Flexible Payment Plans: Discovering Apps Like Sezzle

Ever been in a checkout line and wished for a magic wallet? Well, apps like Sezzle are flipping the script on traditional shopping, making that wish a digital reality.

Let’s slice through the noise in the bustling world of buy now, pay later services. With a tap, these payment apps have transformed our screens into modern-day layaway programs, minus the waiting.

Diving in, you’ll unravel the secret sauce behind these split payment services. This isn’t just about delaying the dent in your wallet; it’s a financial revolution tucked in your pocket.

By the end of our talk, you’ll be equipped to navigate the vast sea of flexible payment options, armed with clarity on how these digital wallets could play nice—or naughty—with your credit score.

From the no credit check financing allure to the nitty-gritty of interest-free payments, expect to become your own financial hero. Ready to redefine your relationship with online splurges? Buckle up, it’s going to be an enlightening ride.

Comprehensive List of Sezzle Alternatives

| App | Overview | Interest/Fees | Repayment Terms | Credit Check |

|---|---|---|---|---|

| Klarna | Payment service offering several flexible payment options. | No interest if paid in full within 30 days or installment terms; late fees may apply. | Pay in 4 installments, 30 days payment, or longer financing options. | Soft check for Pay in 4 and Pay in 30; hard check for financing. |

| PayPal Credit | Credit line attached to PayPal account. | No interest if paid in full in 6 months on purchases of $99 or more; otherwise, variable APR. | Minimum monthly payments with the option to pay over time. | Hard credit check. |

| Venue | Marketplace with financing options for various products. | Interest rates vary; offers promotional financing on select purchases. | Flexible financing terms depending on the purchase. | Varies by the financing plan. |

| Four | Buy now, pay later service. | No interest; no fees if payments are made on time. | Pay in 4 installments over 6 weeks. | Soft credit check. |

| Affirm | Offers financing for online purchases at participating retailers. | 0-30% APR based on creditworthiness; no late fees. | Ranges from one month to 36 months. | Soft check initially; hard check if you proceed with the loan. |

| Zip | Service that allows you to pay for purchases over time. | Small convenience fee per payment; some retailers may charge interest. | Four installments over six weeks. | Soft credit check. |

| ViaBill | Monthly installment payment service. | No interest; late fees may apply. | Pay in four monthly installments. | Soft credit check. |

| Perpay | E-commerce site that offers payment plans based on your income. | No interest or fees with on-time payments. | Varies; typically structured around paychecks (every 2 weeks, monthly, etc.). | Checks income and spending habits instead of credit. |

| Splitit | Enables installment payments using your existing credit card. | No interest or fees; uses your card’s existing credit line. | Monthly installments; terms depend on purchase and retailer. | No credit check required. |

| Fingerhut | Online retailer offering credit accounts for purchases from its catalog. | High APR; no annual fees. | Flexible repayment terms, but higher interest rates apply. | Hard credit check. |

| AfterPay | Buy now, pay later service. | No interest; late fees may apply. | Pay in 4 installments due every 2 weeks. | Soft credit check. |

| Zebit | Offers a credit line to shop in their marketplace without interest. | No interest; no membership fees; late fees may apply. | Up to 6 months to pay off the balance. | No credit check to open account. |

| Pay in 4 by PayPal | A feature within PayPal for split payments. | No interest; late fees may apply. | 4 payments over 6 weeks. | Soft credit check. |

Klarna

Features and Benefits

Klarna’s one of those apps like Sezzle that’s got people talking. It’s smooth, it’s sleek, and it’s got some killer features. You can shop now and pay later, or even pay in installments. And the best part? No interest if you pay on time. It’s like having a personal shopper in your pocket.

Payment Plans

With Klarna, you’ve got options. Want to pay in 30 days? You got it. Want to split it into 4 equal payments? No problem. It’s all about giving you the control to choose how you pay. It’s not just another app; it’s a whole new way to shop.

Comparison with Sezzle

So how does Klarna stack up against Sezzle? Both are apps like Sezzle, but Klarna’s got a bit more flair. It’s got more payment options, and it’s accepted in more places. But hey, it’s not a competition. It’s about finding what works for you.

PayPal Credit

Features and Benefits

PayPal Credit’s not just another name in the game. It’s a big player. It’s like having a credit line, right there in your PayPal account. No annual fee, and you can even score some special financing offers. It’s not just about buying stuff; it’s about buying stuff smarter.

Acceptance and Limitations

But here’s the catch. PayPal Credit’s not accepted everywhere. It’s got its limitations. It’s like having a VIP pass, but only to certain clubs. Still, where it’s accepted, it’s golden. And with the backing of PayPal, you know it’s secure.

Comparison with Sezzle

So how does it compare to Sezzle? Well, they’re both apps like Sezzle, but they’ve got their vibes. PayPal Credit’s more about credit, while Sezzle’s more about installments. Different strokes for different folks, right?

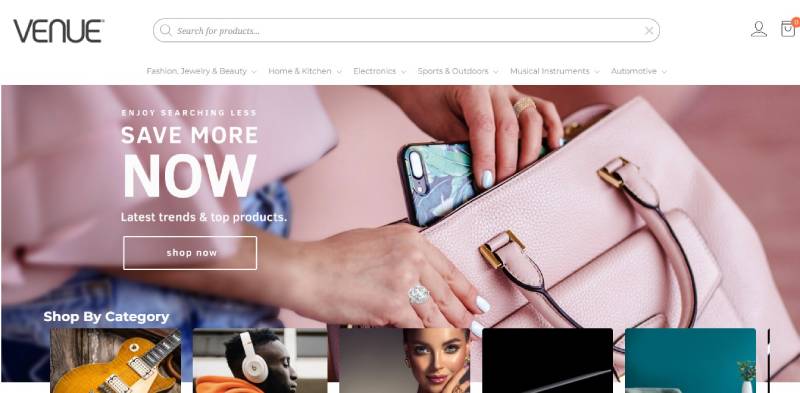

Venue

Features and Benefits

Venue’s a bit of a wildcard. It’s new, it’s fresh, and it’s making waves. It’s not just about buying and paying later. It’s about experiencing shopping in a whole new way. It’s one of those apps like Sezzle that’s not just following the trend; it’s setting it.

Flexibility and Brand Catalog

With Venue, you’ve got options. Lots of them. From big brands to small boutiques, it’s all there. And the payment plans? Flexible as a yoga instructor. It’s not just another app; it’s a shopping revolution.

Comparison with Sezzle

So how does Venue stack up against Sezzle? Well, they’re both apps like Sezzle, but Venue’s got a bit more sass. It’s more flexible, and it’s got a broader brand catalog. But that doesn’t mean it’s better or worse. It’s just different.

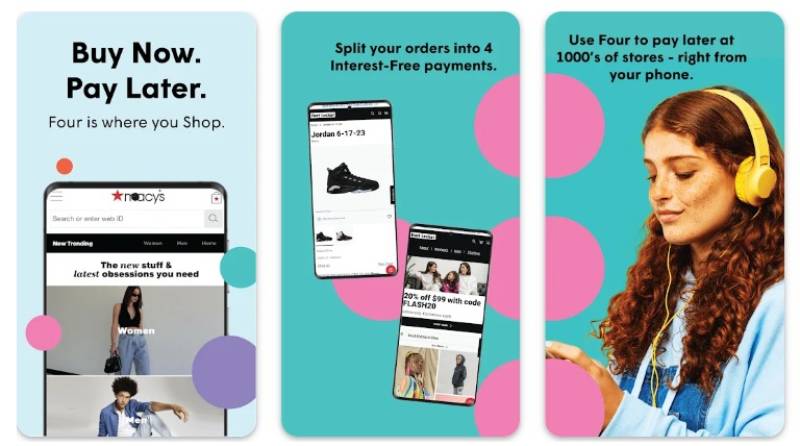

Four

Features and Benefits

Four’s all about keeping it simple. Four payments, over six weeks, with zero interest. It’s like having a straightforward roadmap for your shopping. No twists, no turns, just a straight shot to owning what you want.

Payment Structure

With Four, what you see is what you get. Four payments, that’s it. No hidden fees, no surprises. It’s one of those apps like Sezzle that’s all about transparency. It’s not trying to be flashy; it’s just trying to be fair.

Comparison with Sezzle

So how does Four compare to Sezzle? They’re both apps like Sezzle, but Four’s a bit more down-to-earth. It’s not trying to be everything to everyone. It’s just trying to be something good for someone.

Affirm

Features and Benefits

Affirm’s not just another name; it’s a statement. It’s about affirming your right to shop how you want. With no late fees and the option to pick your payment schedule, it’s putting you in the driver’s seat. It’s not just another app; it’s a way of life.

Credit Limit and Payment Options

With Affirm, you’ve got a credit line that’s all about you. You choose how you pay, and how much you pay. It’s like having a tailor-made suit; it just fits. And with no hidden fees, it’s one of those apps like Sezzle that’s all about keeping it real.

Comparison with Sezzle

So how does Affirm stack up against Sezzle? They’re both apps like Sezzle, but Affirm’s got a bit more swagger. It’s more personalized, and it’s more about you. But that doesn’t mean it’s better; it’s just different.

Zip

Features and Benefits

Zip’s not just a name; it’s a promise. It’s about zipping through checkout with no hassle. With no interest and a simple payment plan, it’s making shopping a breeze. It’s not just one of those apps like Sezzle; it’s a whole new way to zip.

Payment Methods

With Zip, you’ve got options. Want to pay with your bank account? You got it. Want to pay with a credit card? No problem. It’s all about giving you the control to choose how you pay. It’s not just another app; it’s a whole new way to zip.

Comparison with Sezzle

So how does Zip compare to Sezzle? They’re both apps like Sezzle, but Zip’s got a bit more zip. It’s faster, it’s sleeker, and it’s got more payment options. But that doesn’t mean it’s better; it’s just zippier.

ViaBill

Features and Benefits

ViaBill’s all about making it easy. With no interest and no credit checks, it’s taking the stress out of shopping. It’s one of those apps like Sezzle that’s not about complicating things; it’s about simplifying them.

Interest and Late Fee Structure

With ViaBill, what you see is what you get. No hidden fees, no nasty surprises. And if you’re late? Well, they’ve got a plan for that too. It’s not about punishing you; it’s about working with you.

Comparison with Sezzle

So how does ViaBill stack up against Sezzle? They’re both apps like Sezzle, but ViaBill’s a bit more chill. It’s not about the flash; it’s about the function. It’s not about being the best; it’s about being the best for you.

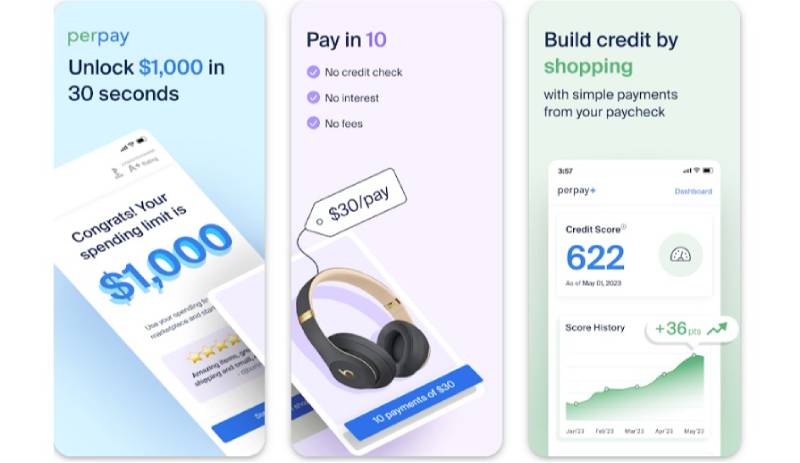

Perpay

Features and Benefits

Perpay’s all about the perks. With no credit checks and a simple payment plan, it’s making shopping a joy. It’s not just one of those apps like Sezzle; it’s a whole new way to perk up your shopping.

Credit Line and Repayment Time

With Perpay, you’ve got a credit line that’s all about you. You choose how you pay, and how much you pay. It’s like having a tailor-made shopping plan; it just fits. And with no hidden fees, it’s one of those apps like Sezzle that’s all about keeping it real.

Comparison with Sezzle

So how does Perpay stack up against Sezzle? They’re both apps like Sezzle, but Perpay’s got a bit more perk. It’s more personalized, and it’s more about you. But that doesn’t mean it’s better; it’s just perkier.

Splitit

Features and Benefits

Splitit’s all about splitting it. With no interest and no credit checks, it’s taking the stress out of shopping. It’s one of those apps like Sezzle that’s not about complicating things; it’s about splitting them.

Growth and User Experience

With Splitit, what you see is what you get. No hidden fees, no nasty surprises. And the user experience? Top-notch. It’s not about splitting hairs; it’s about splitting payments.

Comparison with Sezzle

So how does Splitit stack up against Sezzle? They’re both apps like Sezzle, but Splitit’s a bit more split. It’s not about the flash; it’s about the function. It’s not about being the best; it’s about being the best for you.

Fingerhut

Features and Benefits

Fingerhut’s not just a name; it’s a legacy. With a catalog that’s got everything from A to Z, it’s a shopper’s paradise. It’s not just one of those apps like Sezzle; it’s a whole new way to finger your shopping.

Payment Plans and Credit Check

With Fingerhut, you’ve got options. Want to pay in installments? You got it. Want to pay later? No problem. And the credit check? It’s all part of the plan. It’s not just another app; it’s a whole new way to finger your shopping.

Comparison with Sezzle

So how does Fingerhut compare to Sezzle? They’re both apps like Sezzle, but Fingerhut’s got a bit more finger. It’s got more options, and it’s got a broader catalog. But that doesn’t mean it’s better; it’s just more fingered.

AfterPay

Features and Benefits

AfterPay’s all about paying after. With no interest and a simple payment plan, it’s making shopping a breeze. It’s not just one of those apps like Sezzle; it’s a whole new way to pay after.

Installment Plans and Fees

With AfterPay, what you see is what you get. Four payments, that’s it. No hidden fees, no surprises. It’s one of those apps like Sezzle that’s all about transparency. It’s not trying to be flashy; it’s just trying to be fair.

Comparison with Sezzle

So how does AfterPay stack up against Sezzle? They’re both apps like Sezzle, but AfterPay’s a bit more after. It’s not about the flash; it’s about the function. It’s not about being the best; it’s about being the best for you.

Zebit

Features and Benefits

Zebit’s all about the zing. With no interest and a credit line that’s all about you, it’s making shopping a joy. It’s not just one of those apps like Sezzle; it’s a whole new way to zing your shopping.

Credit Checks and Line of Credit

With Zebit, you’ve got a credit line that’s all about you. You choose how you pay, and how much you pay. It’s like having a tailor-made shopping plan; it just fits. And with no hidden fees, it’s one of those apps like Sezzle that’s all about keeping it real.

Comparison with Sezzle

So how does Zebit stack up against Sezzle? They’re both apps like Sezzle, but Zebit’s got a bit more zing. It’s more personalized, and it’s more about you. But that doesn’t mean it’s better; it’s just zingier.

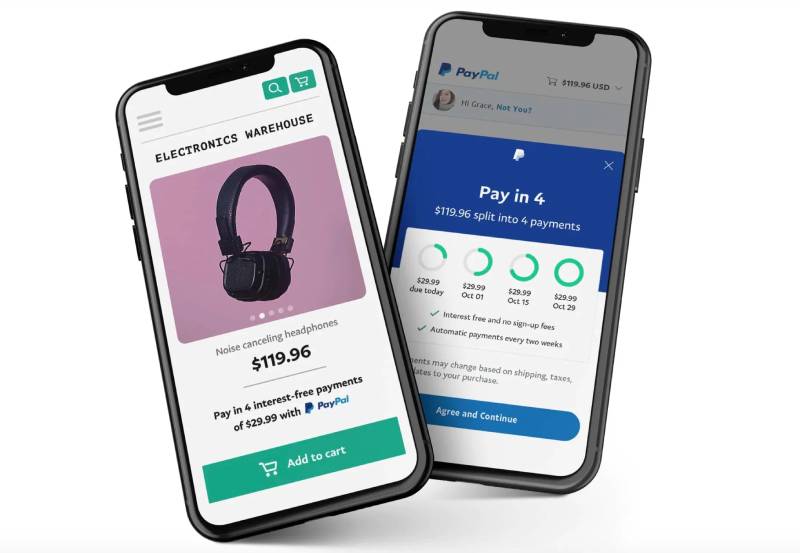

Pay in 4 by PayPal

Features and Benefits

Pay in 4’s not just another option; it’s a game-changer. Backed by PayPal, it’s all about making shopping smooth. With no interest and four easy payments, it’s not just one of those apps like Sezzle; it’s a whole new way to pay.

Price Range and Acceptance

With Pay in 4, you’ve got a price range that works for you. From small buys to big splurges, it’s got you covered. And with the backing of PayPal, you know it’s accepted almost everywhere. It’s not just another app; it’s a whole new way to experience shopping.

Comparison with Sezzle

So how does Pay in 4 stack up against Sezzle? They’re both apps like Sezzle, but Pay in 4’s got a bit more punch. It’s more flexible, and it’s got the backing of PayPal. But that doesn’t mean it’s better; it’s just punchier.

Comparison and Analysis

Similarities Among Alternatives

So, you’ve got all these apps like Sezzle, right? But what’s the deal with them? Are they all the same, or is there something that sets them apart? Let’s break it down.

First off, they’re all about that Buy Now Pay Later vibe. You shop, you enjoy, and you pay later. It’s like having a party and cleaning up the next day. They all give you that freedom, that flexibility.

And then there’s the no-interest thing. Most of these apps like Sezzle are all about keeping it interest-free if you pay on time. It’s like getting a free ride, as long as you stick to the rules.

But that’s not all. They’re all about making shopping easy, making it fun. They’re not just apps; they’re like your shopping buddies, always there when you need them.

Unique Features of Each Platform

But hold on, they’re not all the same. Each one of these apps like Sezzle has got its flavor, its style.

Take Klarna, for example. It’s all about those payment options. Want to pay in 30 days? You got it. Want to split it into four? No problem. It’s like having a personal shopper who knows just what you want.

And then there’s PayPal Credit. It’s got that big-name backing, and it’s all about credit. It’s like having a VIP pass to the shopping world.

Don’t forget about Venue. It’s new, it’s fresh, and it’s all about the experience. It’s not just one of those apps like Sezzle; it’s a whole new way to shop.

Each one’s got something that makes it tick, something that makes it special. It’s not about finding the best one; it’s about finding the one that’s best for you.

Market Trends and Consumer Preferences

So what’s the big picture? What’s going on in the world of apps like Sezzle?

First off, it’s a trend that’s here to stay. People are loving the freedom, the flexibility. It’s like having a new way to shop, and it’s catching on like wildfire.

And then there’s the whole online shopping thing. These apps like Sezzle are making it easier to shop online, to grab what you want without leaving your couch. It’s like having the mall in your living room.

But it’s not just about the young crowd. It’s reaching everyone, from the tech-savvy to the tech-shy. It’s not just a youth movement; it’s a shopping revolution.

Impact on Credit Scores and Financial Health

But wait, what about the money stuff? What’s the deal with these apps like Sezzle and your wallet?

First off, most of these apps don’t hit your credit score. It’s like shopping without the financial hangover. As long as you pay on time, you’re golden.

But that doesn’t mean you can go wild. Like anything in life, you’ve got to be responsible. These apps like Sezzle are tools, not toys. They can help you shop smarter, but they can’t stop you from overspending.

And then there’s the whole financial health thing. These apps are great, but they’re not a substitute for good money habits. It’s like eating junk food; a little is fine, but too much can hurt.

FAQ On Apps Like Sezzle

How do apps like Sezzle work?

These slick apps split your purchase cost into smaller, manageable chunks. Buy now, pay later is the game, and they’re the players making it oh-so-easy. You buy the goodies today, and the app sorts the bill into bite-sized payments, often with zero interest. Handy, right?

Are apps like Sezzle safe to use?

Absolutely. They’re like financial Fort Knox on your phone. Security’s a top priority so transactions are protected fort-style, wrapping your details in layers of encryption. It’s peace of mind while you peace out over your shopping.

What impact do apps like Sezzle have on credit scores?

Generally, they’re like a credit score ninja—mostly invisible. Most of these apps sneak around without pinging your credit at sign-up. But, mind the repayment terms; late dances can stumble into credit report territory.

Is there an interest fee with apps like Sezzle?

Interest-free payments are their claim to fame. Imagine a joyride through an online store with no extra cost on the tag. Stay within their play rules, and it remains a free whirl on the financial Ferris wheel.

Can I return items bought using apps like Sezzle?

It’s like any other buy—you’re good to return. The store handles your woes while your app buddy sorts out the refund. It’s a teamwork dream, simplifying your shop and return saga.

What if I miss a payment with Sezzle-like apps?

Miss a beat, and there’s usually a fee—like a late party tax. But they’re all about second chances. Sort it out quick, and it’s like nothing ever happened. Still, best keep those payments on point.

How do Sezzle and similar apps make money?

Think of them as your shopping wingman—they get paid by the stores. For you, it’s a sweet deal; for stores, it’s more happy customers. And late fees? Yup, those add up too.

Can I use Sezzle-like apps for in-store purchases?

Lately, yes! The digital wallet isn’t just for the web anymore. They’ve been spreading like a good vibe across brick-and-mortar spots. Just look for the sign, and you’re on for an in-person installment spree.

Are there spending limits with apps like Sezzle?

Just like a gas tank, there’s a limit. They start you small, but like a financial workout, your spending muscles can grow. Pay on time, and you could level up for more splurging power.

How do apps like Sezzle affect the return process?

Returns are not like space rockets—no launch and forget. The store hooks up with your app and they sort it out on the back-end. It’s like a behind-the-scenes ballet, ensuring your wallet gets back what’s due.

Conclusion

Diving through the digital landscape, we’ve seen apps like Sezzle carve out a new niche in our wallets.

- They’re flexible payment options.

- They’re interest-free zones.

- They’re consumer lending made easy.

And they’re also transforming how we manage personal finance — all within a tap’s reach.

But remember, the real magic isn’t in the app itself; it’s in how you wield this modern financial tool. Be the savvy shopper, the informed consumer, the timely payer. That way, credit scores stay afloat, and the interest-free joyride keeps rolling.

Let this be your takeoff ramp from the mundane payment methods of yore. March forth, backed by the knowledge that these apps are more than just a marketplace cheat code — they’re gateways to financial flexibility. With the keys to your spending kingdom in your grasp, make every swipe, tap, and confirm a step towards a smarter expenditure empire.

If you enjoyed reading this article about apps like Sezzle, you should read these as well:

- Organized Digital Notetaking: Apps Like OneNote Reviewed

- Gamifying Good Habits: Why Choose Apps Like Habitica?

- Save on Groceries: Top Apps Like Flashfood

- Understanding JavaScript Loops: A Beginner’s Guide - May 16, 2024

- Trending CSS-in-JS Libraries for Developers - May 16, 2024

- Integrating External JavaScript for Enhanced Functionality - May 15, 2024