made Affordable: Why Choose Apps Like Hopper?

- Home Cleaning Services: Apps Like HomeAglow Reviewed

- Unlocking Capabilities: What is JavaScript Used For? - April 28, 2024

- Creative Collages: Designing with Apps Like PicCollage - April 27, 2024

- TypeScript Today: What is TypeScript Used For? - April 27, 2024