Early investors in a company that is about to go public need to understand what the IPO lockup period is. If they choose to cash out, what they need to do is sell their shares and gain profit. However, things do not always move this quickly. After an IPO, many companies are going to tie up their stock through a lockup period that keeps investors from cashing out too soon.

The initial public offering, also known as the IPO lockup period, is a signed restriction that prevents shareholders of a company from selling the stock before the company goes public. This period can vary, and it is usually happening anywhere from 90 days to 180 days from the day of the IPO. This article will explore in more detail the IPO lockup period and how it works.

What is an IPO lockup period?

A lockup period means that there is a predetermined time frame in which corporate insiders, investors, or employees cannot sell or redeem their shares after an initial public offering. This happens when a company offers its first public stock.

A lockup period is a contract that states there is a period after a company goes public when the major shareholders are not allowed to sell their shares. The lockup usually lasts between 90 and 180 days. When this period ends, the trading restrictions get removed.

Any investor or employee wants the lockups to be as short as possible so that they can cash out early. However, underwriting banks would ideally like the IPO lockup period to be longer to prevent insiders the drop the share price. The company itself is usually in the middle. They want to be sure the investors are happy with their returns but also don’t want to show that insiders lack faith in the stock.

The goal of an IPO lockup period is to stop the flooding of the market with too much of a company’s stock supply. Usually, just 20% of a company’s shares are offered for the investing public. If a significant shareholder is trying to unload all their holdings in the first week, they can send the stock down, and this does not help anyone.

There is significant evidence that suggests that at the end of the lockup period, stock prices experience a permanent drop of about 1% to 3%. What is also worth noting before a company goes public is that it often goes through an underwriting process where an underwriter is a bank.

Its goal is to structure and support the IPO to make it successful. One of the most common ways is to do this by agreeing to buy the entire inventory of stock of a company.

Quiet Periods

When talking about IPOs, companies need to have a quiet period that takes place before and after the IPO. For the executives of a company, this is an SEC-mandated period of 40 days in which they are prohibited from offering new information. However, this is not available to the public using the S-a filing.

The window of time that is first requested by the SEC is the pre-issue (the quiet period mentioned above) that extends from the date a company files the registration statement with the SEC. This lasts until the day the account becomes effective.

During this period, the SEC limits public discussion or marketing for the upcoming share offering by the company. The second-quarter period lasts 40 days and comes after the IPO. During this time, the staff and syndicate members are not allowed to comment on anything about any projected earnings or issue research reports.

The IPO lockup period also has a quiet period regarding the research reports that relate to the IPO. Even though there is no deadline set here, sell-side analysts that participated in the IPO go through do not publish anything for 20-30 days after the IPO date underwriting process.

The idea behind this is to stop any conflict of interest that might appear in connection with the stock.

Why should you know the IPO lockup period expiring date?

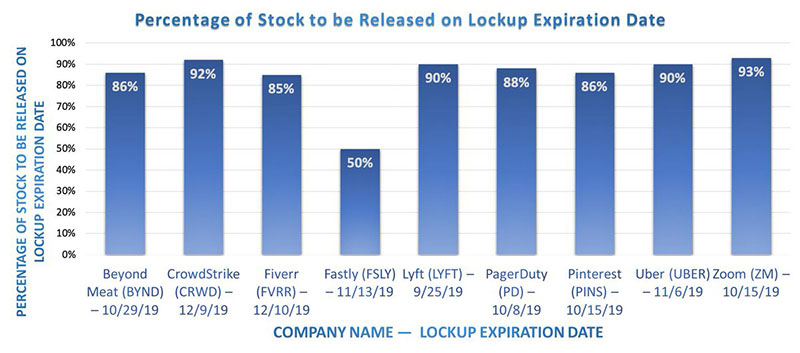

This is an important topic, and if this is the first time you have heard about this concept, here is an explanation. When you want to invest in a company that has made an initial public offering, you need to determine if the company has a lockup and when it expires. This is important because the price of the company’s stock can drop as a result of the locked-up shares that are going to be sold in the market when the lockup is finished.

It is important to consider the fact that every stock is different when using expiring lockups as the motivation to put on a trade. Some might go down a lot, or even collapse as a result of the IPO lockup period ending. Others might flourish and increase their prices. Most of the time, a stock is going to dip a few days in advance before the lockup expiration.

However, they quickly recover and rise even higher than before. The idea is that these dates influence the stock price and you need to pay attention to them.

To discover if a company has an IPO lockup period, you can contact the company’s shareholder relations department. Another option is to get this information online using the SEC’s EDGAR database. Some commercial websites also track when companies have their IPO lockup period set to expire. The SEC does not endorse these websites and makes no representation of the information that is contained on them.

The usefulness of the IPO lockup period

The primary purpose of an IPO lockup period is to stop investors from flooding the market with a high number of shares, which would make the stock price drop. Company insiders have a high percentage of stock shares compared with the general public. Having a higher volume means that when they sell them, this activity can impact the share price very fast after the company goes public.

IPO lockup periods let the new shares to stabilize in the market without any pressure from the investors. This period allows time for the shares to flow naturally between supply and demand. At the start, liquidity can be low but will increase in time.

A company, together with its underwriters, can use the lockup period as a tool to bolster the share price in the IPO. Shares that are held by the bank or investors can be sold during the IPO, but shares owned by company insiders like founders, executives, and more are subject to a lockup period.

Another use of the lockup period is to retain key employees. When stock awards are not redeemable, they keep an employee from moving to the competitor, maintain continuity, or until they completed a critical mission. Lockup periods can be a way for companies to keep up appearances. When the closest to the company keep their shares, they can signal to investors that they have confidence in the power of the company.

FAQs about the IPO lockup period

1. What is an IPO lockup period?

An initial public offering (IPO) lockup period is the time following an IPO during which certain shareholders are banned from selling their shares.

The lockup period is often put in place to prevent a sudden influx of shares into the market that may sharply depress the stock price.

2. How long does an IPO lockup period typically last?

Depending on the company and the specifics of its IPO, the length of an IPO lockup period can change. The lockup period typically lasts 90 to 180 days following the IPO, but it may be shorter or longer in some circumstances.

3. Why do companies have IPO lockup periods?

To prevent significant shareholders, including company executives, from selling their shares too soon after the IPO, companies implement IPO lockup periods.

As a result, there won’t be a sharp decline in the stock price, and the market for the company’s shares will be stabilized.

4. Can insiders sell their shares during the lockup period?

Insiders normally aren’t allowed to sell their shares during the lockup period, including corporate executives, directors, and major shareholders.

Nonetheless, there might be some exceptions, such the sale of shares to pay off tax debts or for other legal reasons.

5. What happens to the stock price when the IPO lockup period ends?

The stock price may become more volatile when the IPO lockup period expires as insiders and significant owners are permitted to sell their shares.

The stock price might decrease if a big number of shares are sold. Yet, if insiders decide to keep their shares, it can be interpreted as a vote of confidence in the business and increase the stock price.

6. How does the expiration of an IPO lockup period affect a company’s stock price?

The stock price of a firm may be significantly impacted by the end of an IPO lockup period. The stock price may decrease if a big number of shares are sold.

Yet if insiders decide to keep their shares, the market may interpret it as a good indicator, which could raise the stock price.

7. Is it common for IPO lockup periods to be extended or shortened?

Although it is uncommon, IPO lockup periods might be lengthened or shortened under specific conditions. Usually, this is done to adjust for shifting market conditions or to meet the demands of insiders who might need to sell their shares for valid reasons.

8. Can the company’s management team sell their shares during the lockup period?

The management team of the company is typically subject to the same lockup period as other insiders and significant shareholders. Nonetheless, there might be some exceptions, such as the sale of shares to pay off tax debts or for other legal reasons.

9. How do investors typically react to the expiration of an IPO lockup period?

The expiration of an IPO lockup period is sometimes closely watched by investors since it can significantly affect the stock price of the company.

The stock price may decrease if a big number of shares are sold. Yet if insiders decide to keep their shares, the market may interpret it as a good indicator, which could raise the stock price.

10. Are there any risks associated with investing in a company during its IPO lockup period?

Purchasing stock in a firm during the IPO lockup period has various risks. After the lockup period expires, a sizable share sale could result in a big decline in the stock price.

Insiders might also have a more thorough insight into the business’s finances and future prospects, giving them an unfair advantage over other investors.

If you enjoyed reading this article on the IPO lockup period, you should check out this one about Steve Jobs leadership style.

We also wrote about a few related subjects like risk assessment matrix, business process modelling, business model innovation, business model vs business plan, accelerator vs incubator, startup funding stages, how to value a startup and IPO process.

- 35 Successful Startups You Could Learn From - January 18, 2024

- The Biggest IT Outsourcing Failures: 7 Examples - January 14, 2024

- Famous Business Pivot Examples That You Should Know Of - January 13, 2024