Neobank App Development Best Practices

Neobanking, a buzzword in the fintech industry, is fundamentally reshaping the way consumers interact with their finances. In 2022, the global neobanking market boasted a valuation of $79.1 billion, and within just one year, it soared to a staggering $118.51 billion. But still, the neobanking sensation is showing no signs of slowing down. By 2027, experts predict that the neobanking market will reach an astonishing $556.66 billion, maintaining an impressive CAGR of 47.2%.

But what is a neobank, precisely?

At its core, a neobank is a completely digital bank without traditional physical branches. These modern banks operate solely online, providing services through mobile and web platforms. With the growing acceptance of digital solutions in daily life, the allure of neobanks has expanded, leading to a burgeoning demand for state-of-the-art, secure neobank apps.

In this article, we’ll describe the key features of neobank and the best practices to build a neobank app.

Essential Features of Neobank App

When designing a standout neobank, incorporating user-centric features is paramount. Here’s what you should consider:

- Onboarding: Streamline user experience by making navigation intuitive, facilitating feature discovery, and simplifying transactions.

- Authorization: Optimize the process, ensuring users can swiftly create accounts or log in.

- Know Your Customer (KYC): Implement a robust KYC system to safeguard clients from fraud, money laundering, and other illicit activities.

- Personal Account Management: Provide easy-to-use controls for users to modify profiles and personalize settings.

- Customer Support: Ensure users have instant access to support. Consider in-app messaging for queries and troubleshooting.

- Card Issuing Schemes: Offer varied card options — physical, virtual, unique BINs, or shared ones — while ensuring compatibility with regional regulations and pricing policies.

- Transaction History: Facilitate real-time tracking of expenditures and payment processing.

- Internet Limits: Empower users to set maximum online spending limits, promoting informed financial decisions.

- Payment Templates: Enhance transaction ease with preset payment options.

- Contact Sync: Use phone numbers as an alternative to card details.

- Notification System: Keep users informed with alerts on account activity, payment confirmations, and app innovations.

To ensure your neobank stands out, consider integrating advanced features:

- Cashback: Offer percentages back on purchases, varying by product category.

- Dynamic CVV2: Enhance security by allowing users to change CVV2, especially if they misplace their phone.

- Expense Tracking: Offer insights into spending categories — like food, housing, or education.

- Referral Incentives: Reward users for bringing in acquaintances.

- Savings Goals: Facilitate automatic fund allocation for specific financial objectives.

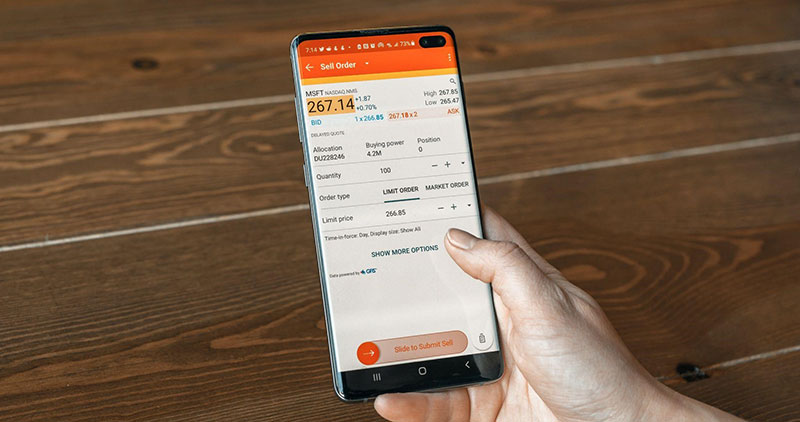

- Stock Trading: Allow users to trade stocks within the app.

- Cryptocurrency Management: Enable transactions with digital currencies, including Bitcoin and Ethereum.

- Budgeting Tools: Assist users in financial planning by setting category-wise spending limits.

Being fully digital, every neobank platform is heavily dependent on technology. This means that any technology failure, be it internal system crashes or issues with third-party service providers, can disrupt services. If you are looking for a more precise description of how to build a neobank, read this neobank app development guide. Embarking on the journey to build a neobank requires a holistic approach, a strong vision, and meticulous attention to detail. By being well-prepared and informed, you’ll be better positioned to navigate the challenges and succeed in the dynamic world of digital banking.

What should you take into account before Developing a Neobank from Scratch?

Starting the journey of developing a neobank from scratch demands meticulous planning and execution. Several pivotal elements define the success of such projects:

- User Interface (UI) and User Experience (UX) Design: The first impression is often the lasting one. An intuitive design, combined with a seamless user experience, ensures that users can navigate effortlessly, making their banking activities a breeze.

- Security Protocols: Given the sensitive nature of financial data, a neobank app’s security is paramount. This not only involves encryption and multi-factor authentication but also continuous monitoring, intrusion detection, and immediate response mechanisms.

- Scalability: Modern apps must be scalable by design. As the user base swells, the app’s infrastructure should gracefully handle the surge, ensuring uninterrupted services.

- Customer Engagement Features: The neo banking arena is competitive. Unique features like financial insights, budgeting tools, gamified savings challenges, and personalized promotions can offer a competitive edge.

Step-be-Step Guide to Neobank App Development

Step 1. Crystalize Your Vision and Objectives

A defined vision and mission lay the groundwork. Draw insights from the journeys of successful fintech giants, such as Monzo, a UK neobank renowned for its simplicity and accessibility. Pinpoint your standout selling features and the challenges your neobank will address. For example, if you’re catering to millennials, devise a bank emphasizing budgeting tools and real-time spending insights.

Tasks to undertake:

- Analyze real-life success stories.

- Frame a compelling selling proposition.

- Recognize and address the potential challenges.

- Tailor features based on user preferences.

Step 2. Grasp Regulatory Compliance

Establishing a neobank or any fintech venture mandates licensing or operating as an EMD/PSD agent under a licensed enterprise. Familiarize yourself with your region’s regulatory landscape and consider licenses like EMI or full banking. Engage legal experts or regulatory consultants to ease the process.

Key financial licenses include:

- Brokerage license

- Forex license

- License for electronic money, aka EMI license

- Investment license

- Banking license

Remember, commitment to compliance is a pledge to financial trustworthiness.

Step 3. Rally Your All-Star Squad

Building a neobank necessitates a range of expertise. Seek professionals well-versed in fintech, possibly from renowned fintech entities or banks. Foster collaboration and adaptability.

Tasks to undertake:

- Engage experts with hands-on fintech experience.

- Foster collaborative and adaptable mindsets.

- Onboard individuals who’ve overcome fintech challenges.

Step 4. Zoom in on UX and Branding

User-centric design is vital. Derive insights from user-friendly apps like Chime. Ensure your platforms are intuitive and secure. Remember, a stellar product paired with effective branding.

Tasks to undertake:

- Invest in intuitive and secure platforms.

- Opt for a user-focused app design.

- Spotlight your unique value in branding.

Step 5. Place Compliance and Security Front and Center in App Development

Security and compliance are non-negotiables in neobank app creation. For instance, Monese, a UK neobank, faced initial regulatory hiccups due to potential gaps in KYC and AML protocols. Staying updated on regulations and bolstering security measures is paramount, ensuring customer trust.

Tasks to undertake:

- Adhere to financial regulations, including KYC and AML.

- Keep abreast of data protection norms.

- Strengthen cybersecurity defenses.

Step 7. Opt for the Perfect Tech Blueprint and Experienced App Development Companies

Incorporate engineers familiar with fintech nuances. Your tech team should choose software for app development congruent with the neobanking domain. Several technologies can offer benefits, including Cloud Computing, API Integration, Blockchain, Data Encryption, AI, DevOps Tools, and Biometric Authentication.

If you are choosing between outsourcing app development companies, prefer those who have experience building apps like yours. Align your tech choices with your business aims, regulatory needs, and user expectations.

Conclusion

Neobanking app development is an intricate tapestry woven with threads of design, technology, security, and user experience. As the world increasingly leans towards digital banking, immense opportunities await those ready to innovate. By adhering to established best practices, being attuned to user preferences, and continually embracing technological advancements, the horizon of crafting unparalleled digital banking experiences broadens.

- Integrating External JavaScript for Enhanced Functionality - May 15, 2024

- Learn about Technical Skills in the Tech Age: 6 Educational Tips - May 15, 2024

- Understanding DDoS Attacks: What You Need to Know - May 15, 2024